Answered step by step

Verified Expert Solution

Question

1 Approved Answer

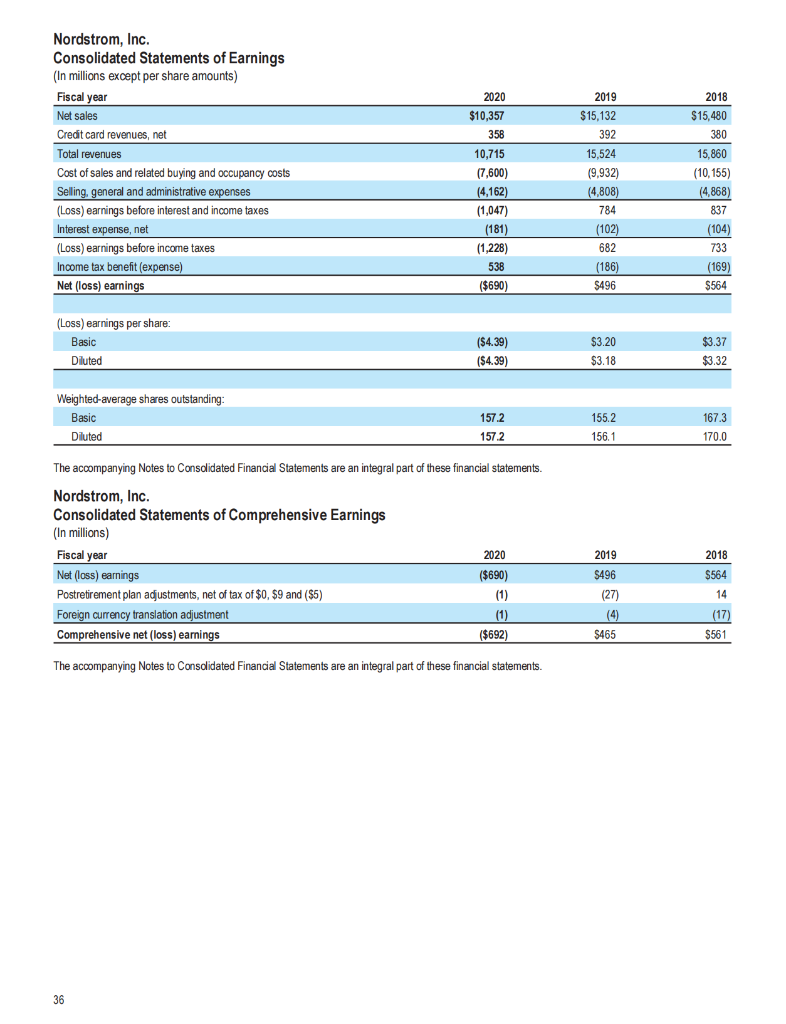

Using the Annual Report, use the formal financial statements to compute the following for Nordstrom: Asset Turnover Current Ratio Earnings per share (this should be

Using the Annual Report, use the formal financial statements to compute the following for Nordstrom:

Asset Turnover

Current Ratio

Earnings per share (this should be disclosed on the Income Statement, already calculated)

Inventory Turnover

Debt to Asset Ratio

Accounts Receivable Turnover

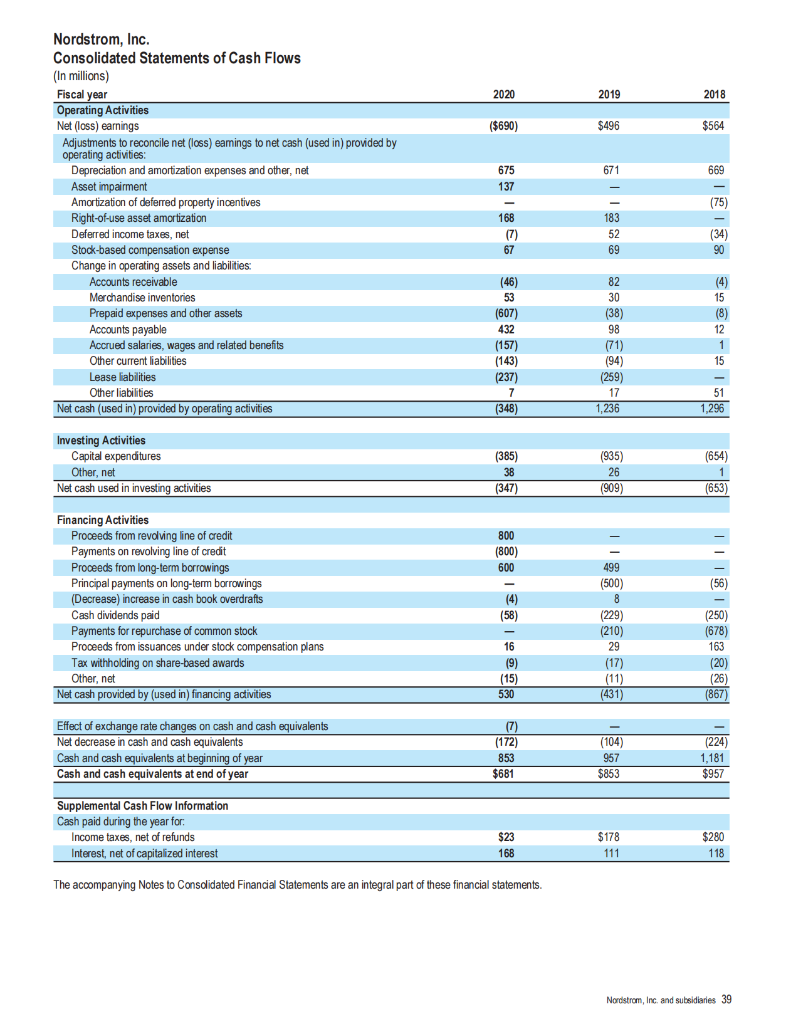

Free Cash Flow

A vertical analysis for COGS, using Net Sales as the base (i.e., compute COGS as a percent of net sales).

A horizontal analysis for Net Sales (i.e., compute the percent change from the prior year to the current year).

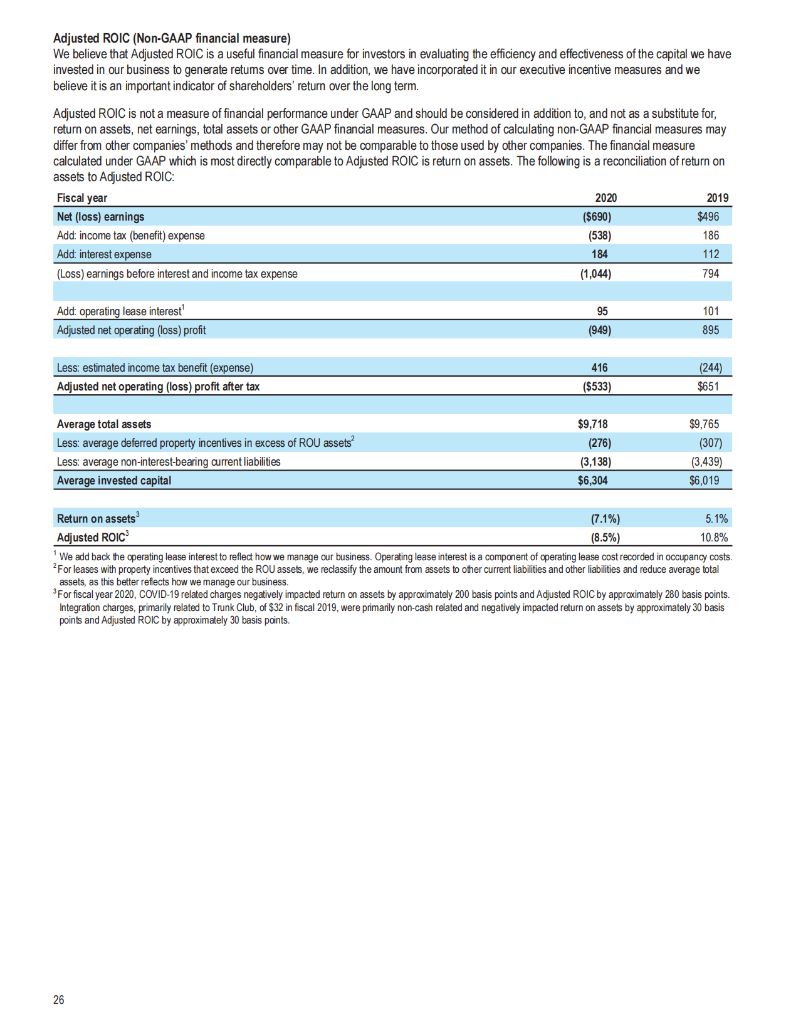

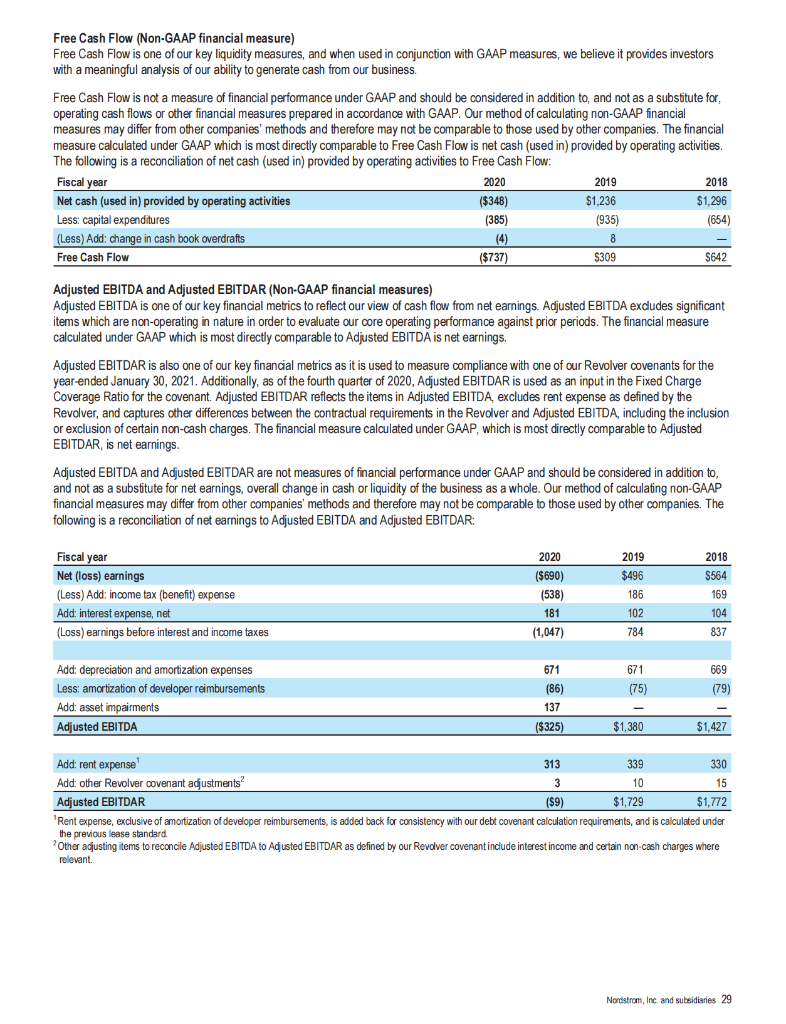

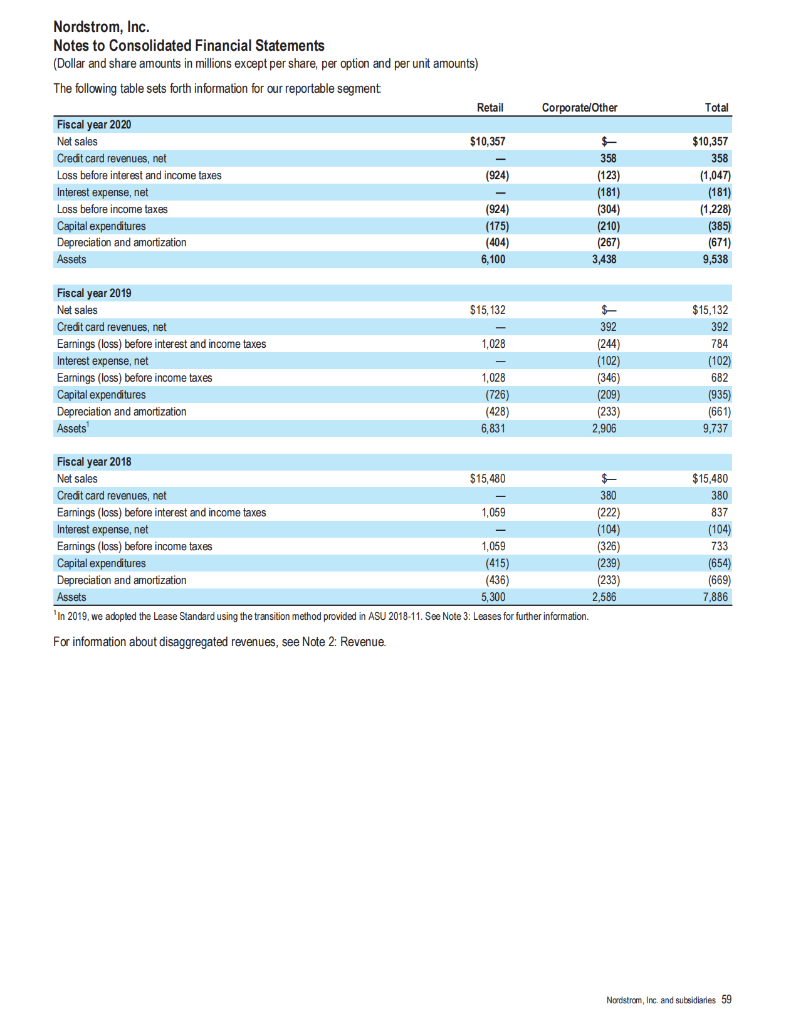

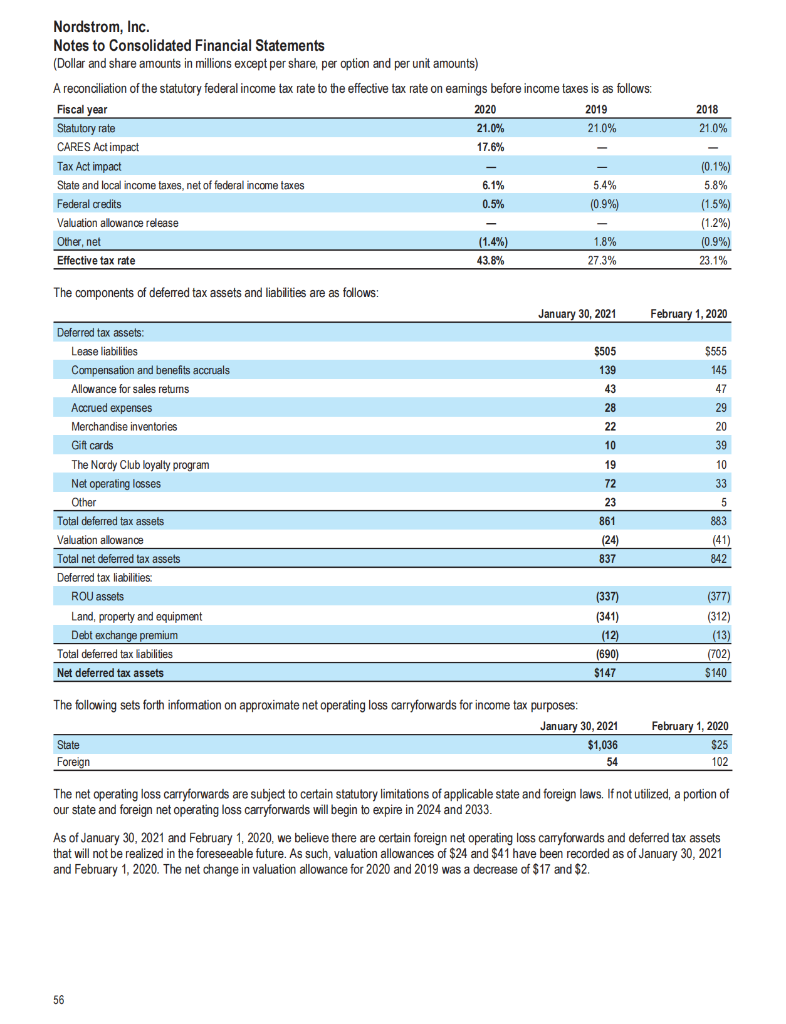

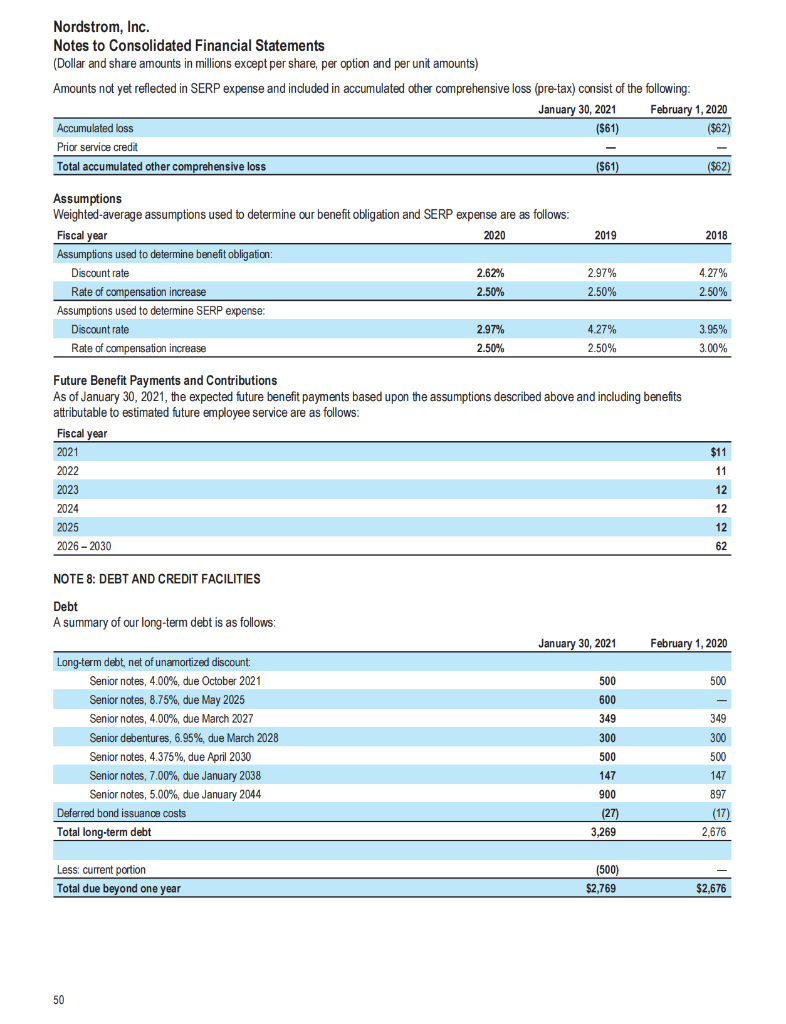

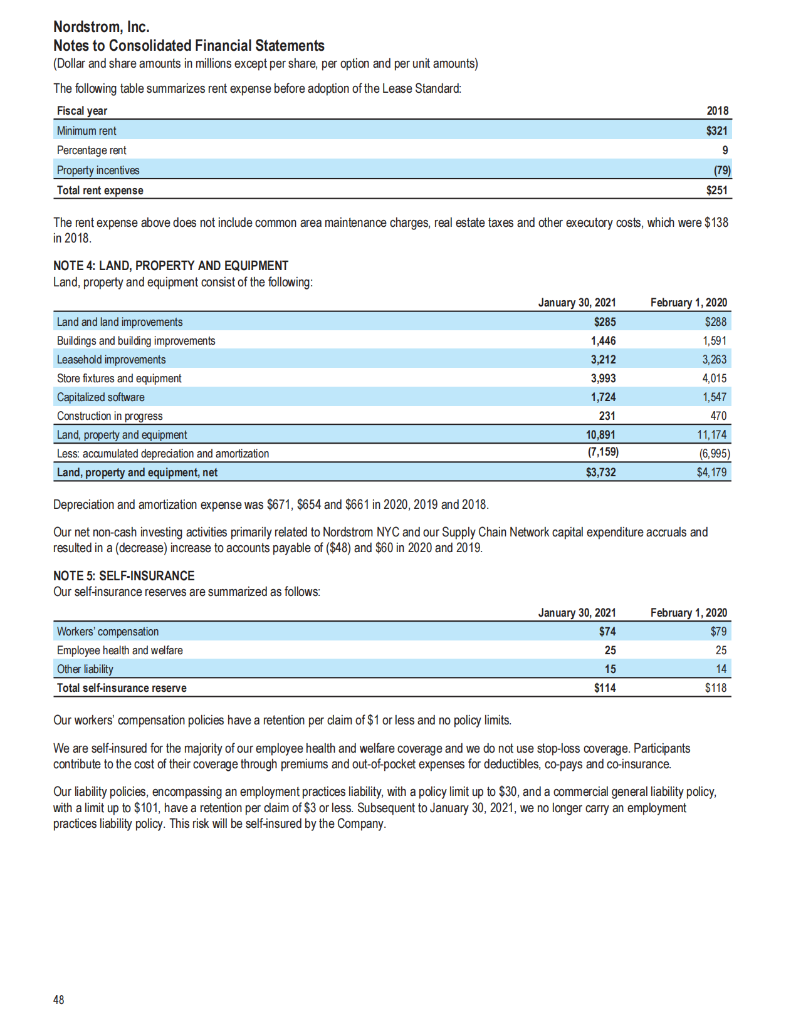

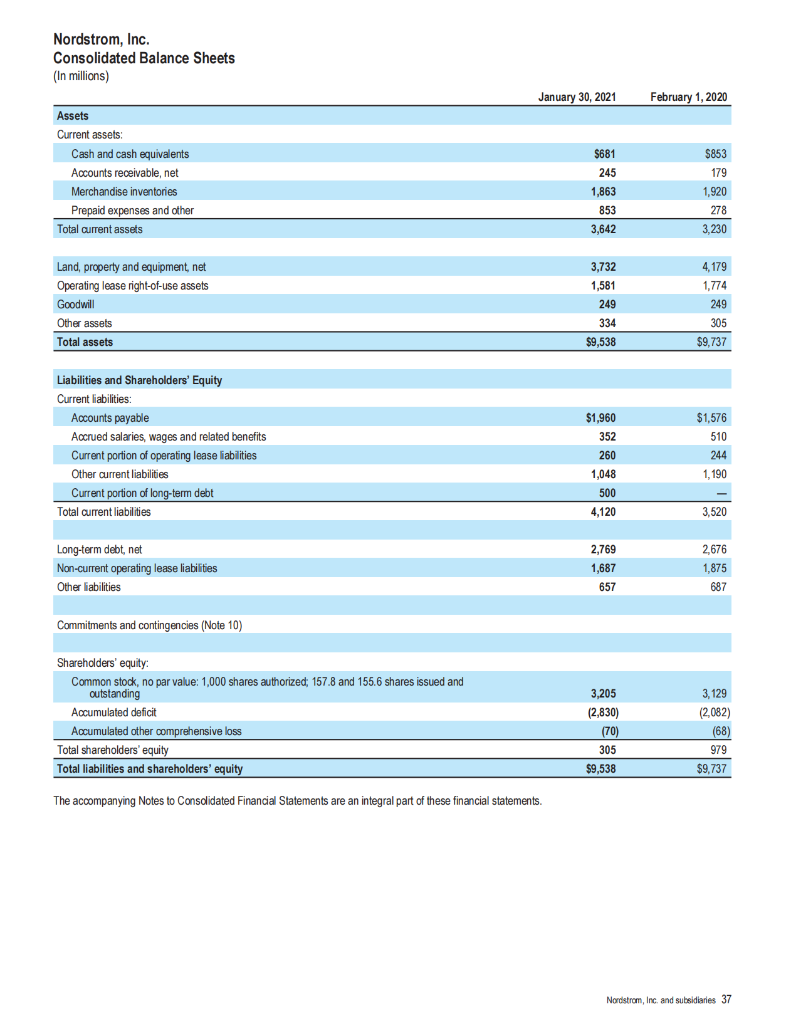

Adjusted ROIC (Non-GAAP financial measure) We believe that Adjusted ROIC is a useful financial measure for investors in evaluating the efficiency and effectiveness of the capital we have invested in our business to generate retums over time. In addition, we have incorporated it in our executive incentive measures and we believe it is an important indicator of shareholders' return over the long term. Adjusted ROIC is not a measure of financial performance under GAAP and should be considered in addition to, and not as a substitute for, return on assets, net earnings, total assets or other GAAP financial measures. Our method of calculating non-GAAP financial measures may differ from other companies' methods and therefore may not be comparable to those used by other companies. The financial measure calculated under GAAP which is most directly comparable to Adjusted ROIC is return on assets. The following is a reconciliation of return on assets to Adjusted ROIC: \begin{tabular}{llll} Return on assets 3 & (7.1\%) & 5.1% \\ Adjusted ROIC & & (8.5\%) & 10.8% \\ \hline \end{tabular} 1 We add back the cperating lease interest to reflect how we manage our business. Operating lease interest is a component of operating lease cost recorded in occupancy costs. 2 For leases with property incentives that exceed the ROU assets, we reclassify the amount from assets to oher current liabilities and other liablities and reduce average total assets, as this better refects how we manage cur business. 3 For fiscal year 2020, COVID-19 related charges negatively impacted return on assets by approwimatcly 200 basis points and Adjusted ROIC by approximately 280 basis points. Integration charges, primarly related to Trunk Club, of $32 in fiscal 2019 , were primarily non-cash related and negatively impacted return on assets by approximately 30 basis points and Adjusted ROK by approximately 30 basis points. Free Cash Flow (Non-GAAP financial measure) Free Cash Flow is one of our key liquidity measures, and when used in conjunction with GAAP measures, we believe it provides investors with a meaningful analysis of our ability to generate cash from our business. Free Cash Flow is not a measure of financial performance under GAAP and should be considered in addition to, and not as a substitute for, operating cash flows or other financial measures prepared in accordance with GAAP. Our method of calculating non-GAAP financial measures may differ from other companies' methods and therefore may not be comparable to those used by other companies. The financial measure calculated under GAAP which is most directly comparable to Free Cash Flow is net cash (used in) provided by operating activities. The following is a reconciliation of net cash (used in) provided by operating activities to Free Cash Flow: Adjusted EBITDA and Adjusted EBITDAR (Non-GAAP financial measures) Adjusted EBITDA is one of our key financial metrics to reflect our view of cash flow from net earnings. Adjusted EBITDA excludes significant items which are non-operating in nature in order to evaluate our core operating performance against prior periods. The financial measure calculated under GAAP which is most directly comparable to Adjusted EBITDA is net earnings. Adjusted EBITDAR is also one of our key financial metrics as it is used to measure compliance with one of cur Revolver covenants for the year-ended January 30, 2021. Additionally, as of the fourth quarter of 2020, Adjusted EBITDAR is used as an input in the Fixed Charge Coverage Ratio for the covenant. Adjusted EBITDAR reflects the items in Adjusted EBITDA, excludes rent expense as defined by the Revolver, and captures other differences between the contractual requirements in the Revolver and Adjusted EBITDA, including the inclusion or exclusion of certain non-cash charges. The financial measure calculated under GAAP, which is most directly comparable to Adjusted EBITDAR, is net earnings. Adjusted EBITDA and Adjusted EBITDAR are not measures of financial performance under GAAP and should be considered in addition to, and not as a substitute for net earnings, overall change in cash or liquidity of the business as a whole. Our method of calculating non-GAAP financial measures may differ from other companies' methods and therefore may not be comparable to those used by other companies. The following is a reconciliation of net earnings to Adjusted EBITDA and Adjusted EBITDAR: relevant. Nordstrom, Inc. and subsidiaries 29 Nordstrom, Inc. Notes to Consolidated Financial Statements (Dollar and share amounts in millions except per share, per option and per unit amounts) 'In 2019, we adopted the Lease Standard using the transition method provided in ASU 2018-11. See Note 3: Leases for further intormation. For information about disaggregated revenues, see Note 2: Revenue. Nordstrom, Inc. and subsidiaries 59 Nordstrom, Inc. Notes to Consolidated Financial Statements (Dollar and share amounts in millions except per share, per option and per unit amounts) A reconciliation of the statutory federal income tax rate to the effective tax rate on eamings before income taxes is as follows: The net operating loss carryforwards are subject to certain statutory limitations of applicable state and foreign laws. If not utilized, a portion of our state and foreign net operating loss carryforwards will begin to expire in 2024 and 2033. As of January 30, 2021 and February 1, 2020, we believe there are rtain foreign net operating loss carryforwards and deferred tax assets that will not be realized in the foreseeable future. As such, valuation allowances of $24 and $41 have been recorded as of January 30,2021 and February 1, 2020. The net change in valuation allowance for 2020 and 2019 was a decrease of $17 and $2. Nordstrom, Inc. Notes to Consolidated Financial Statements (Dollar and share amounts in millions except per share, per option and per unit amounts) Amounts not yet reflected in SERP expense and included in accumulated other comprehensive loss (pre-tax) consist of the following: Assumptions Weighted-average assumptions used to determine our benefit obligation and SERP expense are as follows: Future Benefit Payments and Contributions As of January 30, 2021, the expected future benefit payments based upon the assumptions described above and including benefits attributable to estimated future employee service are as follows: NOTE 8: DEBT AND CREDIT FACILITIES Debt A summary of our long-term debt is as follows: Nordstrom, Inc. Notes to Consolidated Financial Statements (Dollar and share amounts in millions except per share, per option and per unit amounts) The following table summarizes rent expense before adoption of the Lease Standard: The rent expense above does not include common area maintenance charges, real estate taxes and other executory costs, which were $138 in 2018 , NOTE 4: LAND, PROPERTY AND EQUIPMENT Land, property and equipment consist of the following: Depreciation and amortization expense was $671,$654 and $661 in 2020, 2019 and 2018. Our net non-cash investing activities primarily related to Nordstrom NYC and our Supply Chain Network capital expenditure accruals and resulted in a (decrease) increase to aocounts payable of ($48) and $60 in 2020 and 2019. NOTE 5: SELF-INSURANCE Our self-insurance reserves are summarized as follows: Our workers' compensation policies have a retention per claim of $1 or less and no policy limits. We are selfinsured for the majority of our employee health and welfare coverage and we do not use stop-loss coverage. Participants contribute to the cost of their coverage through premiums and out-of-pocket expenses for deductibles, co-pays and co-insurance. Our liability policies, encompassing an employment practices liability, with a policy limit up to $30, and a commercial general liability policy, with a limit up to $101, have a retention per claim of $3 or less. Subsequent to January 30,2021 , we no longer carry an employment practices liability policy. This risk will be self-insured by the Company. Nordstrom, Inc. C.onenlidated Ralance Sheate Nordstrom, Inc. and subsidiaries 37 The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statements. Nodstrtrom, Inc. and subesidianies 39 Adjusted ROIC (Non-GAAP financial measure) We believe that Adjusted ROIC is a useful financial measure for investors in evaluating the efficiency and effectiveness of the capital we have invested in our business to generate retums over time. In addition, we have incorporated it in our executive incentive measures and we believe it is an important indicator of shareholders' return over the long term. Adjusted ROIC is not a measure of financial performance under GAAP and should be considered in addition to, and not as a substitute for, return on assets, net earnings, total assets or other GAAP financial measures. Our method of calculating non-GAAP financial measures may differ from other companies' methods and therefore may not be comparable to those used by other companies. The financial measure calculated under GAAP which is most directly comparable to Adjusted ROIC is return on assets. The following is a reconciliation of return on assets to Adjusted ROIC: \begin{tabular}{llll} Return on assets 3 & (7.1\%) & 5.1% \\ Adjusted ROIC & & (8.5\%) & 10.8% \\ \hline \end{tabular} 1 We add back the cperating lease interest to reflect how we manage our business. Operating lease interest is a component of operating lease cost recorded in occupancy costs. 2 For leases with property incentives that exceed the ROU assets, we reclassify the amount from assets to oher current liabilities and other liablities and reduce average total assets, as this better refects how we manage cur business. 3 For fiscal year 2020, COVID-19 related charges negatively impacted return on assets by approwimatcly 200 basis points and Adjusted ROIC by approximately 280 basis points. Integration charges, primarly related to Trunk Club, of $32 in fiscal 2019 , were primarily non-cash related and negatively impacted return on assets by approximately 30 basis points and Adjusted ROK by approximately 30 basis points. Free Cash Flow (Non-GAAP financial measure) Free Cash Flow is one of our key liquidity measures, and when used in conjunction with GAAP measures, we believe it provides investors with a meaningful analysis of our ability to generate cash from our business. Free Cash Flow is not a measure of financial performance under GAAP and should be considered in addition to, and not as a substitute for, operating cash flows or other financial measures prepared in accordance with GAAP. Our method of calculating non-GAAP financial measures may differ from other companies' methods and therefore may not be comparable to those used by other companies. The financial measure calculated under GAAP which is most directly comparable to Free Cash Flow is net cash (used in) provided by operating activities. The following is a reconciliation of net cash (used in) provided by operating activities to Free Cash Flow: Adjusted EBITDA and Adjusted EBITDAR (Non-GAAP financial measures) Adjusted EBITDA is one of our key financial metrics to reflect our view of cash flow from net earnings. Adjusted EBITDA excludes significant items which are non-operating in nature in order to evaluate our core operating performance against prior periods. The financial measure calculated under GAAP which is most directly comparable to Adjusted EBITDA is net earnings. Adjusted EBITDAR is also one of our key financial metrics as it is used to measure compliance with one of cur Revolver covenants for the year-ended January 30, 2021. Additionally, as of the fourth quarter of 2020, Adjusted EBITDAR is used as an input in the Fixed Charge Coverage Ratio for the covenant. Adjusted EBITDAR reflects the items in Adjusted EBITDA, excludes rent expense as defined by the Revolver, and captures other differences between the contractual requirements in the Revolver and Adjusted EBITDA, including the inclusion or exclusion of certain non-cash charges. The financial measure calculated under GAAP, which is most directly comparable to Adjusted EBITDAR, is net earnings. Adjusted EBITDA and Adjusted EBITDAR are not measures of financial performance under GAAP and should be considered in addition to, and not as a substitute for net earnings, overall change in cash or liquidity of the business as a whole. Our method of calculating non-GAAP financial measures may differ from other companies' methods and therefore may not be comparable to those used by other companies. The following is a reconciliation of net earnings to Adjusted EBITDA and Adjusted EBITDAR: relevant. Nordstrom, Inc. and subsidiaries 29 Nordstrom, Inc. Notes to Consolidated Financial Statements (Dollar and share amounts in millions except per share, per option and per unit amounts) 'In 2019, we adopted the Lease Standard using the transition method provided in ASU 2018-11. See Note 3: Leases for further intormation. For information about disaggregated revenues, see Note 2: Revenue. Nordstrom, Inc. and subsidiaries 59 Nordstrom, Inc. Notes to Consolidated Financial Statements (Dollar and share amounts in millions except per share, per option and per unit amounts) A reconciliation of the statutory federal income tax rate to the effective tax rate on eamings before income taxes is as follows: The net operating loss carryforwards are subject to certain statutory limitations of applicable state and foreign laws. If not utilized, a portion of our state and foreign net operating loss carryforwards will begin to expire in 2024 and 2033. As of January 30, 2021 and February 1, 2020, we believe there are rtain foreign net operating loss carryforwards and deferred tax assets that will not be realized in the foreseeable future. As such, valuation allowances of $24 and $41 have been recorded as of January 30,2021 and February 1, 2020. The net change in valuation allowance for 2020 and 2019 was a decrease of $17 and $2. Nordstrom, Inc. Notes to Consolidated Financial Statements (Dollar and share amounts in millions except per share, per option and per unit amounts) Amounts not yet reflected in SERP expense and included in accumulated other comprehensive loss (pre-tax) consist of the following: Assumptions Weighted-average assumptions used to determine our benefit obligation and SERP expense are as follows: Future Benefit Payments and Contributions As of January 30, 2021, the expected future benefit payments based upon the assumptions described above and including benefits attributable to estimated future employee service are as follows: NOTE 8: DEBT AND CREDIT FACILITIES Debt A summary of our long-term debt is as follows: Nordstrom, Inc. Notes to Consolidated Financial Statements (Dollar and share amounts in millions except per share, per option and per unit amounts) The following table summarizes rent expense before adoption of the Lease Standard: The rent expense above does not include common area maintenance charges, real estate taxes and other executory costs, which were $138 in 2018 , NOTE 4: LAND, PROPERTY AND EQUIPMENT Land, property and equipment consist of the following: Depreciation and amortization expense was $671,$654 and $661 in 2020, 2019 and 2018. Our net non-cash investing activities primarily related to Nordstrom NYC and our Supply Chain Network capital expenditure accruals and resulted in a (decrease) increase to aocounts payable of ($48) and $60 in 2020 and 2019. NOTE 5: SELF-INSURANCE Our self-insurance reserves are summarized as follows: Our workers' compensation policies have a retention per claim of $1 or less and no policy limits. We are selfinsured for the majority of our employee health and welfare coverage and we do not use stop-loss coverage. Participants contribute to the cost of their coverage through premiums and out-of-pocket expenses for deductibles, co-pays and co-insurance. Our liability policies, encompassing an employment practices liability, with a policy limit up to $30, and a commercial general liability policy, with a limit up to $101, have a retention per claim of $3 or less. Subsequent to January 30,2021 , we no longer carry an employment practices liability policy. This risk will be self-insured by the Company. Nordstrom, Inc. C.onenlidated Ralance Sheate Nordstrom, Inc. and subsidiaries 37 The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statements. Nodstrtrom, Inc. and subesidianies 39Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started