Question

Using a trial balance and T-accounts, prepare an income statement for the month of July 2012, and prepare a balance sheet dated 31 July 2012.

Using a trial balance and T-accounts, prepare an income statement for the month of July 2012, and prepare a balance sheet dated 31 July 2012. Cross-reference entries in the T-accounts using the numbers of the transactions shown above.

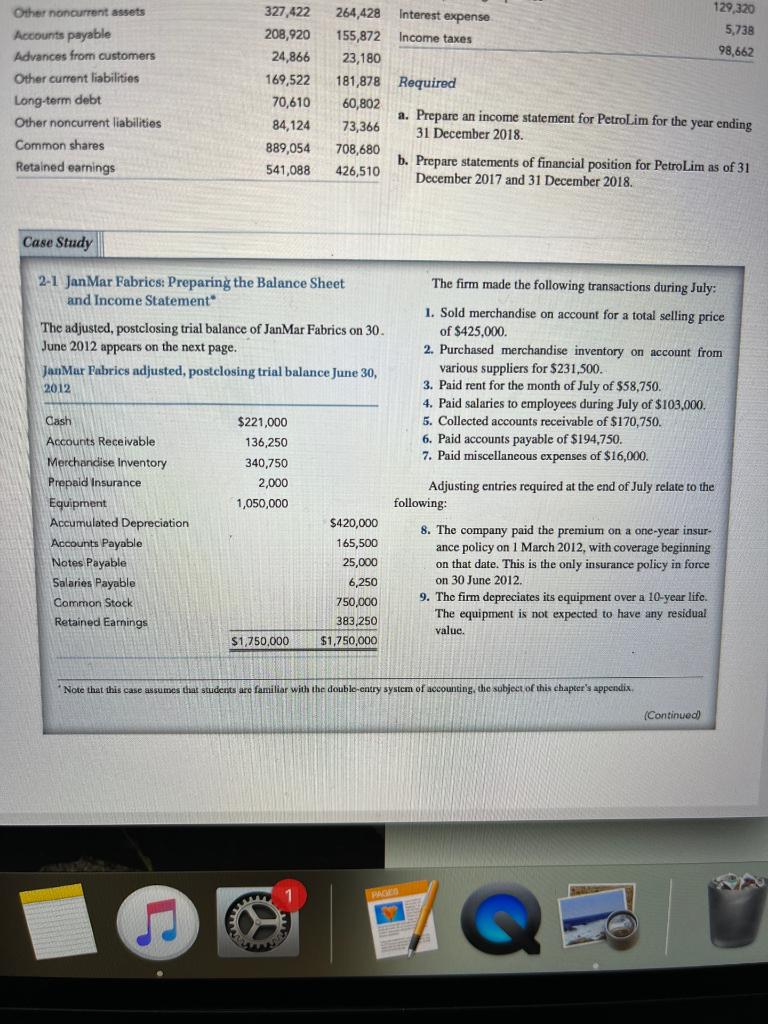

2-1 JanMar Fabrics: Preparing the Balance Sheet and Income Statement*

The adjusted, postclosing trial balance of JanMar Fabrics on 30 June 2012 appears on the next page.

JanMar Fabrics adjusted, postclosing trial balance June 30, 2012

The firm made the following transactions during July:

1. Sold merchandise on account for a total selling price of $425,000.

2. Purchased merchandise inventory on account from various suppliers for $231,500.

3. Paid rent for the month of July of $58,750. 4. Paid salaries to employees during July of $103,000. 5. Collected accounts receivable of $170,750. 6. Paid accounts payable of $194,750. 7. Paid miscellaneous expenses of $16,000.

Adjusting entries required at the end of July relate to the following:

-

The company paid the premium on a one-year insur- ance policy on 1 March 2012, with coverage beginning on that date. This is the only insurance policy in force on 30 June 2012.

-

The firm depreciates its equipment over a 10-year life. The equipment is not expected to have any residual value.

-

Employees earned salaries of $8,000 during the last three days of July but were not paid. These are the only unpaid salaries at the end of July.

-

The note payable is a 90-day, 12% note issued on 30 June 2012.

-

Merchandise inventory on hand on 31 July 2012 was $389,750.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started