Question

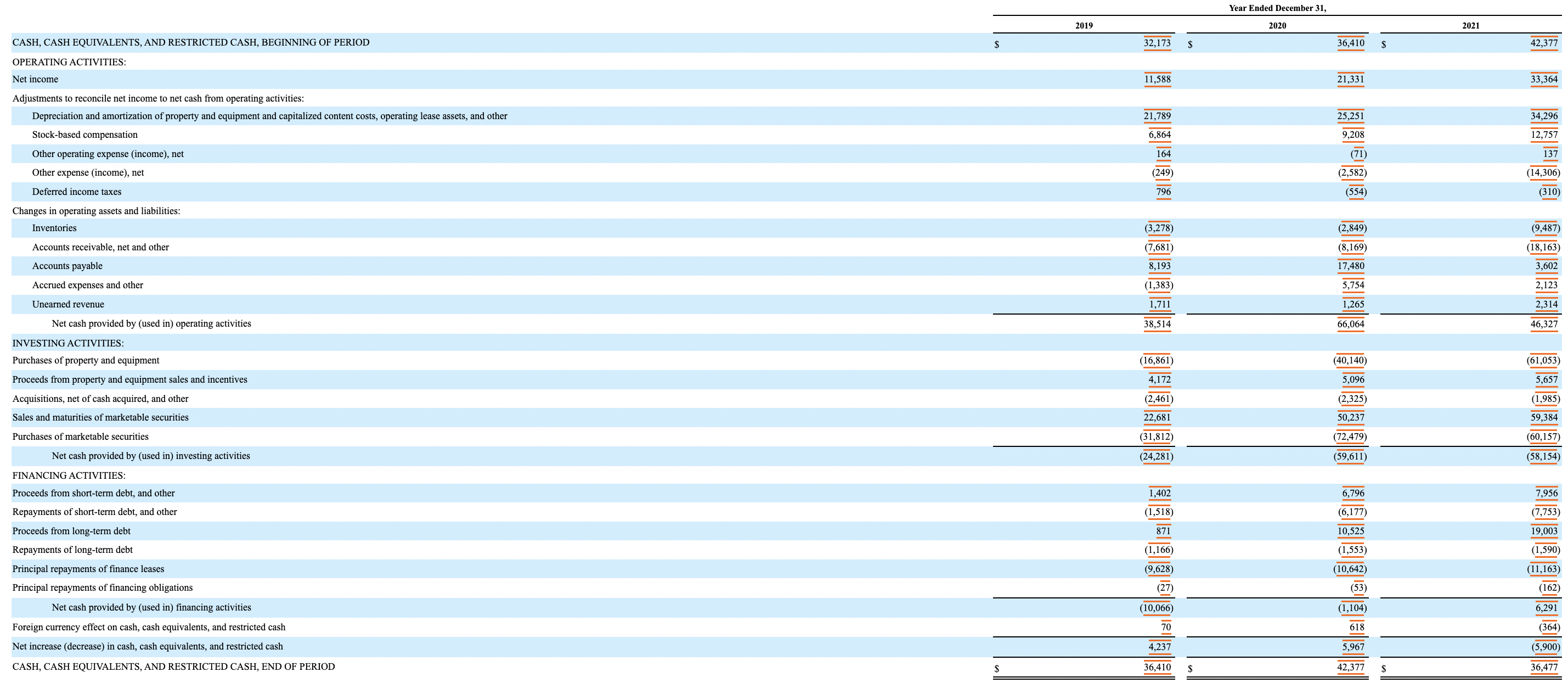

*USING AMAZON'S CASH FLOW STATEMENT BELOW* 1. During fiscal year 2021, Amazon borrowed from banks and other lenders, on a short-term and long-term basis, and

*USING AMAZON'S CASH FLOW STATEMENT BELOW*

1. During fiscal year 2021, Amazon borrowed from banks and other lenders, on a short-term and long-term basis, and also repaid principal on existing short-term and long-term debt. Were Amazons net borrowings positive or negative in 2021 (where positive means they borrowed more than they paid off)?

a) Net borrowings negative

b) Net borrowings positive

c) Net borrowings neutral

2. How does this borrowing activity compare to 2019, pre-pandemic?

a) Amazon was a net negative borrower pre-pandemic.

b) Amazon was a net postive borrower pre-pandemic.

c) Amazon was neither a new negative nor a net postive borrower re-pandemic becase it had positve free cash flow.

3. During 2021 Amazon's the change in operating assets/liabilities attributed to unearned revenue was $2,314.. How was this impact reflected on Amazon's income statement and balance sheet?

a) Revenues/income decreased, Accounts receivable/assets increased.

b) Revenues/income increased, Cash/assets increased.

c) Cash/assets increased, Unearned revenue/liabilities increased.

d) Cash assets decreased, Unearned revenue/liabilities decreased.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started