Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Indigo intends to merge with Pricy. The managers anticipate cost savings pretax of $50 million in the first year of the deal, and $100

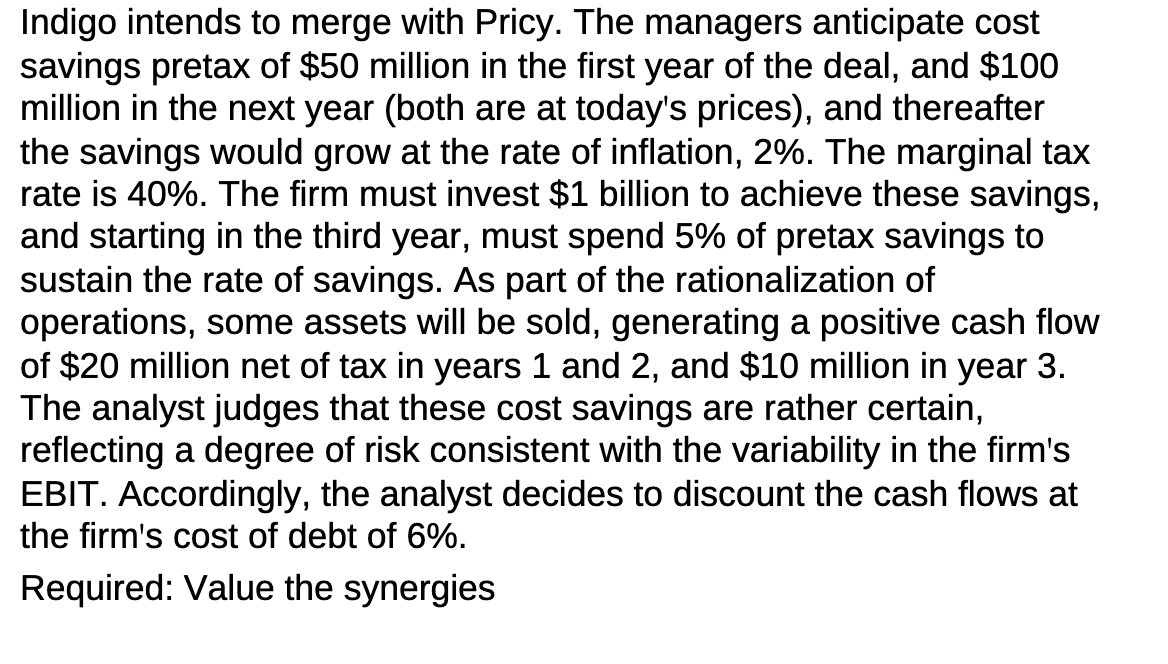

Indigo intends to merge with Pricy. The managers anticipate cost savings pretax of $50 million in the first year of the deal, and $100 million in the next year (both are at today's prices), and thereafter the savings would grow at the rate of inflation, 2%. The marginal tax rate is 40%. The firm must invest $1 billion to achieve these savings, and starting in the third year, must spend 5% of pretax savings to sustain the rate of savings. As part of the rationalization of operations, some assets will be sold, generating a positive cash flow of $20 million net of tax in years 1 and 2, and $10 million in year 3. The analyst judges that these cost savings are rather certain, reflecting a degree of risk consistent with the variability in the firm's EBIT. Accordingly, the analyst decides to discount the cash flows at the firm's cost of debt of 6%. Required: Value the synergies

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Valuation of IndigoPricy Merger Synergies 1 Calculate the pretax cost savings Year 1 50 million Year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started