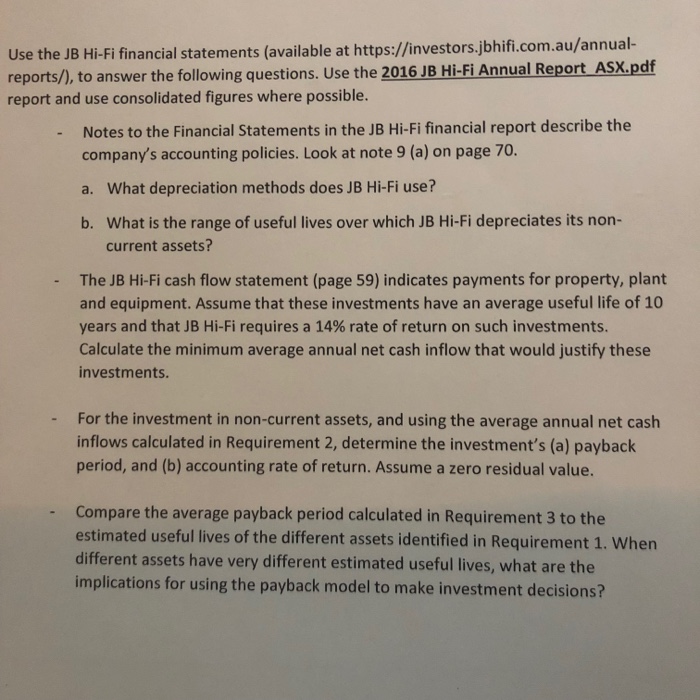

Use the JB Hi-Fi financial statements (available at https://investors.jbhifi.com.au/annual- reports/), to answer the following questions. Use the 2016 JB Hi-Fi Annual Report ASX.pdf report and use consolidated figures where possible. Notes to the Financial Statements in the JB Hi-Fi financial report describe the company's accounting policies. Look at note 9 (a) on page 70. a. What depreciation methods does JB Hi-Fi use? b. What is the range of useful lives over which JB Hi-Fi depreciates its non- current assets? The JB Hi-Fi cash flow statement (page 59) indicates payments for property, plant and equipment. Assume that these investments have an average useful life of 10 years and that JB Hi-Fi requires a 14% rate of return on such investments Calculate the minimum average annual net cash inflow that would justify these investments. For the investment in non-current assets, and using the average annual net cash inflows calculated in Requirement 2, determine the investment's (a) payback period, and (b) accounting rate of return. Assume a zero residual value. Compare the average payback period calculated in Requirement 3 to the estimated useful lives of the different assets identified in Requirement 1. When different assets have very different estimated useful lives, what are the implications for using the payback model to make investment decisions? Use the JB Hi-Fi financial statements (available at https://investors.jbhifi.com.au/annual- reports/), to answer the following questions. Use the 2016 JB Hi-Fi Annual Report ASX.pdf report and use consolidated figures where possible. Notes to the Financial Statements in the JB Hi-Fi financial report describe the company's accounting policies. Look at note 9 (a) on page 70. a. What depreciation methods does JB Hi-Fi use? b. What is the range of useful lives over which JB Hi-Fi depreciates its non- current assets? The JB Hi-Fi cash flow statement (page 59) indicates payments for property, plant and equipment. Assume that these investments have an average useful life of 10 years and that JB Hi-Fi requires a 14% rate of return on such investments Calculate the minimum average annual net cash inflow that would justify these investments. For the investment in non-current assets, and using the average annual net cash inflows calculated in Requirement 2, determine the investment's (a) payback period, and (b) accounting rate of return. Assume a zero residual value. Compare the average payback period calculated in Requirement 3 to the estimated useful lives of the different assets identified in Requirement 1. When different assets have very different estimated useful lives, what are the implications for using the payback model to make investment decisions