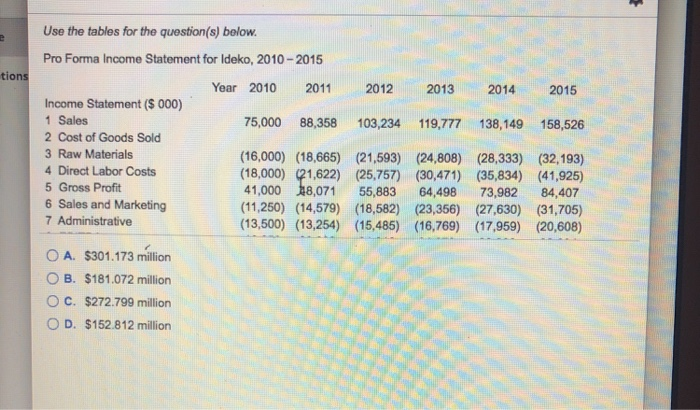

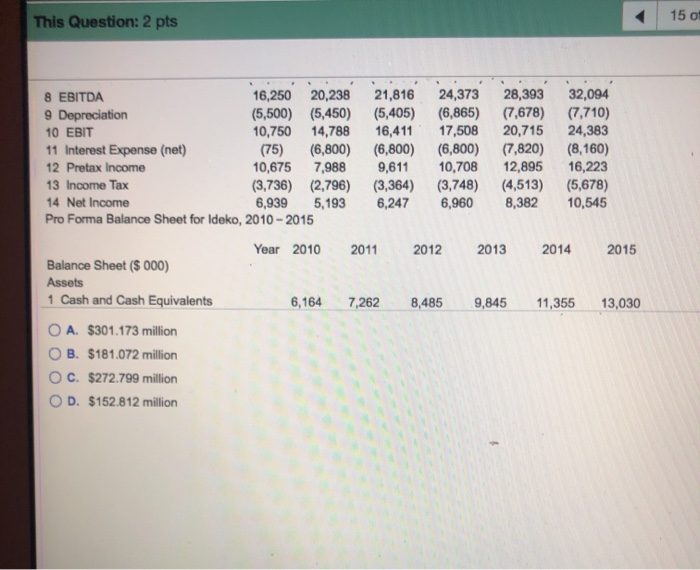

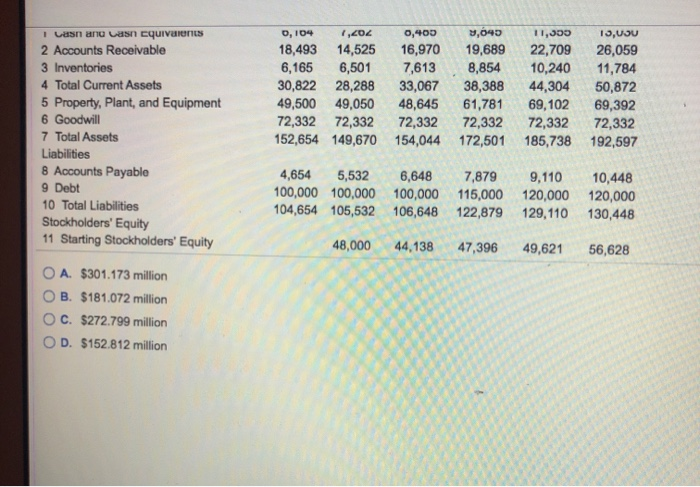

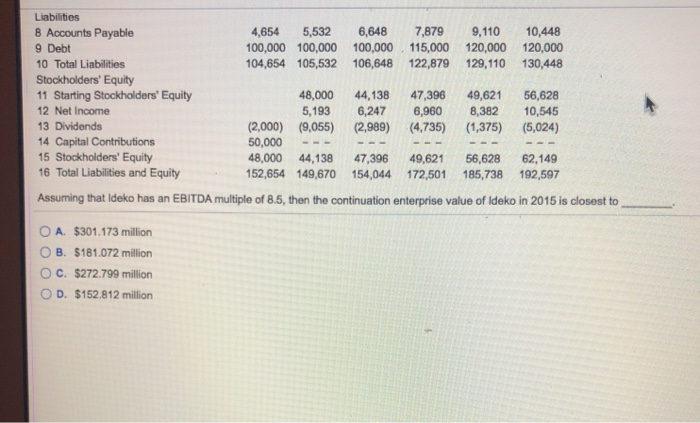

Use the tables for the question(s) below. tions Pro Forma Income Statement for Ideko, 2010-2015 Year 2010 2011 2012 2013 2014 2015 Income Statement ($ 000) 1 Sales 75,000 88,358 103,234 119,777 138,149 158,526 2 Cost of Goods Sold 3 Raw Materials (16,000) (18,665) (21,593) (24,808) (28,333) (32,193) 4 Direct Labor Costs (18,000) (21,622) (25,757) (30,471) (35,834) (41,925) 5 Gross Profit 41,000 $8,071 55,883 64,498 73,982 84,407 6 Sales and Marketing (11,250) (14,579) (18,582) (23,356) (27,630) (31,705) 7 Administrative (13,500) (13,254) (15,485) (16,769) (17,959) (20,608) O A. $301.173 million O B. $181.072 million OC. $272.799 million OD. $152.812 million This Question: 2 pts 150 8 EBITDA 16,250 20,238 21,816 24,373 28,393 32,094 9 Depreciation (5,500) (5,450) (5,405) (6,865) (7,678) (7,710) 10 EBIT 10,750 14,788 16,411 17,508 20,715 24,383 11 Interest Expense (net) (75) (6,800) (6,800) (6,800) (7,820) (8,160) 12 Pretax Income 10,675 7,988 9,611 10,708 12,895 16,223 13 Income Tax (3,736) (2,796) (3,364) (3,748) (4,513) (5,678) 14 Net Income 6,9395,193 6,247 6,960 8,382 10,545 Pro Forma Balance Sheet for ldeko, 2010-2015 Year 2010 2011 2012 2013 2014 2015 Balance Sheet ($ 000) Assets 1 Cash and Cash Equivalents 6,164 7,262 8 ,485 9,845 11,355 13,030 O A. $301.173 million O B. $181,072 million O C. $272.799 million OD. $152.812 million I can no Lasn Equivalents 2 Accounts Receivable 3 Inventories 4 Total Current Assets 5 Property, Plant, and Equipment 6 Goodwill 7 Total Assets Liabilities 8 Accounts Payable 9 Debt 10 Total Liabilities Stockholders' Equity 11 Starting Stockholders' Equity 0,104 18,493 6,165 30,822 49,500 72,332 152,654 1,202 0,400 14,525 16,970 6,501 7,613 28,288 33,067 49,050 48,645 72,332 72,332 149,670 154,044 2,045 19,689 8,854 38,388 61,781 72,332 172,501 11,300 22,709 10,240 44,304 69,102 72,332 185,738 13, USU 26,059 11,784 50,872 69,392 72,332 192,597 4,654 5,532 100,000 100,000 104,654 105,532 6,648 100,000 106,648 7,8799 ,110 115,000 120,000 122,879 129, 110 10,448 120,000 130,448 48,000 44,138 47,396 49,621 56,628 O A. $301.173 million O B. $181.072 million O C. $272.799 million OD. $152.812 million Liabilities 8 Accounts Payable 4,654 5,532 6,648 7,879 9 ,110 10,448 9 Debt 100,000 100,000 100,000 115,000 120,000 120,000 10 Total Liabilities 104,654 105,532 106,648 122,879 129,110 130,448 Stockholders' Equity 11 Starting Stockholders' Equity 48,000 44,138 47,396 49,621 56,628 12 Net Income 5,193 6,2476,960 8,382 10,545 13 Dividends (2.000) (9,055) (2,989) (4,735) (1,375) (5,024) 14 Capital Contributions 50,000 --- 15 Stockholders' Equity 48,000 44,138 47,396 49,62156,628 62,149 16 Total Liabilities and Equity 152,654 149,670 154,044 172,501 185,738 192,597 Assuming that Ideko has an EBITDA multiple of 8.5, then the continuation enterprise value of Ideko in 2015 is closest to O A $301.173 million O B. $181.072 million OC. $272.799 million OD. $152.812 million