Answered step by step

Verified Expert Solution

Question

1 Approved Answer

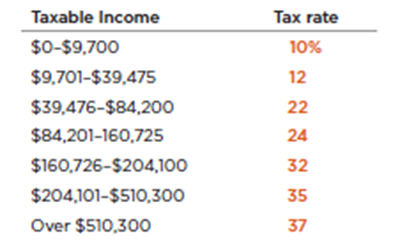

Using the 2019 marginal tax rates provided in the table below, find the marginal and average tax rates for the incomes shown. Give all answers

Using the 2019 marginal tax rates provided in the table below, find the marginal and average tax rates for the incomes shown. Give all answers to two decimals.

Part 1 (2 points) What would be your federal income tax if your taxable income was $104,000.00? $

What is the average tax rate for $104,000.00 in taxable income? % Part 2 (2 points) How much tax would you owe if your income increased by $25,000 to $129,000.00? $

What would be your average tax rate with $129,000.00 of taxable income? %

Taxable income $0-$9.700 $9,701-$39,475 $39,476-$84,200 $84,201-160,725 $160,726-5204,100 $204,101-$510,300 Over $510,300 Tax rate 10% 12 22 24 32 35 37Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started