Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the returns of these three stocks below to answer the questions that follow in excel format. Stock A Stock B Stock C 2.81% 0.79%

Use the returns of these three stocks below to answer the questions that follow in excel format.

| Stock A | Stock B | Stock C |

| 2.81% | 0.79% | -0.25% |

| 2.12% | 1.80% | -0.77% |

| -2.82% | -3.50% | 1.93% |

| 4.65% | 6.78% | 0.19% |

| 0.27% | -3.15% | -0.14% |

| 0.95% | 4.52% | 0.82% |

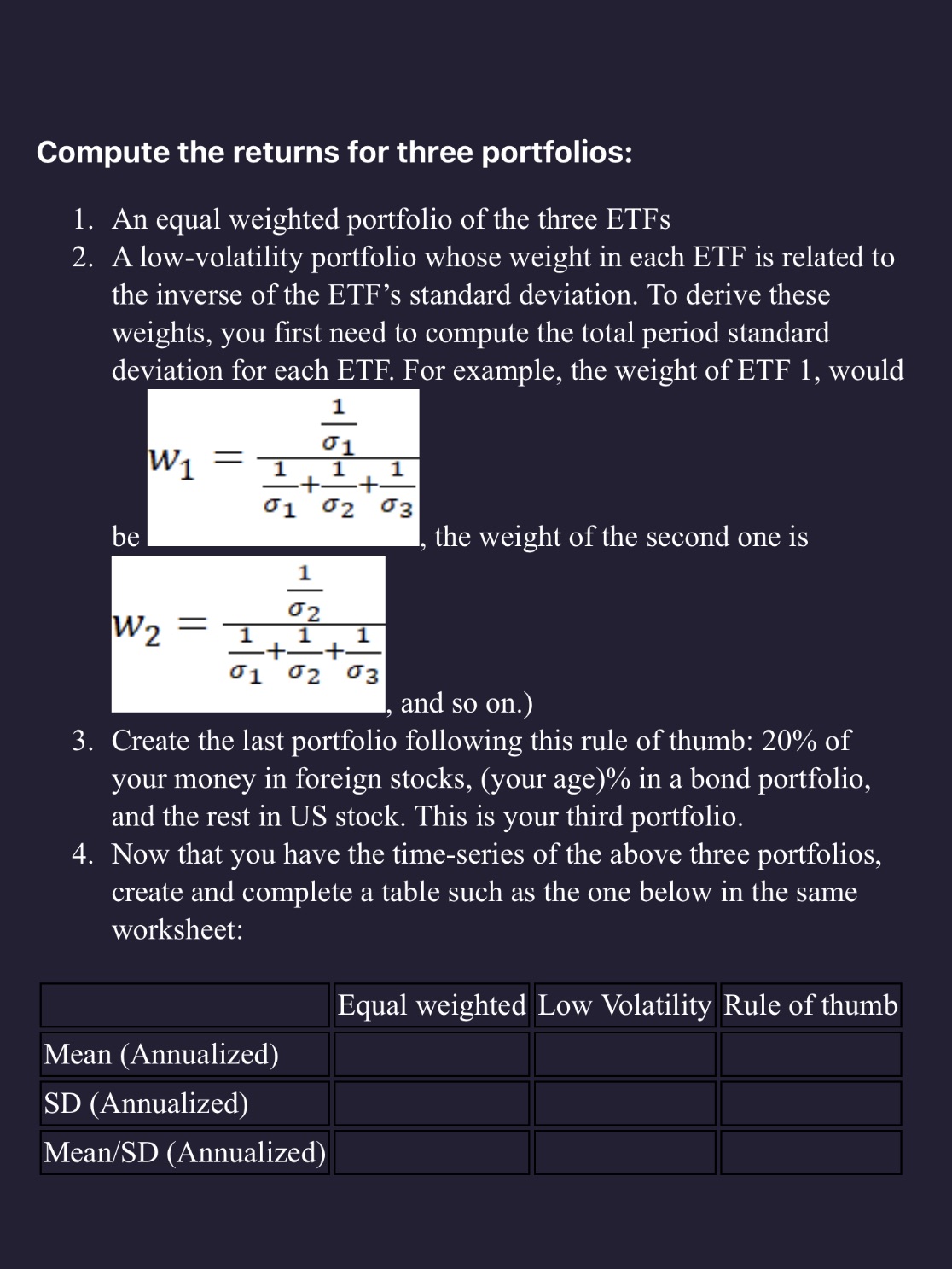

Compute the returns for three portfolios: 1. An equal weighted portfolio of the three ETFs 2. A low-volatility portfolio whose weight in each ETF is related to the inverse of the ETF's standard deviation. To derive these weights, you first need to compute the total period standard deviation for each ETF. For example, the weight of ETF 1, would w1=11+21+3111 be the weight of the second one is w2=11+21+3121 and so on.) 3. Create the last portfolio following this rule of thumb: 20% of your money in foreign stocks, (your age) % in a bond portfolio, and the rest in US stock. This is your third portfolio. 4. Now that you have the time-series of the above three portfolios, create and complete a table such as the one below in the same worksheet: Compute the returns for three portfolios: 1. An equal weighted portfolio of the three ETFs 2. A low-volatility portfolio whose weight in each ETF is related to the inverse of the ETF's standard deviation. To derive these weights, you first need to compute the total period standard deviation for each ETF. For example, the weight of ETF 1, would w1=11+21+3111 be the weight of the second one is w2=11+21+3121 and so on.) 3. Create the last portfolio following this rule of thumb: 20% of your money in foreign stocks, (your age) % in a bond portfolio, and the rest in US stock. This is your third portfolio. 4. Now that you have the time-series of the above three portfolios, create and complete a table such as the one below in the same worksheet

Compute the returns for three portfolios: 1. An equal weighted portfolio of the three ETFs 2. A low-volatility portfolio whose weight in each ETF is related to the inverse of the ETF's standard deviation. To derive these weights, you first need to compute the total period standard deviation for each ETF. For example, the weight of ETF 1, would w1=11+21+3111 be the weight of the second one is w2=11+21+3121 and so on.) 3. Create the last portfolio following this rule of thumb: 20% of your money in foreign stocks, (your age) % in a bond portfolio, and the rest in US stock. This is your third portfolio. 4. Now that you have the time-series of the above three portfolios, create and complete a table such as the one below in the same worksheet: Compute the returns for three portfolios: 1. An equal weighted portfolio of the three ETFs 2. A low-volatility portfolio whose weight in each ETF is related to the inverse of the ETF's standard deviation. To derive these weights, you first need to compute the total period standard deviation for each ETF. For example, the weight of ETF 1, would w1=11+21+3111 be the weight of the second one is w2=11+21+3121 and so on.) 3. Create the last portfolio following this rule of thumb: 20% of your money in foreign stocks, (your age) % in a bond portfolio, and the rest in US stock. This is your third portfolio. 4. Now that you have the time-series of the above three portfolios, create and complete a table such as the one below in the same worksheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started