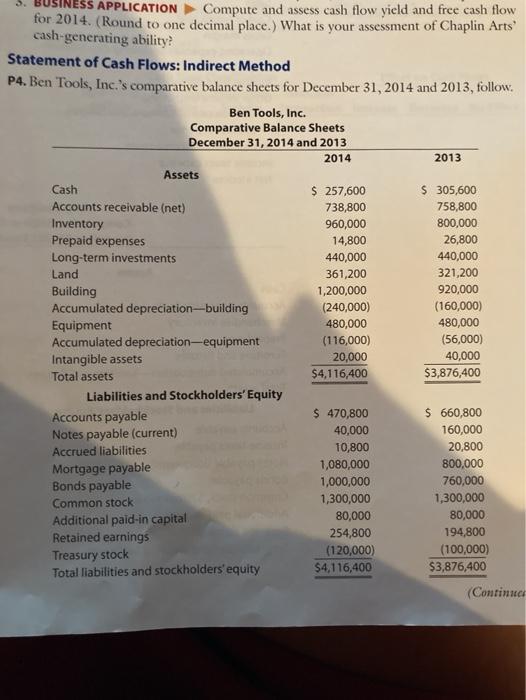

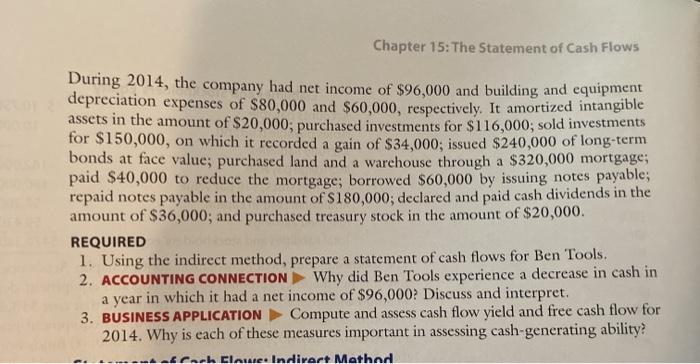

USINESS APPLICATION Compute and assess cash flow yield and free cash flow for 2014. (Round to one decimal place.) What is your assessment of Chaplin Arts cash-generating ability? Statement of Cash Flows: Indirect Method P4. Ben Tools, Inc.'s comparative balance sheets for December 31, 2014 and 2013, follow. Ben Tools, Inc. Comparative Balance Sheets December 31, 2014 and 2013 2014 2013 Assets Cash Accounts receivable (net) Inventory Prepaid expenses Long-term investments Land Building Accumulated depreciation-building Equipment Accumulated depreciation-equipment Intangible assets Total assets Liabilities and Stockholders' Equity Accounts payable Notes payable (current) Accrued liabilities Mortgage payable Bonds payable Common stock Additional paid-in capital Retained earnings Treasury stock Total liabilities and stockholders'equity $ 257,600 738,800 960,000 14,800 440,000 361,200 1,200,000 (240,000) 480,000 (116,000) 20,000 $4,116,400 $ 305,600 758,800 800,000 26,800 440,000 321,200 920,000 (160,000) 480,000 (56,000) 40,000 $3,876,400 $ 470,800 40,000 10,800 1,080,000 1,000,000 1,300,000 80,000 254,800 (120,000) $4,116,400 $ 660,800 160,000 20,800 800,000 760,000 1,300,000 80,000 194,800 (100,000) $3,876,400 ( (Continua Chapter 15: The Statement of Cash Flows During 2014, the company had net income of $96,000 and building and equipment depreciation expenses of $80,000 and $60,000, respectively. It amortized intangible assets in the amount of $20,000; purchased investments for $116,000; sold investments for $150,000, on which it recorded a gain of $34,000; issued $240,000 of long-term bonds at face value; purchased land and a warehouse through a $320,000 mortgage; paid $40,000 to reduce the mortgage; borrowed $60,000 by issuing notes payable; repaid notes payable in the amount of $180,000; declared and paid cash dividends in the amount of $36,000; and purchased treasury stock in the amount of $20,000. REQUIRED 1. Using the indirect method, prepare a statement of cash flows for Ben Tools. 2. ACCOUNTING CONNECTION Why did Ben Tools experience a decrease in cash in a year in which it had a net income of $96,000? Discuss and interpret. 3. BUSINESS APPLICATION Compute and assess cash flow yield and free cash flow for 2014. Why is each of these measures important in assessing cash-generating ability? - Clowe Indirect Method