Question

Use the websites to find CPP, EI, Federal Tax, and Provincial Tax. If the gross pay falls between the range, then use that number. One

Use the websites to find CPP, EI, Federal Tax, and Provincial Tax. If the gross pay falls between the range, then use that number. One chart asks for claim code so connect the claim code with the gross pay range. Answers should be correct. Let me know if there are any errors.

Reference: https://www.canada.ca/content/dam/cra-arc/migration/cra-arc/tx/bsnss/tpcs/pyrll/t4032/2021/t4032cpp-52pp-21eng.pdf

Reference:https://www.canada.ca/content/dam/cra-arc/migration/cra-arc/tx/bsnss/tpcs/pyrll/t4032/2021/t4032-on-1-52pp-21eng.pdf

Reference: https://www.canada.ca/content/dam/cra-arc/migration/cra-arc/tx/bsnss/tpcs/pyrll/t4032/2021/t4032einoqc-21eng.pdf

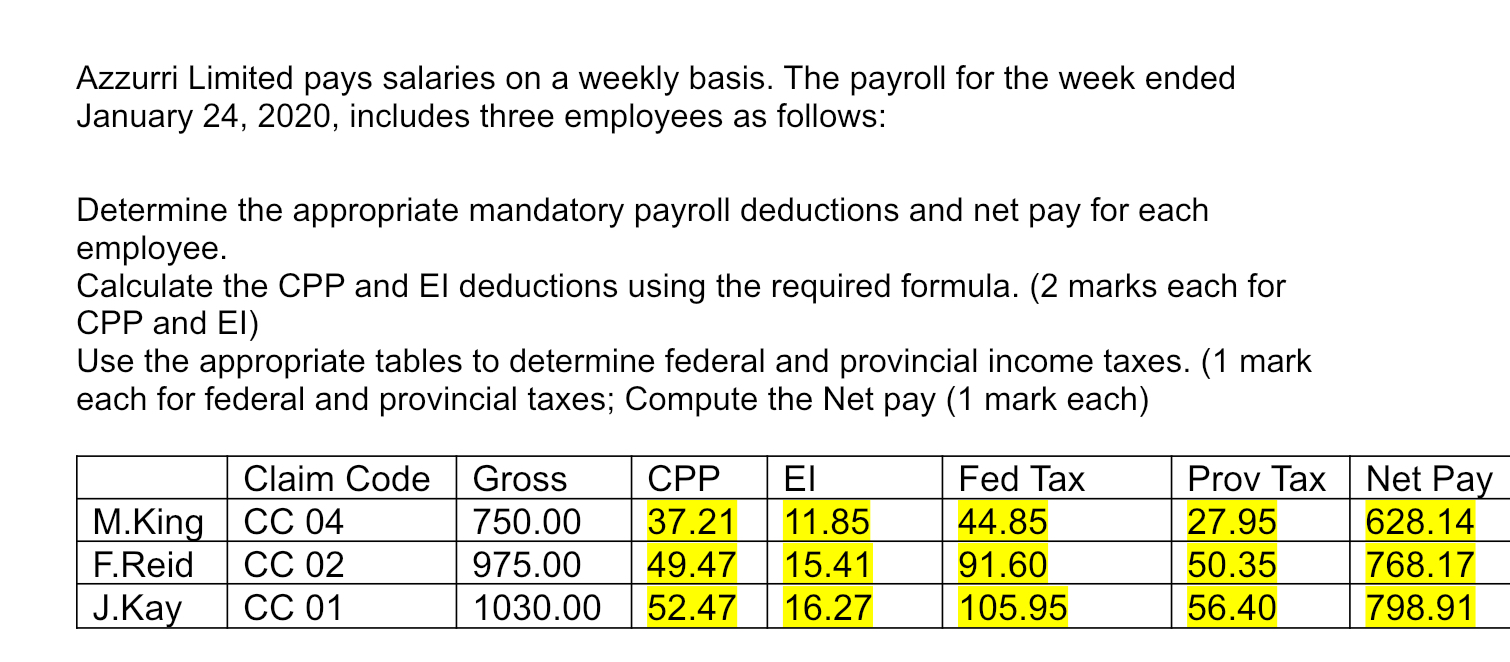

Azzurri Limited pays salaries on a weekly basis. The payroll for the week ended January 24, 2020, includes three employees as follows: Determine the appropriate mandatory payroll deductions and net pay for each employee. Calculate the CPP and El deductions using the required formula. (2 marks each for CPP and El) Use the appropriate tables to determine federal and provincial income taxes. (1 mark each for federal and provincial taxes; Compute the Net pay (1 mark each) Claim Code Gross CPP EI M.King CC 04 750.00 37.21 F.Reid CC 02 975.00 49.47 J.Kay CC 01 1030.00 52.47 11.85 15.41 16.27 Fed Tax 44.85 91.60 105.95 Prov Tax 27.95 50.35 56.40 Net Pay 628.14 768.17 798.91

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part 1 M King CPP 495 of 750 3713 rounded to 3721 EI 163 of 750 1223 rounded to 1185 Fed Tax Basic personal amount exemption applies tax bracket is 15 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started