Answered step by step

Verified Expert Solution

Question

1 Approved Answer

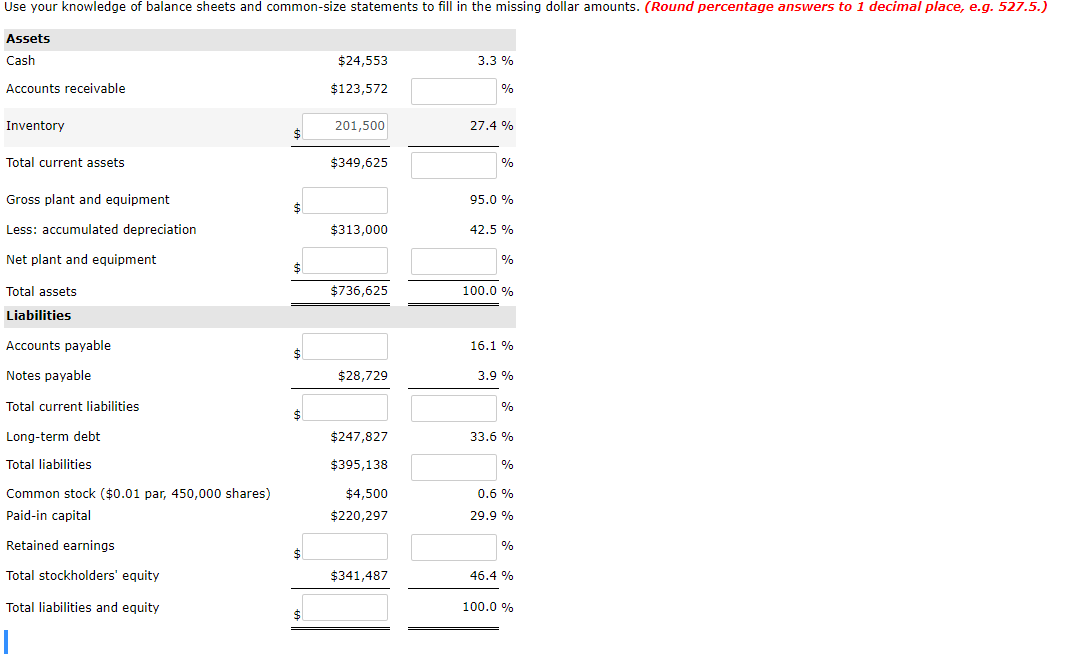

Use your knowledge of balance sheets and common-size statements to fill in the missing dollar amounts. (Round percentage answers to 1 decimal place, e.g. 527.5.)

Use your knowledge of balance sheets and common-size statements to fill in the missing dollar amounts. (Round percentage answers to 1 decimal place, e.g. 527.5.)

| Assets | ||||||

| Cash | $24,553 | 3.3 | % | |||

| Accounts receivable | $123,572 | % | ||||

| Inventory | $ | 27.4 | % | |||

| Total current assets | $349,625 | % | ||||

| Gross plant and equipment | $ | 95.0 | % | |||

| Less: accumulated depreciation | $313,000 | 42.5 | % | |||

| Net plant and equipment | $ | % | ||||

| Total assets | $736,625 | 100.0 | % | |||

| Liabilities | ||||||

| Accounts payable | $ | 16.1 | % | |||

| Notes payable | $28,729 | 3.9 | % | |||

| Total current liabilities | $ | % | ||||

| Long-term debt | $247,827 | 33.6 | % | |||

| Total liabilities | $395,138 | % | ||||

| Common stock ($0.01 par, 450,000 shares) | $4,500 | 0.6 | % | |||

| Paid-in capital | $220,297 | 29.9 | % | |||

| Retained earnings | $ | % | ||||

| Total stockholders' equity | $341,487 | 46.4 | % | |||

| Total liabilities and equity | $ | 100.0 | % |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started