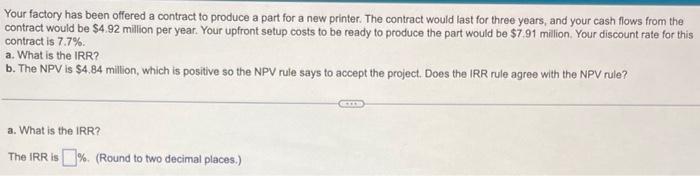

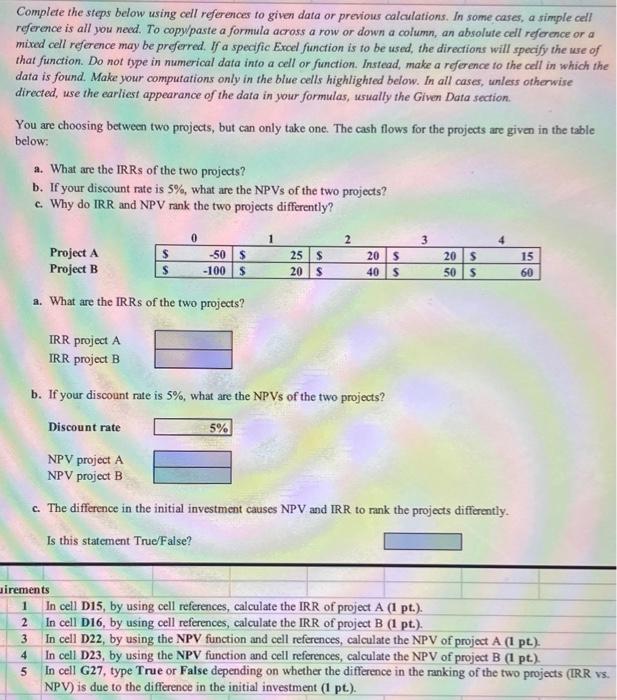

Your factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $4.92 million per year. Your upfront setup costs to be ready to produce the part would be $7.91 million. Your discount rate for this contract is 7.7%. a. What is the IRR? b. The NPV is $4.84 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? a. What is the IRR? The IRR is \%. (Round to two decimal places.) Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reforence or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the wre of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. You are choosing between two projects, but can only take one. The cash flows for the projects are given in the table below: a. What are the IRRs of the two projects? b. If your discount rate is 5%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently? Project A Project B a. What are the IRRs of the two projects? IRR project A IRR project B b. If your discount rate is 5%, what are the NPVs of the two projects? Discount rate NPV project A NPV project B c. The difference in the initial investment causes NPV and IRR to rank the projects differently. Is this statement Truefalse? 1 In cell D15, by using cell references, calculate the IRR of project A (1 pt.). 2 In cell D16, by using cell references, calculate the IRR of project B ( 1 pt.). 3 In cell D22, by using the NPV function and cell references, calculate the NPV of project A ( 1 pt). 4 In cell D23, by using the NPV function and cell references, calculate the NPV of project B ( 1 pt.). 5 In cell G27, type True or False depending on whether the difference in the ranking of the two projects (IRR vs. NPV) is due to the difference in the initial investment ( 1 pt)