Answered step by step

Verified Expert Solution

Question

1 Approved Answer

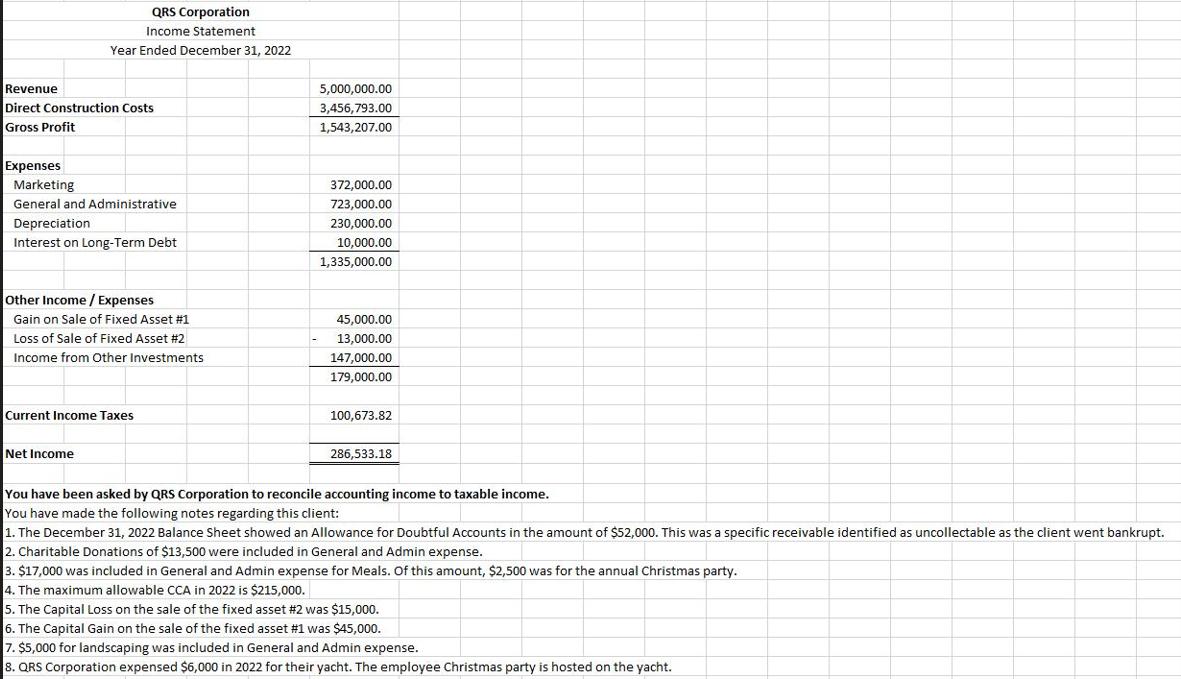

Use this income statement and reconcile the accounting income Revenue Direct Construction Costs Gross Profit Expenses QRS Corporation Income Statement Year Ended December 31, 2022

Use this income statement and reconcile the accounting income

Revenue Direct Construction Costs Gross Profit Expenses QRS Corporation Income Statement Year Ended December 31, 2022 Marketing General and Administrative Depreciation Interest on Long-Term Debt Other Income / Expenses Gain on Sale of Fixed Asset #1 Loss of Sale of Fixed Asset #2 Income from Other Investments Current Income Taxes Net Income 5,000,000.00 3,456,793.00 1,543,207.00 372,000.00 723,000.00 230,000.00 10,000.00 1,335,000.00 45,000.00 13,000.00 147,000.00 179,000.00 100,673.82 286,533.18 You have been asked by QRS Corporation to reconcile accounting income to taxable income. You have made the following notes regarding this client: 1. The December 31, 2022 Balance Sheet showed an Allowance for Doubtful Accounts in the amount of $52,000. This was a specific receivable identified as uncollectable as the client went bankrupt. 2. Charitable Donations of $13,500 were included in General and Admin expense. 3. $17,000 was included in General and Admin expense for Meals. Of this amount, $2,500 was for the annual Christmas party. 4. The maximum allowable CCA in 2022 is $215,000. 5. The Capital Loss on the sale of the fixed asset # 2 was $15,000. 6. The Capital Gain on the sale of the fixed asset #1 was $45,000. 7. $5,000 for landscaping was included in General and Admin expense. 8. QRS Corporation expensed $6,000 in 2022 for their yacht. The employee Christmas party is hosted on the yacht.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To reconcile accounting income to taxable income we need to consider the accounting principles that differ from tax laws and regulations We will start ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started