Answered step by step

Verified Expert Solution

Question

1 Approved Answer

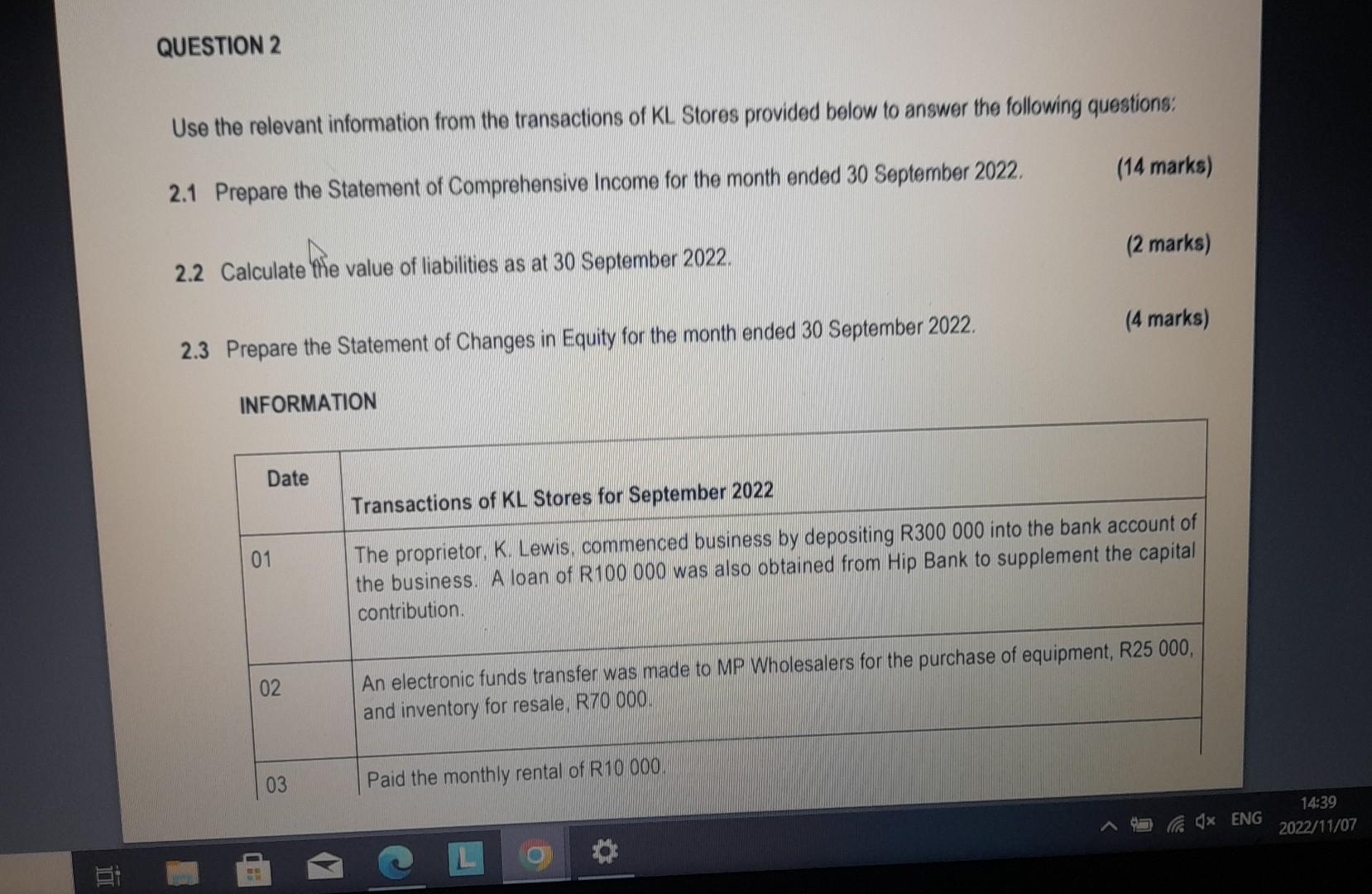

Use the relevant information from the transactions of KL Stores provided below to answer the following questions: 2.1 Prepare the Statement of Comprehensive Income for

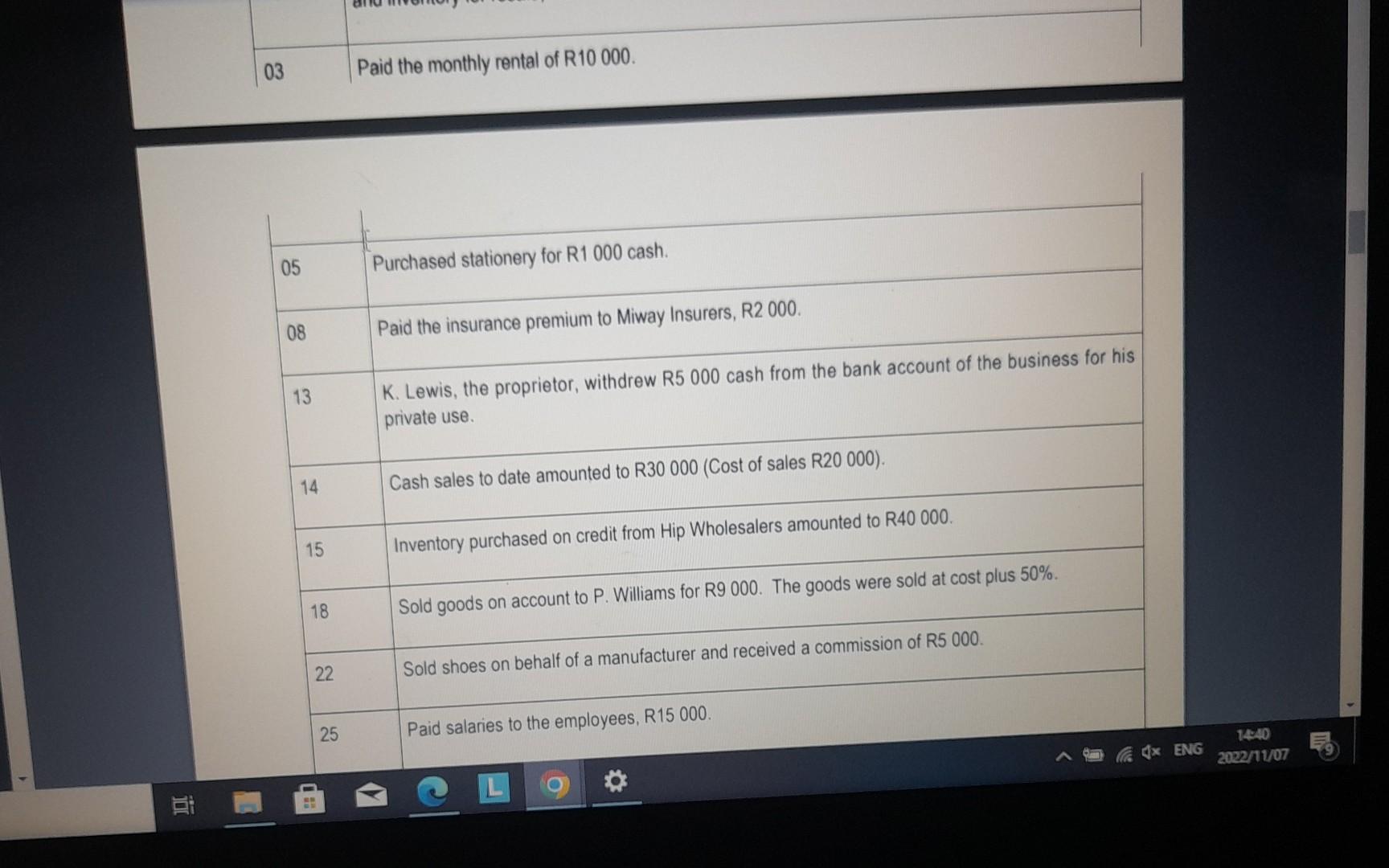

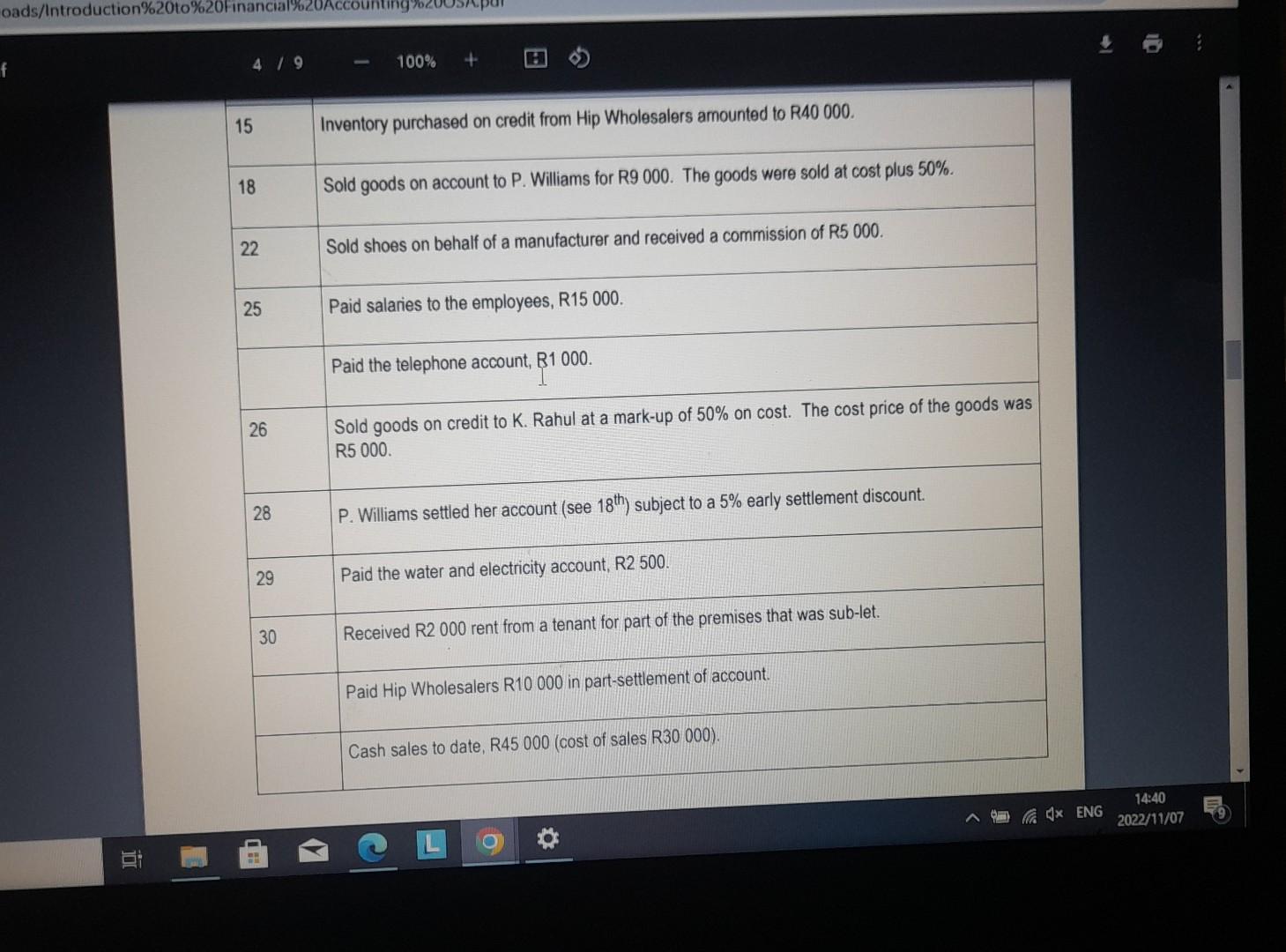

Use the relevant information from the transactions of KL Stores provided below to answer the following questions: 2.1 Prepare the Statement of Comprehensive Income for the month ended 30 September 2022. (14 marks) 2.2 Calculate the value of liabilities as at 30 September 2022. (2 marks) 2.3 Prepare the Statement of Changes in Equity for the month ended 30 September 2022. (4 marks) \begin{tabular}{|l|l} \hline 03 & Paid the monthly rental of R10 000 . \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline 05 & Purchased stationery for R1 000 cash. \\ \hline 08 & Paid the insurance premium to Miway Insurers, R2 000. \\ \hline 13 & K. Lewis, the proprietor, withdrew R5 000 cash from the bank account of the business for his private use. \\ \hline \end{tabular} 14 Cash sales to date amounted to R30000 (Cost of sales R20 000). 15 Inventory purchased on credit from Hip Wholesalers amounted to R40 000. 18 Sold goods on account to P. Williams for R9 000 . The goods were sold at cost plus 50%. 22 Sold shoes on behalf of a manufacturer and received a commission of R5000. 29 Paid the water and electricity account, R2 500. 30 Received R2 000 rent from a tenant for part of the premises that was sub-let. Paid Hip Wholesalers R10 000 in part-settlement of account. Cash sales to date, R45000 (cost of sales R30 000). Use the relevant information from the transactions of KL Stores provided below to answer the following questions: 2.1 Prepare the Statement of Comprehensive Income for the month ended 30 September 2022. (14 marks) 2.2 Calculate the value of liabilities as at 30 September 2022. (2 marks) 2.3 Prepare the Statement of Changes in Equity for the month ended 30 September 2022. (4 marks) \begin{tabular}{|l|l} \hline 03 & Paid the monthly rental of R10 000 . \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline 05 & Purchased stationery for R1 000 cash. \\ \hline 08 & Paid the insurance premium to Miway Insurers, R2 000. \\ \hline 13 & K. Lewis, the proprietor, withdrew R5 000 cash from the bank account of the business for his private use. \\ \hline \end{tabular} 14 Cash sales to date amounted to R30000 (Cost of sales R20 000). 15 Inventory purchased on credit from Hip Wholesalers amounted to R40 000. 18 Sold goods on account to P. Williams for R9 000 . The goods were sold at cost plus 50%. 22 Sold shoes on behalf of a manufacturer and received a commission of R5000. 29 Paid the water and electricity account, R2 500. 30 Received R2 000 rent from a tenant for part of the premises that was sub-let. Paid Hip Wholesalers R10 000 in part-settlement of account. Cash sales to date, R45000 (cost of sales R30 000)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started