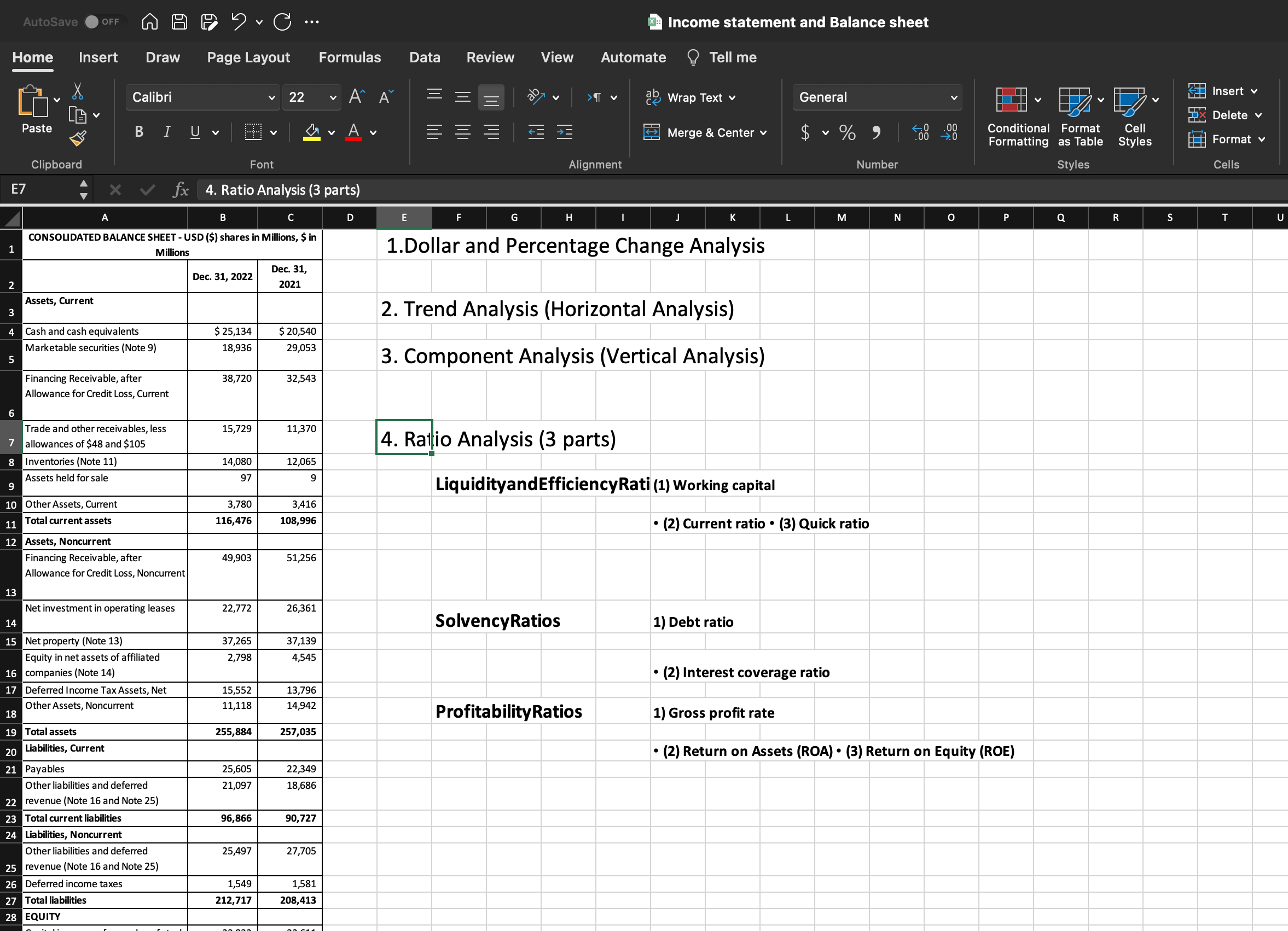

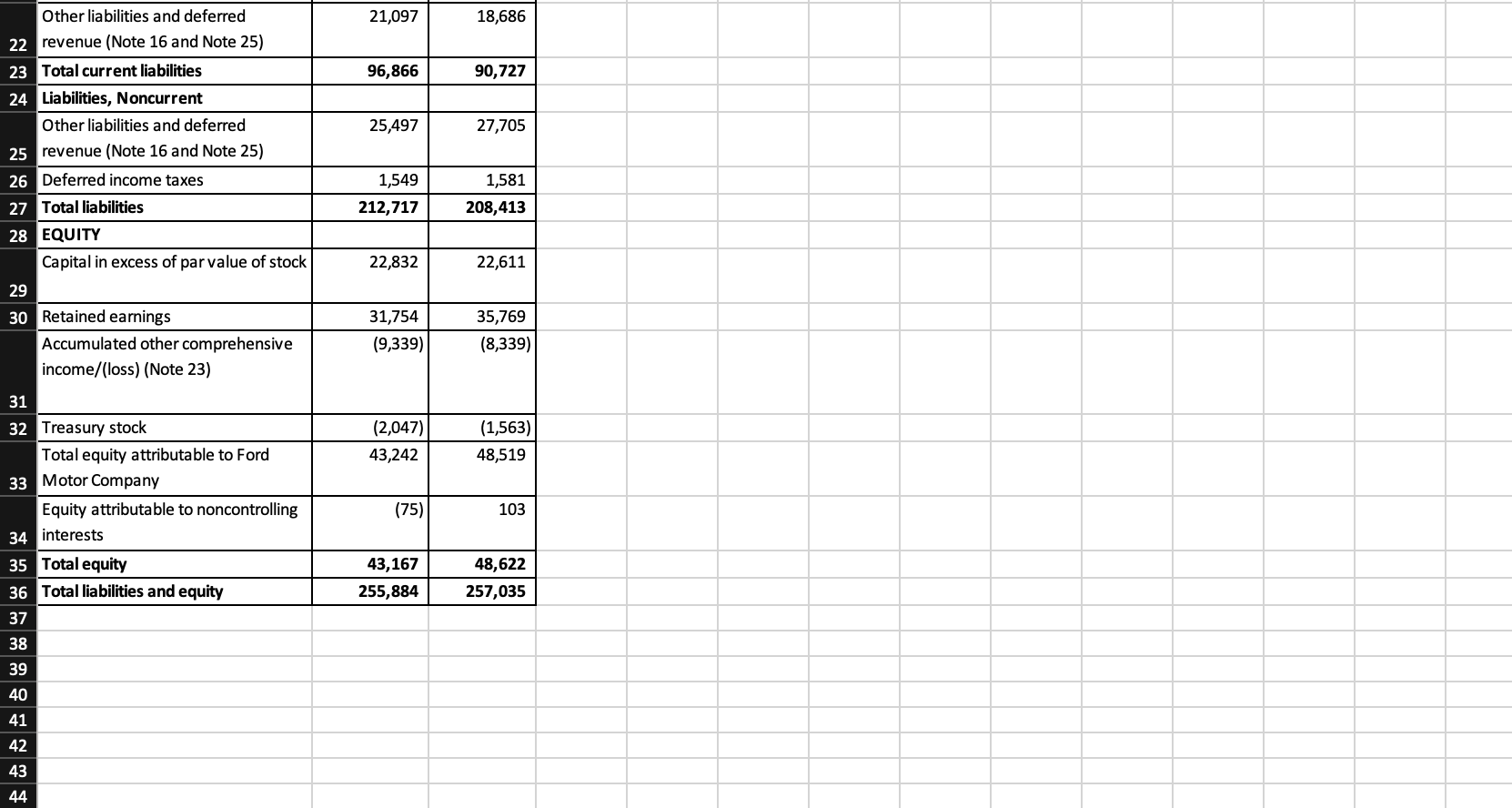

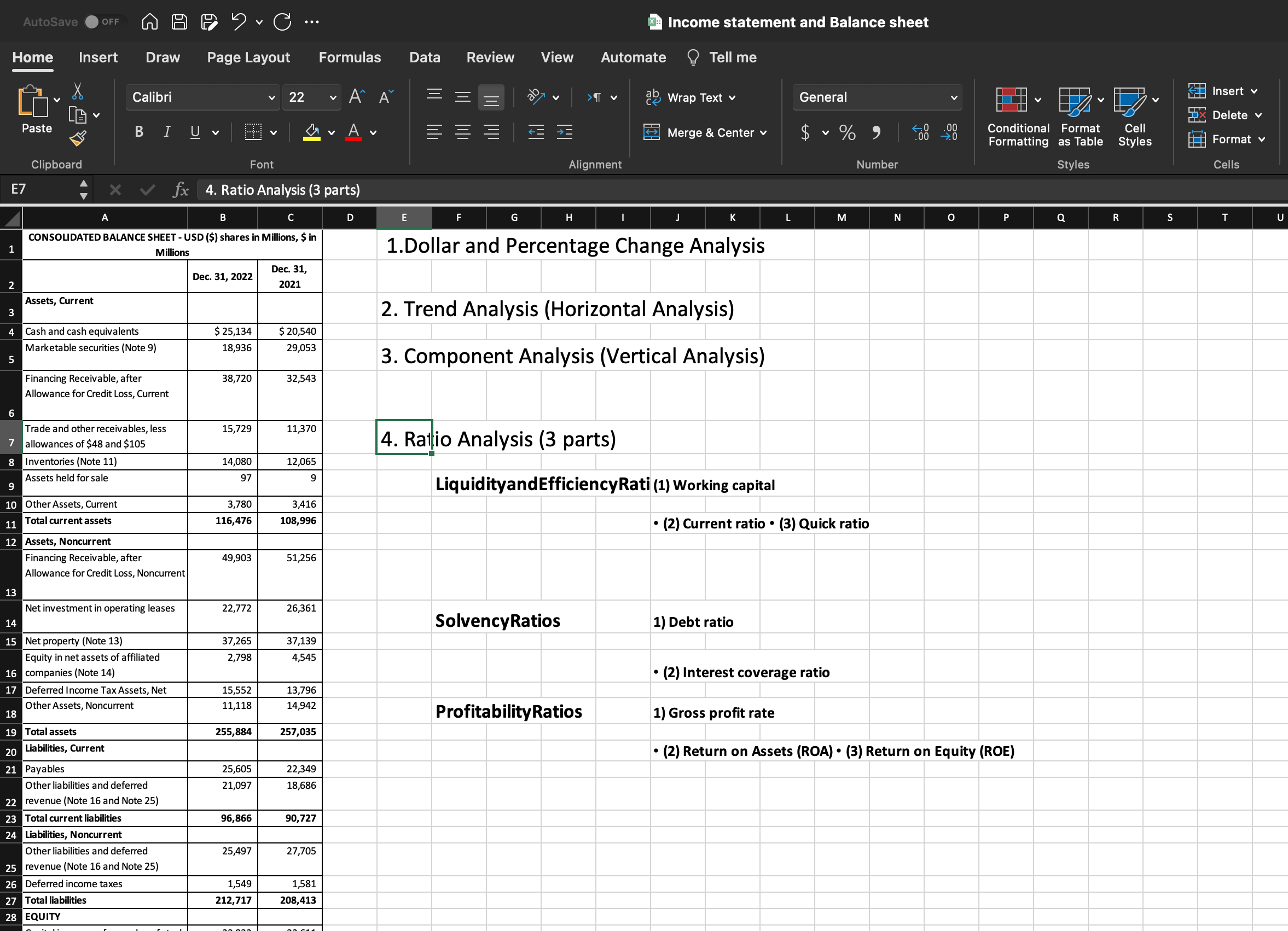

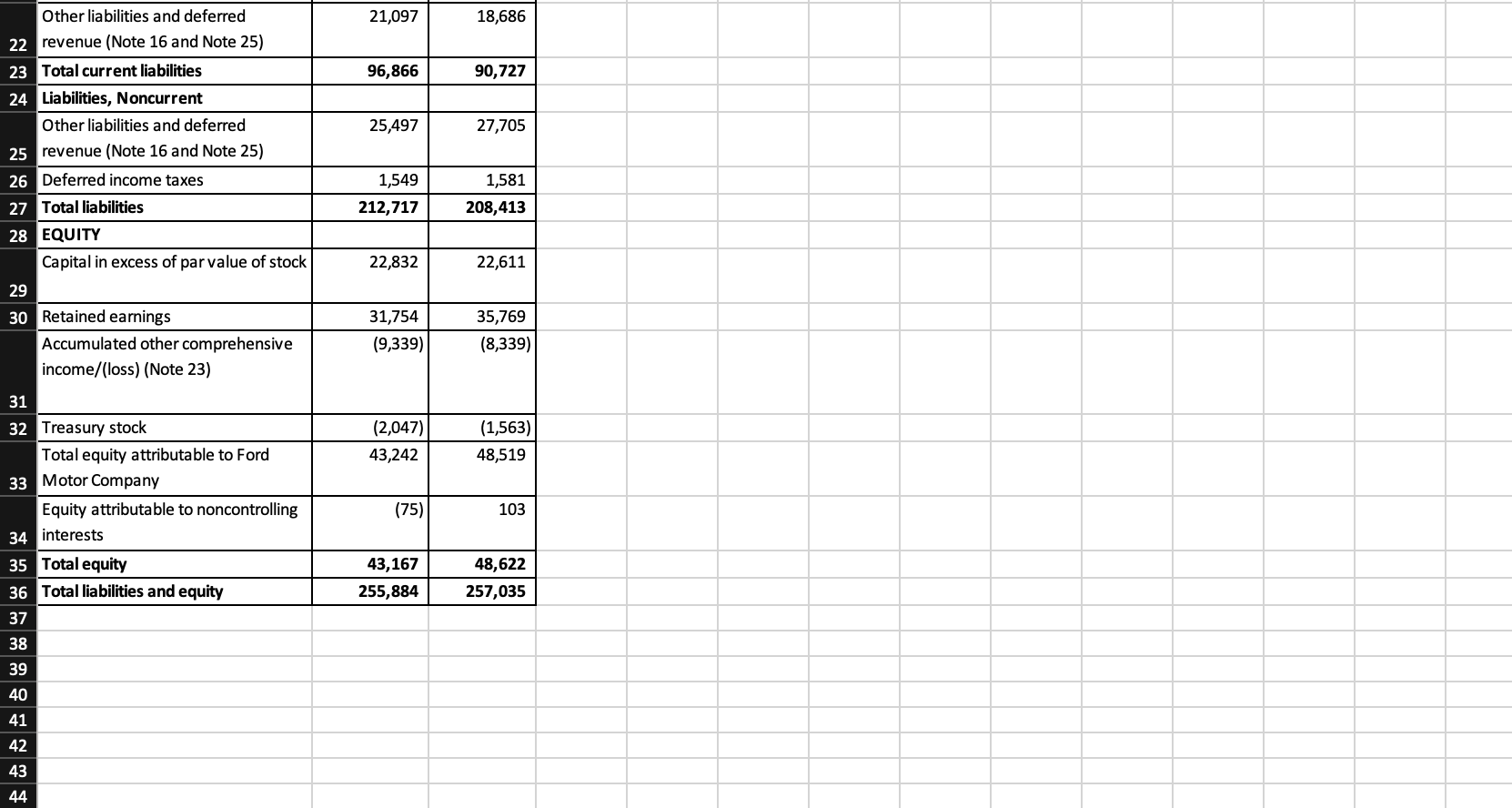

Using the attached Income statement and Balance sheet, conduct the following analyses:

AutoSave OFF Income statement and Balance sheet Home Insert Draw Page Layout Formulas Data Review View Automate @ Tell me E7 fx 4. Ratio Analysis (3 parts) Number D E F G H I J K L M N 0 P Q R S T 1.Dollar and Percentage Change Analysis \begin{tabular}{|c|c|c|c|} \hline 1 & \multicolumn{3}{|l|}{ Millions } \\ \hline 2 & & Dec. 31, 2022 & Dec.31,2021 \\ \hline 3 & Assets, Current & & \\ \hline 4 & Cash and cash equivalents & $25,134 & $20,540 \\ \hline 5 & Marketable securities (Note 9) & 18,936 & 29,053 \\ \hline & FinancingReceivable,afterAllowanceforCreditLoss,Current & 38,720 & 32,543 \\ \hline 7 & Tradeandotherreceivables,lessallowancesof$48and$105 & 15,729 & 11,370 \\ \hline 8 & Inventories (Note 11) & 14,080 & 12,065 \\ \hline 9 & Assets held for sale & 97 & 9 \\ \hline 10 & Other Assets, Current & 3,780 & 3,416 \\ \hline 11 & Total current assets & 116,476 & 108,996 \\ \hline 12 & Assets, Noncurrent & & \\ \hline 13 & FinancingReceivable,afterAllowanceforCreditLoss,Noncurrent & 49,903 & 51,256 \\ \hline 14 & Net investment in operating leases & 22,772 & 26,361 \\ \hline 15 & Net property (Note 13) & 37,265 & 37,139 \\ \hline 16 & Equityinnetassetsofaffiliatedcompanies(Note14) & 2,798 & 4,545 \\ \hline 17 & Deferred Income Tax Assets, Net & 15,552 & 13,796 \\ \hline 18 & Other Assets, Noncurrent & 11,118 & 14,942 \\ \hline 19 & Total assets & 255,884 & 257,035 \\ \hline 20 & Liabilities, Current & & \\ \hline 21 & Payables & 25,605 & 22,349 \\ \hline 22 & Otherliabilitiesanddeferredrevenue(Note16andNote25) & 21,097 & 18,686 \\ \hline 23 & Total current liabilities & 96,866 & 90,727 \\ \hline 24 & Liabilities, Noncurrent & & \\ \hline 25 & Otherliabilitiesanddeferredrevenue(Note16andNote25) & 25,497 & 27,705 \\ \hline 26 & Deferred income taxes & 1,549 & 1,581 \\ \hline 27 & Total liabilities & 212,717 & 208,413 \\ \hline 28 & EQUITY & & \\ \hline \end{tabular} 2. Trend Analysis (Horizontal Analysis) 3. Component Analysis (Vertical Analysis) 4. Ratio Analysis (3 parts) LiquidityandEfficiencyRati (1) Working capital - (2) Current ratio (3) Quick ratio SolvencyRatios 1) Debt ratio - (2) Interest coverage ratio ProfitabilityRatios 1) Gross profit rate - (2) Return on Assets (ROA) (3) Return on Equity (ROE)