Answered step by step

Verified Expert Solution

Question

1 Approved Answer

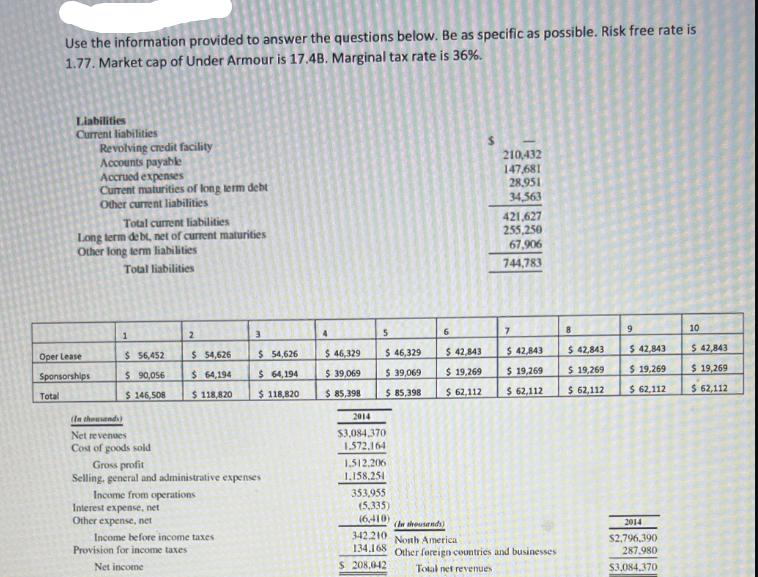

Use the information provided to answer the questions below. Be as specific as possible. Risk free rate is 1.77. Market cap of Under Armour

Use the information provided to answer the questions below. Be as specific as possible. Risk free rate is 1.77. Market cap of Under Armour is 17.4B. Marginal tax rate is 36%. Liabilities Current liabilities Revolving credit facility Accounts payable Accrued expenses Current maturities of long term debt Other current liabilities Total current liabilities Long term debt, net of current maturities Other long term liabilities Total liabilities 210,432 147,681 28,951 34,563 421,627 255,250 67,906 744,783 1 2 3 4 5 6 7 B 9 10 Oper Lease $ 56,452 $ 54,626 $ 54,626 $ 46,329 $ 46,329 $ 42,843 $ 42,843 $ 42,843 $42,843 $ 42,843 Sponsorships $ 90,056 $ 64,194 $ 64,194 $ 39,069 $ 39,069 $ 19,269 $ 19,269 $ 19,269 $ 19,269 $ 19,269 Total $146,508 $ 118,820 $ 118,820 $ 85,398 $ 85,398 $ 62,112 $ 62,112 $ 62,112 $ 62,112 $ 62,112 (In thousands) 2014 Net revenues $3,084,370 Cost of goods sold 1.572.164 Gross profit Selling, general and administrative expenses Income from operations Interest expense, net 1.512.206 1.158,251 353,955 (5,335) Other expense, net Income before income taxes Provision for income taxes Net income $ 208,042 (6,410) (In thousands) 342.210 North America 134,168 Other foreign countries and businesses Total net revenues 2014 $2,796,390 287.980 $3,084.370 Net income $ 208,042 Total net revenues $3,084,370 1. What is the coverage ratio, interest bearing debt and PV of lease commitments for Under Armour? How does off-balance sheet debt compare to balance sheet debt? 2. Compute the cost of debt. Under Armour does not have a credit rating. Infer the default spread from the synthetic rating. 3. Compute the cost of equity. It operates in North America (ERP-5.75) and other foreign countries, which is split evenly between China (ERP-6.65), Europe (ERP-6.88) and Latin America (ERP=9.95). 70% of its revenues come from the apparel industry (unlevered beta of 0.86) and 30% from footwear (unlevered beta 0.82) 4. Compute the cost of capital.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started