Answered step by step

Verified Expert Solution

Question

1 Approved Answer

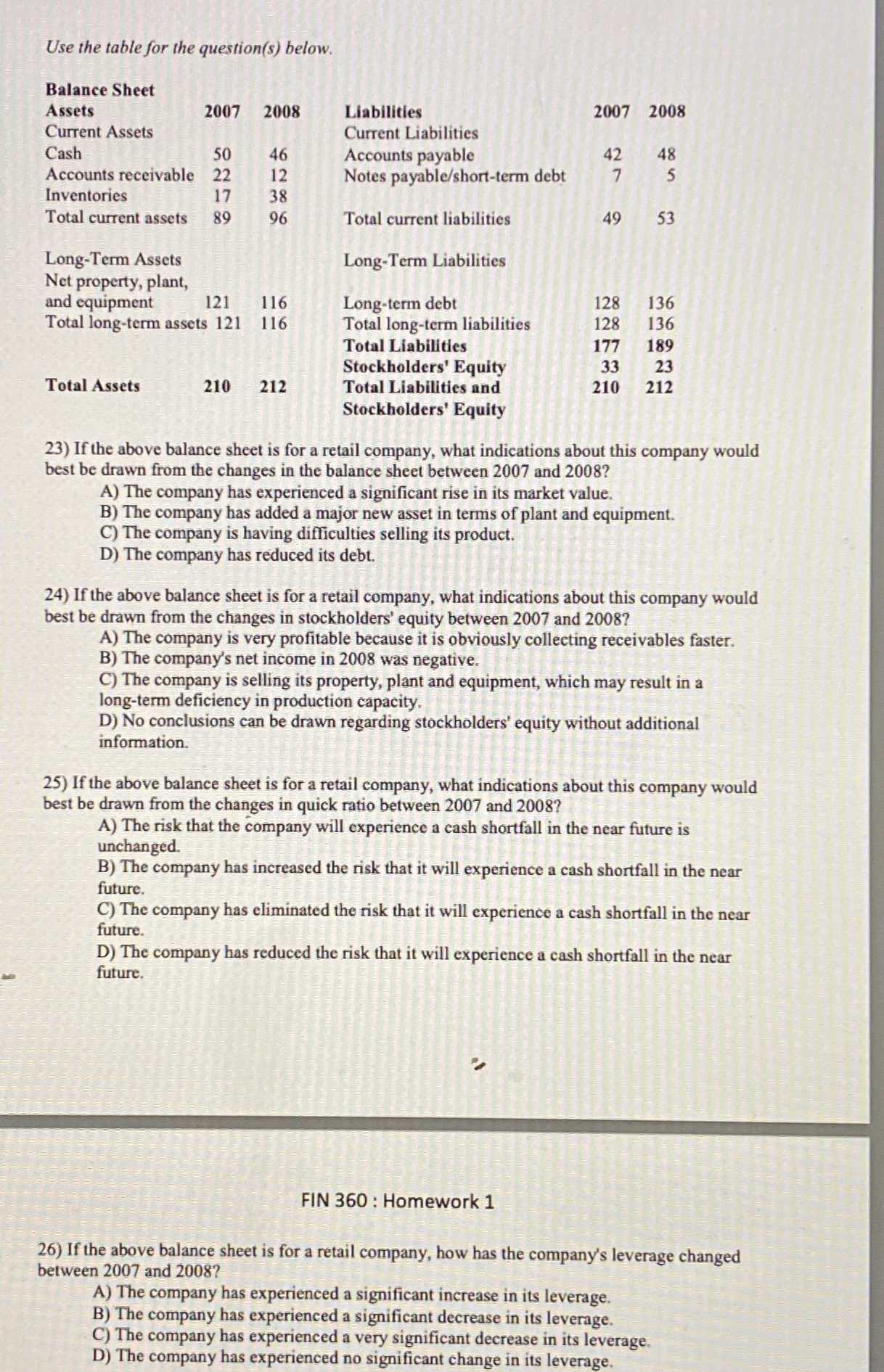

Use the table for the question ( s ) below. table [ [ , , , , , ] , [ table [

Use the table for the questions below.

tabletableAssetsCurrent AssetstableLiabilitiesCurrent LiabilitiesCashAccounts payable,Accounts receivable,Notes payableshortterm debt,InventoriesTotal current assets,Total current liabilities,LongTerm Assets,,,LongTerm Liabilities,,tableNet property, plant,and equipmentLongterm debt,Total longterm assets,ts Total longterm liabilities,tableTotal LiabilitiesStockholders EquitytabletableTotal Assets,tableTotal Liabilities andStockholders Equity

If the above balance sheet is for a retail company, what indications about this company would best be drawn from the changes in the balance sheet between and

A The company has experienced a significant rise in its market value.

B The company has added a major new asset in terms of plant and equipment.

C The company is having difficulties selling its product.

D The company has reduced its debt.

If the above balance sheet is for a retail company, what indications about this company would best be drawn from the changes in stockholders' equity between and

A The company is very profitable because it is obviously collecting receivables faster.

B The company's net income in was negative.

C The company is selling its property, plant and equipment, which may result in a longterm deficiency in production capacity.

D No conclusions can be drawn regarding stockholders' equity without additional information.

If the above balance sheet is for a retail company, what indications about this company would best be drawn from the changes in quick ratio between and

A The risk that the company will experience a cash shortfall in the near future is unchanged.

B The company has increased the risk that it will experience a cash shortfall in the near future.

C The company has eliminated the risk that it will experience a cash shortfall in the near future.

D The company has reduced the risk that it will experience a cash shortfall in the near future.

FIN : Homework

If the above balance sheet is for a retail company, how has the company's leverage changed between and

A The company has experienced a significant increase in its leverage.

B The company has experienced a significant decrease in its leverage.

C The company has experienced a very significant decrease in its leverage.

D The company has experienced no significant change in its leverage.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started