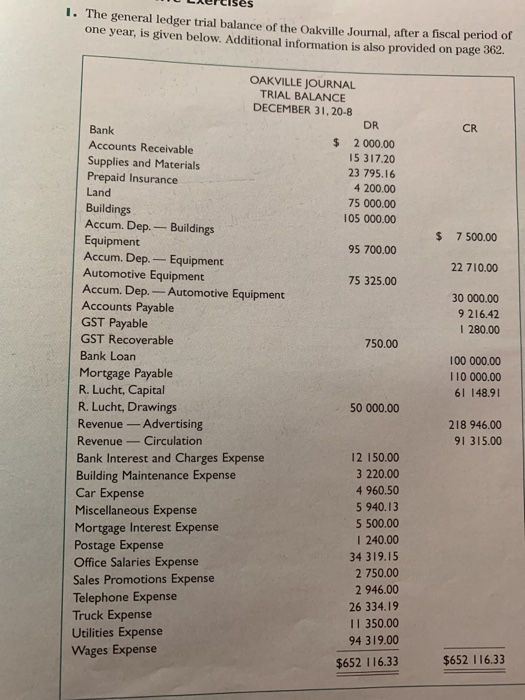

Use the trial balance and additional information to complete question C (journalize the adjusting and closing entries)

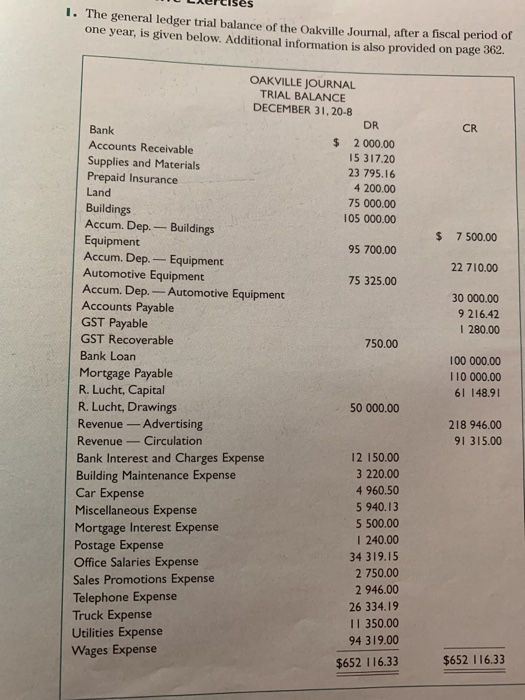

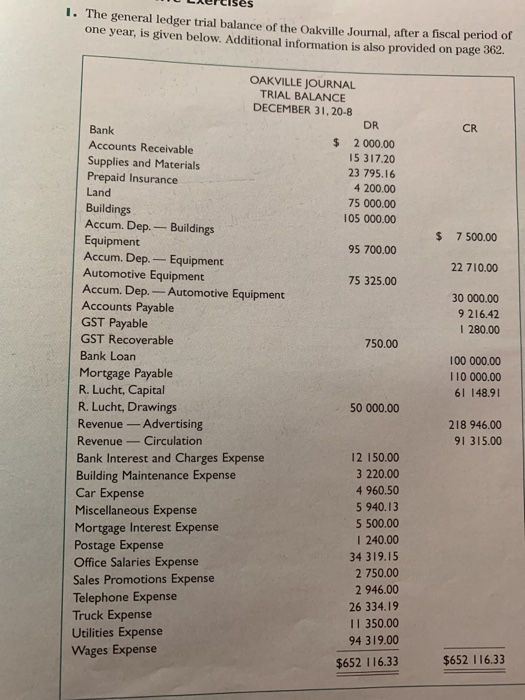

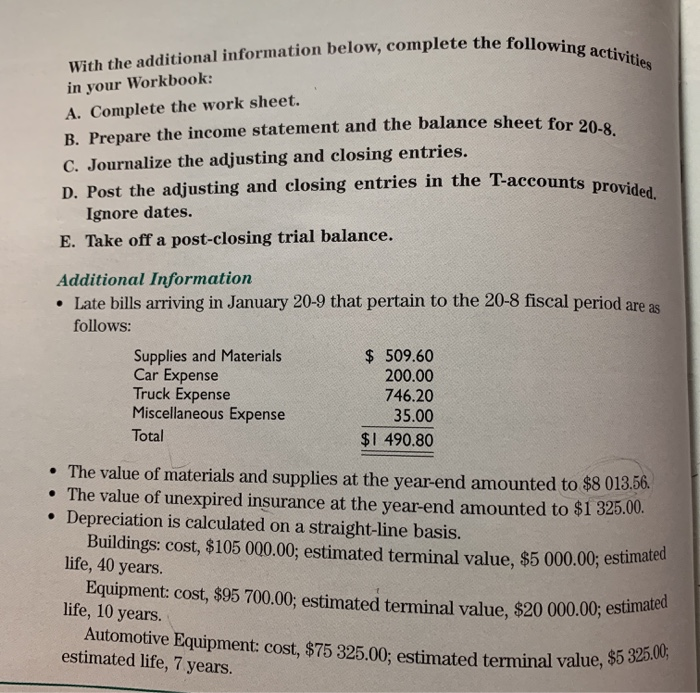

MULAereises 1. The general ledger trial balance of the Oakville Journal, after a fiscal period of one year, is given below. Additional information is also provided on page 302 $ 7 500.00 22 710.00 30 000.00 9 216.42 I 280.00 OAKVILLE JOURNAL TRIAL BALANCE DECEMBER 31, 20-8 DR Bank $ Accounts Receivable 2.000.00 Supplies and Materials 15 317.20 Prepaid Insurance 23 795.16 Land 4 200.00 Buildings 75 000.00 105 000.00 Accum. Dep. - Buildings Equipment 95 700.00 Accum. Dep. -- Equipment Automotive Equipment 75 325.00 Accum. Dep. - Automotive Equipment Accounts Payable GST Payable GST Recoverable 750.00 Bank Loan Mortgage Payable R. Lucht, Capital R. Lucht, Drawings 50 000.00 Revenue - Advertising Revenue - Circulation Bank Interest and Charges Expense 12 150.00 Building Maintenance Expense 3 220.00 Car Expense 4 960.50 Miscellaneous Expense 5 940.13 5 500.00 Mortgage Interest Expense 1 240.00 Postage Expense Office Salaries Expense 34 319.15 2 750.00 Sales Promotions Expense 2 946.00 Telephone Expense 26 334.19 Truck Expense 11 350.00 Utilities Expense 94 319.00 Wages Expense $652 116.33 100 000.00 110 000.00 61 148.91 218 946.00 91 315.00 $652 116.33 the following activities With the additional information below, complete the follo in your Workbook: A. Complete the work sheet. B. Prepare the income statement and the balance sheet for 20. C. Journalize the adjusting and closing entries. D. Post the adjusting and closing entries in the T-accounts Ignore dates. E. Take off a post-closing trial balance. the T-accounts provided. Additional Information Late bills arriving in January 20-9 that pertain to the 20-8 fiscal period are ad follows: Supplies and Materials $ 509.60 Car Expense 200.00 Truck Expense 746.20 Miscellaneous Expense 35.00 Total $1 490.80 The value of materials and supplies at the year-end amounted to $8 013.56. The value of unexpired insurance at the year-end amounted to $1 325.00. Depreciation is calculated on a straight-line basis. Buildings: cost, $105 000.00; estimated terminal value, $5 000.00; estim life, 40 years. Equipment: cost, $95 700.00; estimated terminal value, $20 000.00; es life, 10 years. Automotive Equipment: cost, $75 325.00: estimated terminal value, po estimated life, 7 years. Tue, $20 000.00; estimated hal value, $5 325.00; Date ANSWERS TO CHAPTER 9 REVIEW EXERCISES (cont) Exercise 1 (cont.) Comprehensive Exercise C. GENERAL JOURNAL PAGE DATE PARTICULARS DEBIT CREDIT Adjusting Entries