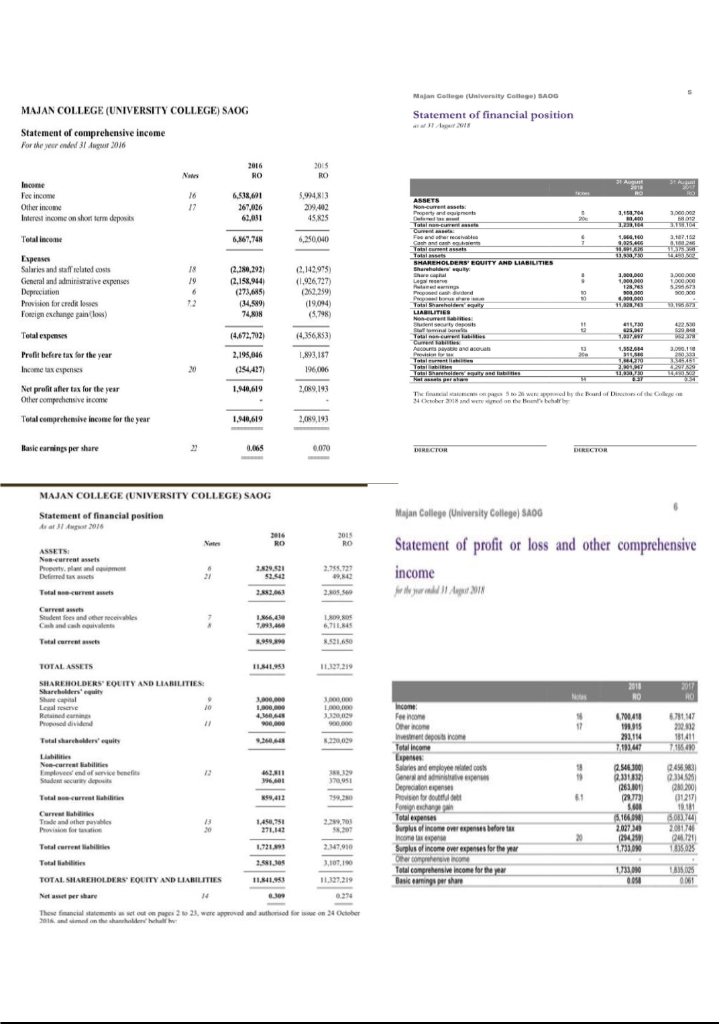

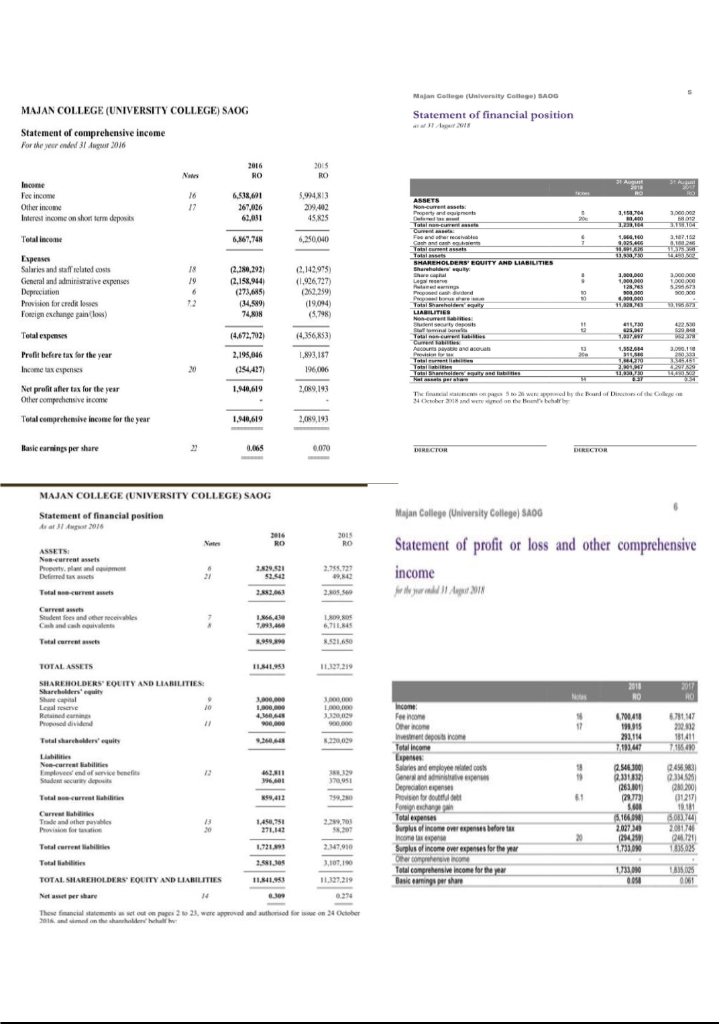

Using the balance sheet and income statement from

2015 to 2018

Calculate financial ratios and analyze the position

by following the steps given below.

a. Prepare common size balance sheet and income statement,

mark the changes from 2015 to 2018.

b. Analyze the financial position from time series viewpoint.

Break your analysis into evaluations of the firm's Liquidity

(current and quick), Asset management (inventory receivables

&total asset turnover, leverage (Debt-equity ratio),

profitability (ROE, Net profit margin), and market value ratios

(EPS and PE)

**Use APA style referencing

Maja College University College) SADG MAJAN COLLEGE (UNIVERSITY COLLEGE) SAOG Statement of financial position Statement of comprehensive income For the year ended 31 Aug 2016 2016 2015 RO MO Income Foc income Other income Interest income a short term deposits 6,538,601 267,026 62,031 5,994813 201402 45.825 3. Totalcante 6,867,748 6.250.040 Expenses Salaries and staff related costs General and miniative expenses Depreciation Provision for credit losses Foreign exchange gain (los) (2,180,292) 2,158044 (7105 (34.99 74,IN 0.142095) (1.926717) ( 2.259 (1900) (5,798) 88 Total expenses (4.672,702) (4.156.853) 2,198,046 1,91187 Profit before tax for the year Income tax expenses (244,427 196006 Tan 1.40,619 2. 9.193 Net profit after tax for the year Other comprehensive it.com 24 Cobranded on the bar E Total comprehensive income for the year 1.440,619 20N9,193 Iasic earnings per share ENRECTOR MAJAN COLLEGE (UNIVERSITY COLLEGE) SAOG Statement of financial position Asar 2016 Majan College (University College) SAOG ASSETS: Nos current assets Property.pl women Deferred 3.829.521 Statement of profit or loss and other comprehensive income for ilerle Student fees and other c ables 700 Total TOTAL ASSETS 11.841,953 2011 SHAREHOLDERS' EQUITY AND LIABILITIES Shareholdere Share capital 4. 6.731.347 Income Fee income Other int os income Total income 6,700,49 199.915 291,114 7.1914 Total shareholders 9,260,65 151411 NO Liabilities N arrabilities Employees and o ne benefits Security depois Salaries and employee 43.811 Q s 2546300 2.331332 2010 Totalcariabilities 273 Deprecat Provision to dou b t Forsiden Total expenses Surplus of income over expenses before tax Income tax expense Surplus of income over expenses for the year Oromgehensive income Total comprehensive income for the year Basic uning per share Trade and other pues Pro 2001 012171 18181 50014 200170 24.121 100% SAN 202734 1294250 73 Total 1,721,891 Total liabilities 21.105 TOTAL SHAREHOLDERS' EQUITY AND LIABILITIES 11,841,243 1.710 0.09 Ne share These financial statements as soon as 2 2016 the hand health 2). were approved and authored fo o n 24 October Maja College University College) SADG MAJAN COLLEGE (UNIVERSITY COLLEGE) SAOG Statement of financial position Statement of comprehensive income For the year ended 31 Aug 2016 2016 2015 RO MO Income Foc income Other income Interest income a short term deposits 6,538,601 267,026 62,031 5,994813 201402 45.825 3. Totalcante 6,867,748 6.250.040 Expenses Salaries and staff related costs General and miniative expenses Depreciation Provision for credit losses Foreign exchange gain (los) (2,180,292) 2,158044 (7105 (34.99 74,IN 0.142095) (1.926717) ( 2.259 (1900) (5,798) 88 Total expenses (4.672,702) (4.156.853) 2,198,046 1,91187 Profit before tax for the year Income tax expenses (244,427 196006 Tan 1.40,619 2. 9.193 Net profit after tax for the year Other comprehensive it.com 24 Cobranded on the bar E Total comprehensive income for the year 1.440,619 20N9,193 Iasic earnings per share ENRECTOR MAJAN COLLEGE (UNIVERSITY COLLEGE) SAOG Statement of financial position Asar 2016 Majan College (University College) SAOG ASSETS: Nos current assets Property.pl women Deferred 3.829.521 Statement of profit or loss and other comprehensive income for ilerle Student fees and other c ables 700 Total TOTAL ASSETS 11.841,953 2011 SHAREHOLDERS' EQUITY AND LIABILITIES Shareholdere Share capital 4. 6.731.347 Income Fee income Other int os income Total income 6,700,49 199.915 291,114 7.1914 Total shareholders 9,260,65 151411 NO Liabilities N arrabilities Employees and o ne benefits Security depois Salaries and employee 43.811 Q s 2546300 2.331332 2010 Totalcariabilities 273 Deprecat Provision to dou b t Forsiden Total expenses Surplus of income over expenses before tax Income tax expense Surplus of income over expenses for the year Oromgehensive income Total comprehensive income for the year Basic uning per share Trade and other pues Pro 2001 012171 18181 50014 200170 24.121 100% SAN 202734 1294250 73 Total 1,721,891 Total liabilities 21.105 TOTAL SHAREHOLDERS' EQUITY AND LIABILITIES 11,841,243 1.710 0.09 Ne share These financial statements as soon as 2 2016 the hand health 2). were approved and authored fo o n 24 October