Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company issues $15,000,000, 7.8%, 20-year bonds to yield 8% on January 1. 26. 2017. Interest is paid on June 30 and December 31.

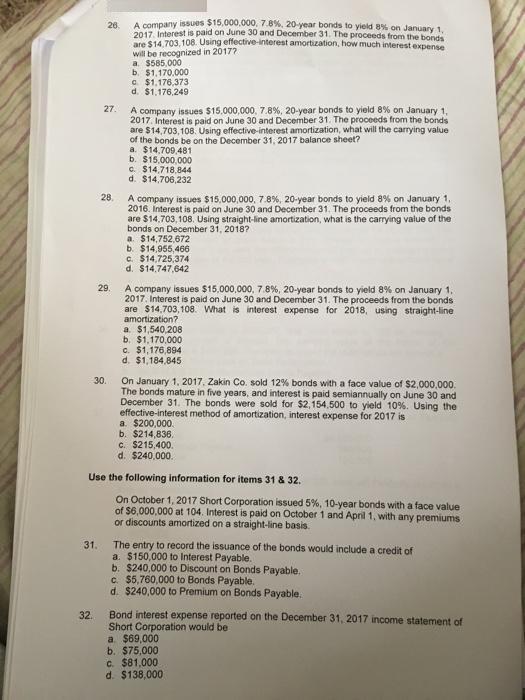

A company issues $15,000,000, 7.8%, 20-year bonds to yield 8% on January 1. 26. 2017. Interest is paid on June 30 and December 31. The proceeds from the bonds are $14,703,108. Using effective-interest amortzation, how much interest expense will be recognized in 2017? a. $585,000 b. $1,170,000 C $1,176,373 d. $1,176,249 27. A company issues $15,000,000, 7.8%, 20-year bonds to yield 8% on January 1, 2017. Interest is paid on June 30 and December 31. The proceeds from the bonds are $14,703,108. Using effective-interest amortization, what will the carrying value of the bonds be on the December 31, 2017 balance sheet? a. $14,709,481 b. $15,000,000 C. $14,718,844 d. $14,706,232 28. A company issues $15,000,000, 7.8%, 20-year bonds to yield 8% on January 1, 2016. Interest is paid on June 30 and December 31. The proceeds from the bonds are $14,703, 108. Using straight-line amortization, what is the carrying value of the bonds on December 31, 2018? a. $14,752,672 b. $14,955,466 c. $14,725,374 d. $14,747,642 29. A company issues $15,000,000, 7.8%, 20-year bonds to yield 8% on January 1, 2017. Interest is paid on June 30 and December 31. The proceeds from the bonds are $14,703, 108. What is interest expense for 2018, using straight-line amortization? a. $1,540,208 b. $1,170,000 c. $1,176,894 d. $1,184,845 On January 1, 2017, Zakin Co. sold 12% bonds with a face value of $2,000,000. The bonds mature in five years, and interest is paid semiannually on June 30 and December 31. The bonds were sold for $2,154,500 to yield 10%. Using the effective-interest method of amortization, interest expense for 2017 is a. $200,000. b. $214,836. C. $215,400. d. $240,000. 30. Use the following information for items 31 & 32. On October 1, 2017 Short Corporation issued 5%, 10-year bonds with a face value of $6,000,000 at 104. Interest is paid on October 1 and April 1, with any premiums or discounts amortized on a straight-line basis The entry to record the issuance of the bonds would include a credit of a. $150,000 to Interest Payable. b. $240,000 to Discount on Bonds Payable. c. $5,760,000 to Bonds Payable. d. $240,000 to Premium on Bonds Payable. 31. 32. Bond interest expense reported on the December 31, 2017 income statement of Short Corporation would be a. $69,000 b. $75,000 c. $81,000 d. $138,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Interest expense to be recognised in 2017 will be equal to the 2 semi annual Interest expense Inter...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started