Answered step by step

Verified Expert Solution

Question

1 Approved Answer

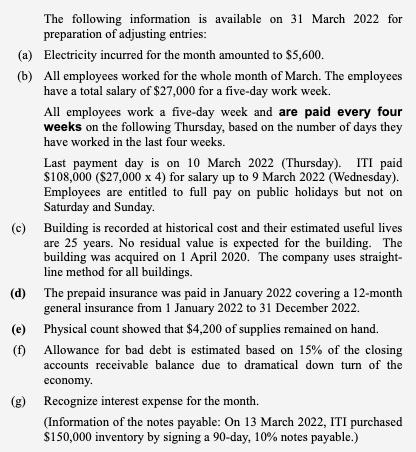

The following information is available on 31 March 2022 for preparation of adjusting entries: (a) Electricity incurred for the month amounted to $5,600. (b)

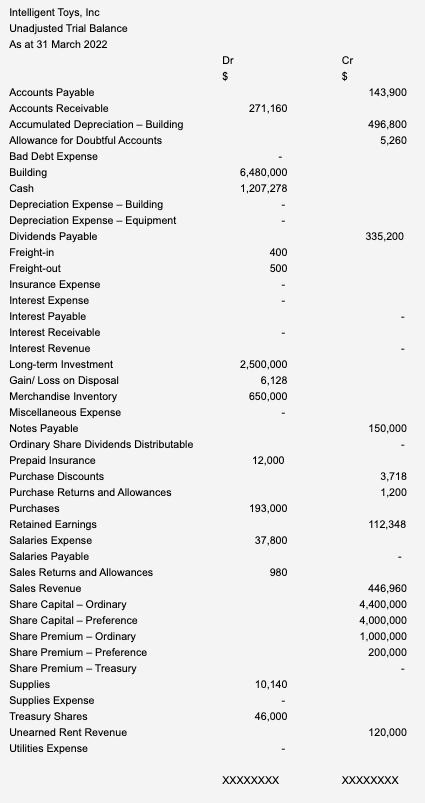

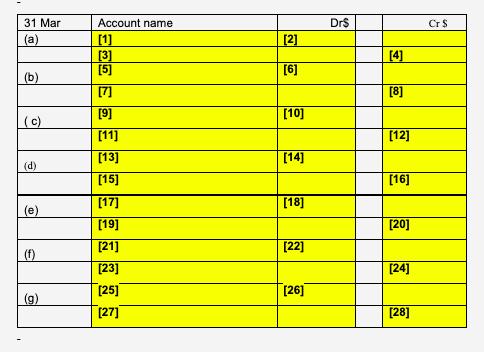

The following information is available on 31 March 2022 for preparation of adjusting entries: (a) Electricity incurred for the month amounted to $5,600. (b) All employees worked for the whole month of March. The employees have a total salary of $27,000 for a five-day work week. All employees work a five-day week and are paid every four weeks on the following Thursday, based on the number of days they have worked in the last four weeks. Last payment day is on 10 March 2022 (Thursday). ITI paid $108,000 ($27,000 x 4) for salary up to 9 March 2022 (Wednesday). Employees are entitled to full pay on public holidays but not on Saturday and Sunday. (c) Building is recorded at historical cost and their estimated useful lives are 25 years. No residual value is expected for the building. The building was acquired on 1 April 2020. The company uses straight- line method for all buildings. (d) The prepaid insurance was paid in January 2022 covering a 12-month general insurance from 1 January 2022 to 31 December 2022. (e) (f) Physical count showed that $4,200 of supplies remained on hand. Allowance for bad debt is estimated based on 15% of the closing accounts receivable balance due to dramatical down turn of the economy. (g) Recognize interest expense for the month. (Information of the notes payable: On 13 March 2022, ITI purchased $150,000 inventory by signing a 90-day, 10% notes payable.) Intelligent Toys, Inc Unadjusted Trial Balance As at 31 March 2022 Accounts Payable Accounts Receivable Accumulated Depreciation - Building Allowance for Doubtful Accounts Bad Debt Expense Building Cash Depreciation Expense - Building Depreciation Expense - Equipment Dividends Payable Freight-in Freight-out Insurance Expense Interest Expense Interest Payable Interest Receivable Interest Revenue Long-term Investment Gain/Loss on Disposal Merchandise Inventory Miscellaneous Expense Notes Payable Ordinary Share Dividends Distributable Prepaid Insurance Purchase Discounts Purchase Returns and Allowances Purchases Retained Earnings Salaries Expense Salaries Payable Sales Returns and Allowances Sales Revenue Share Capital - Ordinary Share Capital - Preference Share Premium - Ordinary Share Premium - Preference Share Premium - Treasury Supplies Supplies Expense Treasury Shares Unearned Rent Revenue Utilities Expense Dr $ 271,160 6,480,000 1,207,278 400 500 2,500,000 6,128 650,000 12,000 193,000 37,800 980 10,140 46,000 XXXXXXXX Cr $ 143,900 496,800 5,260 335,200 150,000 3,718 1,200 112,348 446,960 4,400,000 4,000,000 1,000,000 200,000 120,000 XXXXXXXX 31 Mar (a) (b) (c) (d) (e) (f) (9) Account name [1] [3] [5] [7] [9] [11] [13] [15] [17] [19] [21] [23] [25] [27] [2] [6] [10] [14] [18] [22] [26] Dr$ [4] [8] [12] [16] [20] [24] [28] Cr $

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started