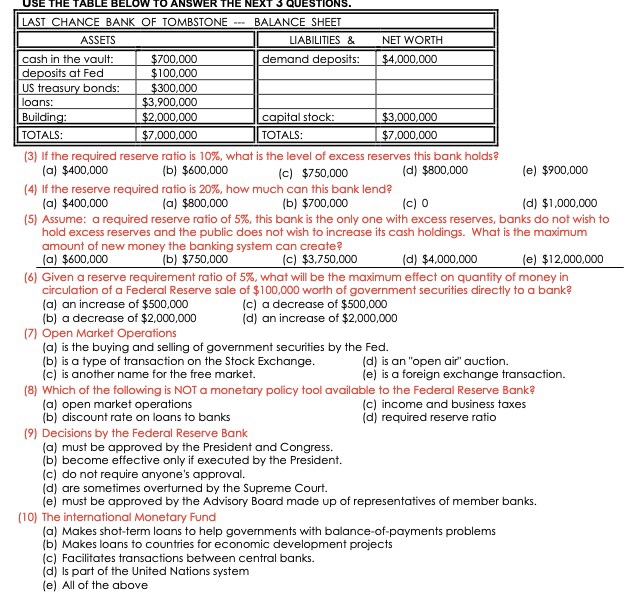

USE THE TABLE BELOW TO ANSWER THE NEXT 3 QUESTIONS. LAST CHANCE BANK OF TOMBSTONE --- BALANCE SHEET ASSETS LIABILITIES & NET WORTH cash in the vault: $700,000 demand deposits: $4,000,000 deposits at Fed $100,000 US treasury bonds: $300,000 loans: $3,900,000 Building: $2,000,000 capital stock: $3,000,000 TOTALS: $7,000,000 TOTALS: $7,000,000 (3) If the required reserve ratio is 10%, what is the level of excess reserves this bank holds (a) $400,000 (6) $600,000 (c) $750,000 (d) $800,000 le) $900,000 (4) If the reserve required ratio is 20%, how much can this bank lend (a) $400,000 (a) $800,000 (b) $700,000 (c) O (d) $1,000,000 (5) Assume: a required reserve ratio of 5%, this bank is the only one with excess reserves, banks do not wish to hold excess reserves and the public does not wish to increase its cash holdings. What is the maximum amount of new money the banking system can create? (a) $600,000 (b) $750,000 (c) $3,750,000 (d) $4,000,000 (e) $12,000,000 (6) Given a reserve requirement ratio of 5%, what will be the maximum effect on quantity of money in circulation of a Federal Reserve sale of $100,000 worth of government securities directly to a bank (a) an increase of $500,000 (c) a decrease of $500,000 (b) a decrease of $2,000,000 (d) an increase of $2,000,000 (7) Open Market Operations (a) is the buying and selling of government securities by the Fed. (b) is a type of transaction on the Stock Exchange. (d) is an "open air" auction. (c) is another name for the free market. (e) is a foreign exchange transaction. (8) Which of the following is NOT a monetary policy tool available to the Federal Reserve Bank (a) open market operations (c) income and business taxes (b) discount rate on loans to banks (d) required reserve ratio (9) Decisions by the Federal Reserve Bank (a) must be approved by the President and Congress. (b) become effective only if executed by the President. (c) do not require anyone's approval. (d) are sometimes overturned by the Supreme Court. (e) must be approved by the Advisory Board made up of representatives of member banks. (10) The international Monetary Fund (a) Makes shot-term loans to help governments with balance of payments problems (b) Makes loans to countries for economic development projects (c) Facilitates transactions between central banks. (d) is part of the United Nations system le) All of the above