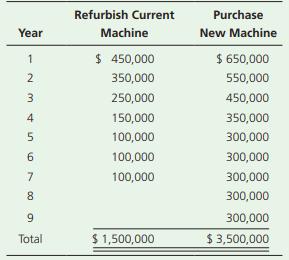

Using payback, ARR, and NPV with unequal cash flows Medeiros Manufacturing, Inc. has a manufacturing machine that needs attention. The company is considering two options.

- Medeiros uses straight-line depreciation and requires an annual return of 10%.

- 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options.

- 2. Which option should Medeiros choose? Why?

Requirements

Refurbish Current Purchase Year Machine New Machine $ 450,000 $ 650,000 2 350,000 550,000 250,000 450,000 4 150,000 350,000 100,000 300,000 100,000 300,000 100,000 300,000 8. 300,000 300,000 Total $ 1,500,000 $ 3,500,000 Refurbish Current Purchase Year Machine New Machine $ 450,000 $ 650,000 2 350,000 550,000 250,000 450,000 4 150,000 350,000 100,000 300,000 100,000 300,000 100,000 300,000 8. 300,000 300,000 Total $ 1,500,000 $ 3,500,000 Refurbish Current Purchase Year Machine New Machine $ 450,000 $ 650,000 2 350,000 550,000 250,000 450,000 4 150,000 350,000 100,000 300,000 100,000 300,000 100,000 300,000 8. 300,000 300,000 Total $ 1,500,000 $ 3,500,000 Refurbish Current Purchase Year Machine New Machine $ 450,000 $ 650,000 2 350,000 550,000 250,000 450,000 4 150,000 350,000 100,000 300,000 100,000 300,000 100,000 300,000 8. 300,000 300,000 Total $ 1,500,000 $ 3,500,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Requirement 1 a Payback Option 1 Refurbish Option 2 Purchase Year Cash Outflow Cash Inflows Cumulative Net Cashflows Year Cash Outflow Cash Inflows Cumulative Net Cashflows 0 2600000 2600000 0 3800000 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started