Question

Using the 2019 Canadian Beta values, an investor invests $55,000 in the following stocks. Company AGF Management Ltd. Bank of Nova Scotia BCE Inc.

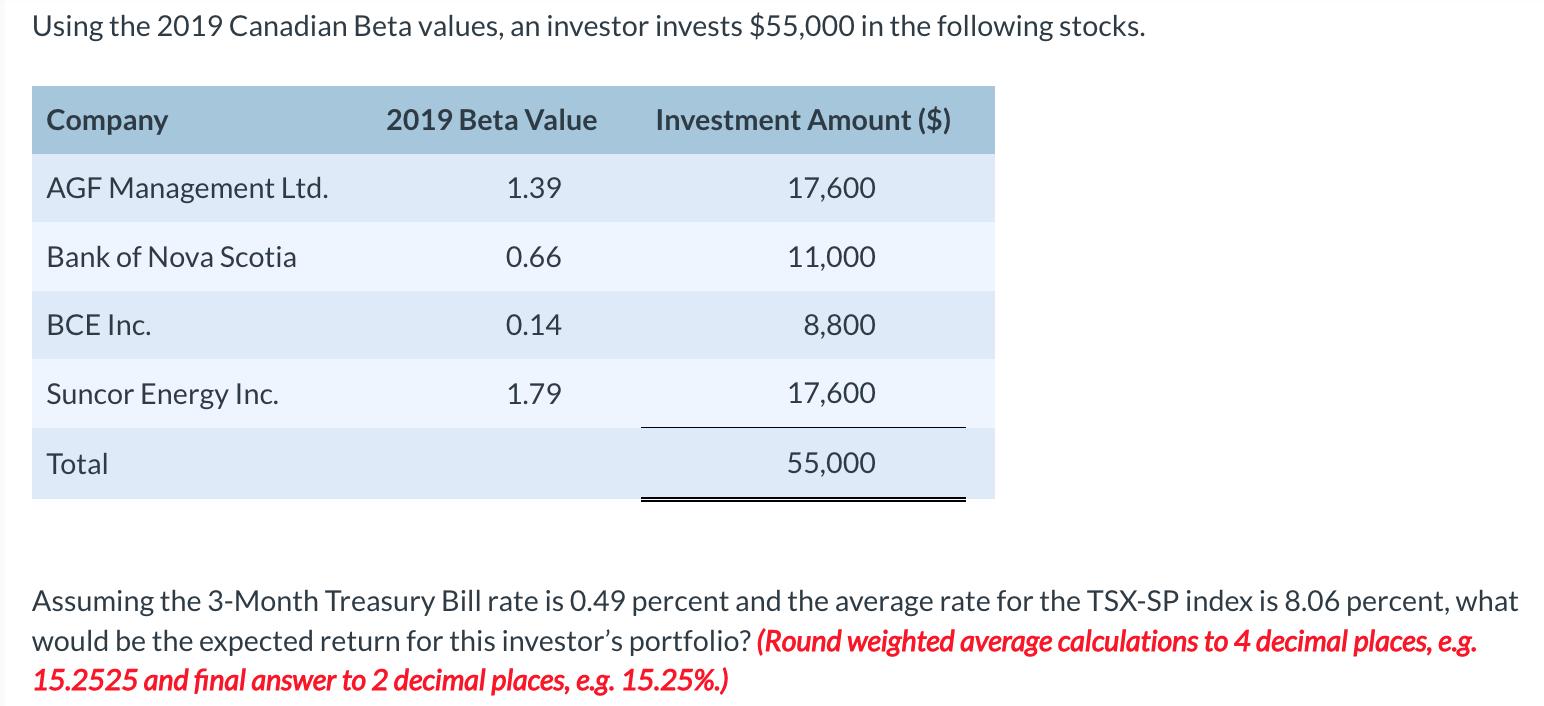

Using the 2019 Canadian Beta values, an investor invests $55,000 in the following stocks. Company AGF Management Ltd. Bank of Nova Scotia BCE Inc. Suncor Energy Inc. Total 2019 Beta Value Investment Amount ($) 1.39 0.66 0.14 1.79 17,600 11,000 8,800 17,600 55,000 Assuming the 3-Month Treasury Bill rate is 0.49 percent and the average rate for the TSX-SP index is 8.06 percent, what would be the expected return for this investor's portfolio? (Round weighted average calculations to 4 decimal places, e.g. 15.2525 and final answer to 2 decimal places, e.g. 15.25%.)

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Federal Income Taxation In Canada

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

33rd Edition

1554965020, 978-1554965021

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App