Answered step by step

Verified Expert Solution

Question

1 Approved Answer

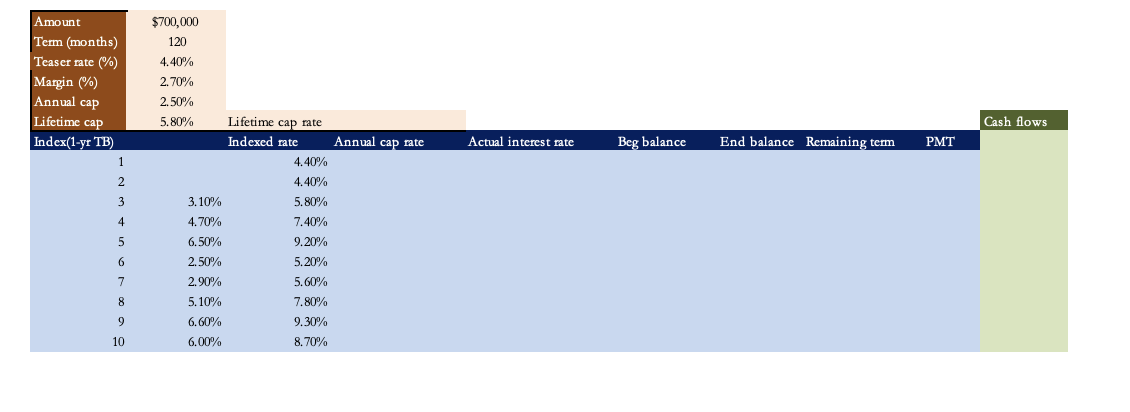

Using tab 2 in the template, create the amortization spreadsheet and answer the following questions for a $ 7 0 0 , 0 0 0

Using tab in the template, create the amortization spreadsheet and answer the

following questions for a $year adjustablerate mortgage ARM loan that is

fullyamortizing and has monthly payments. A teaser rate of applies to the

mortgage payments and amortization during the first years of the loan. After the second

year, the annual interest rate on the loan is equal to the going rate on an index a margin

of subject to an annual interest rate cap of and a lifetime interest rate cap of

over the initial teaser rate. Expectations for the beginningofyear values for the

appropriate index are as follows:

Year Index

a Based on these expectations and conditions, what would be the actual contract

interest rates applied to the mortgage payment during years through

b What would be the APR on this loan, if held until maturity assuming upfront points

of

C What is the outstanding balance at the end of year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started