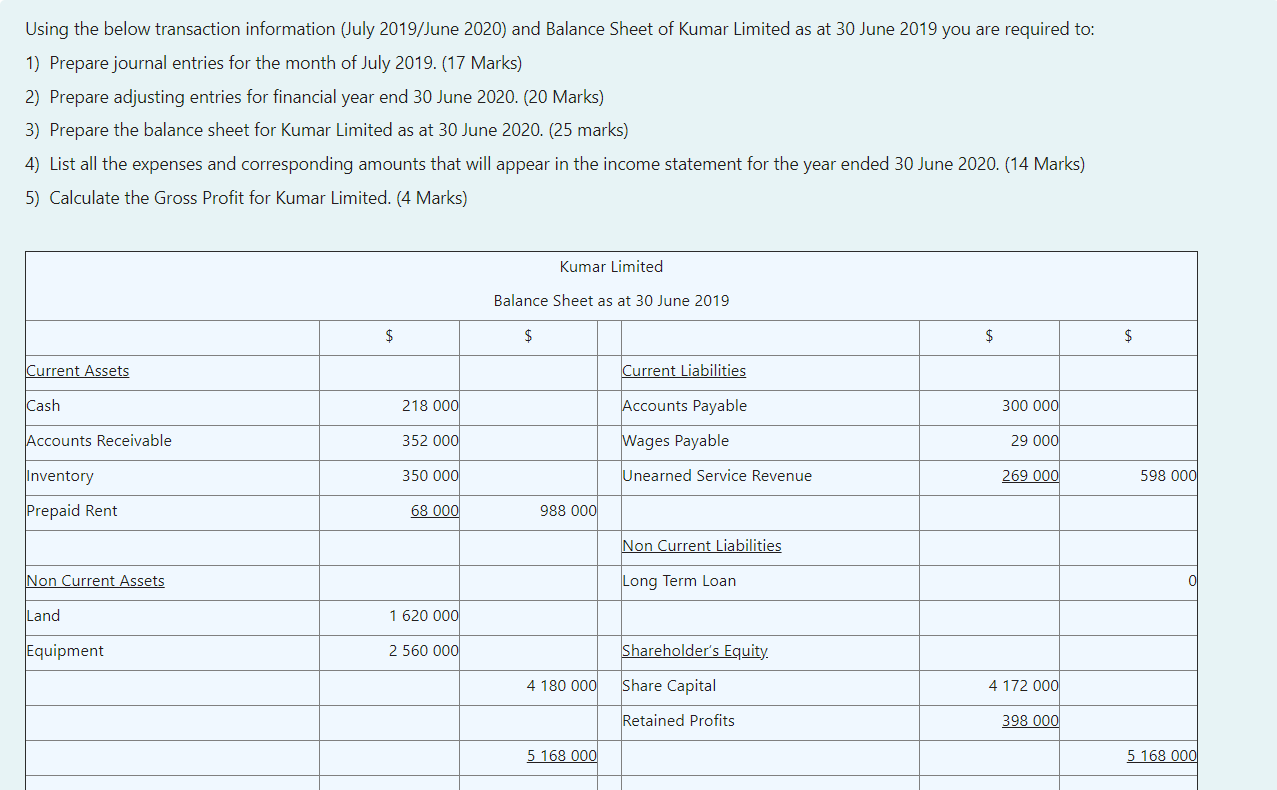

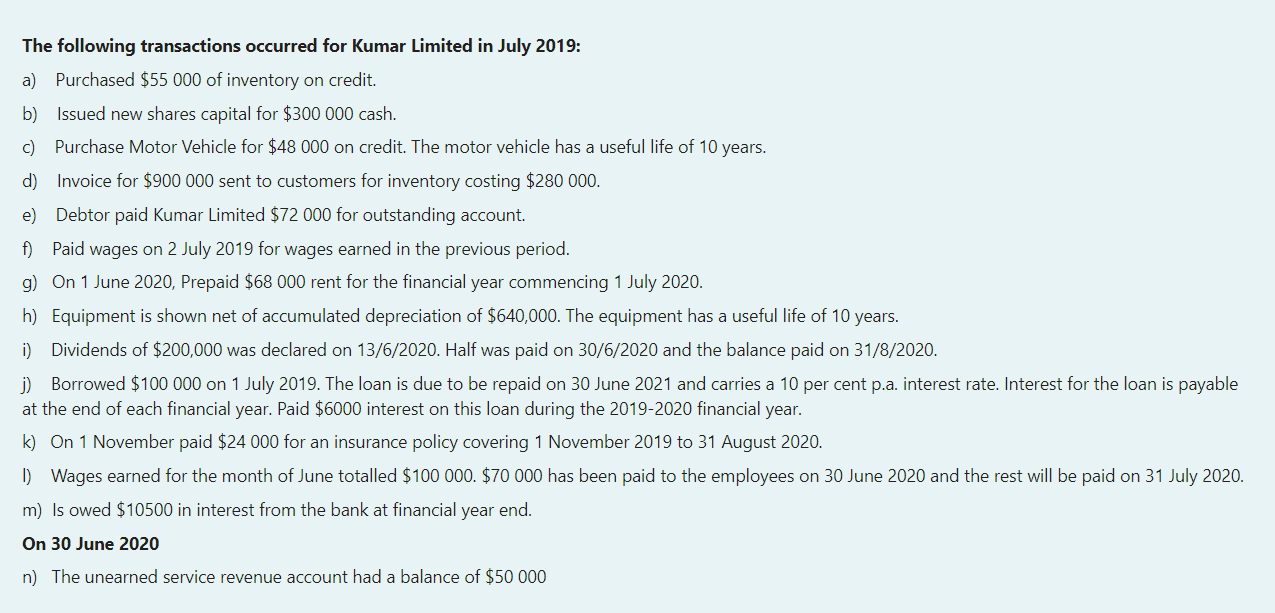

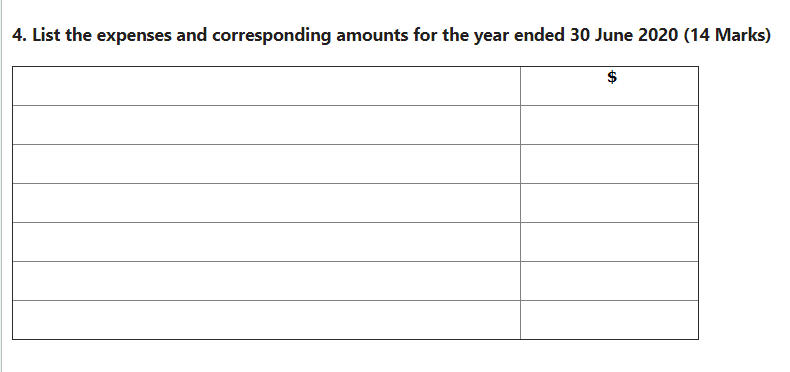

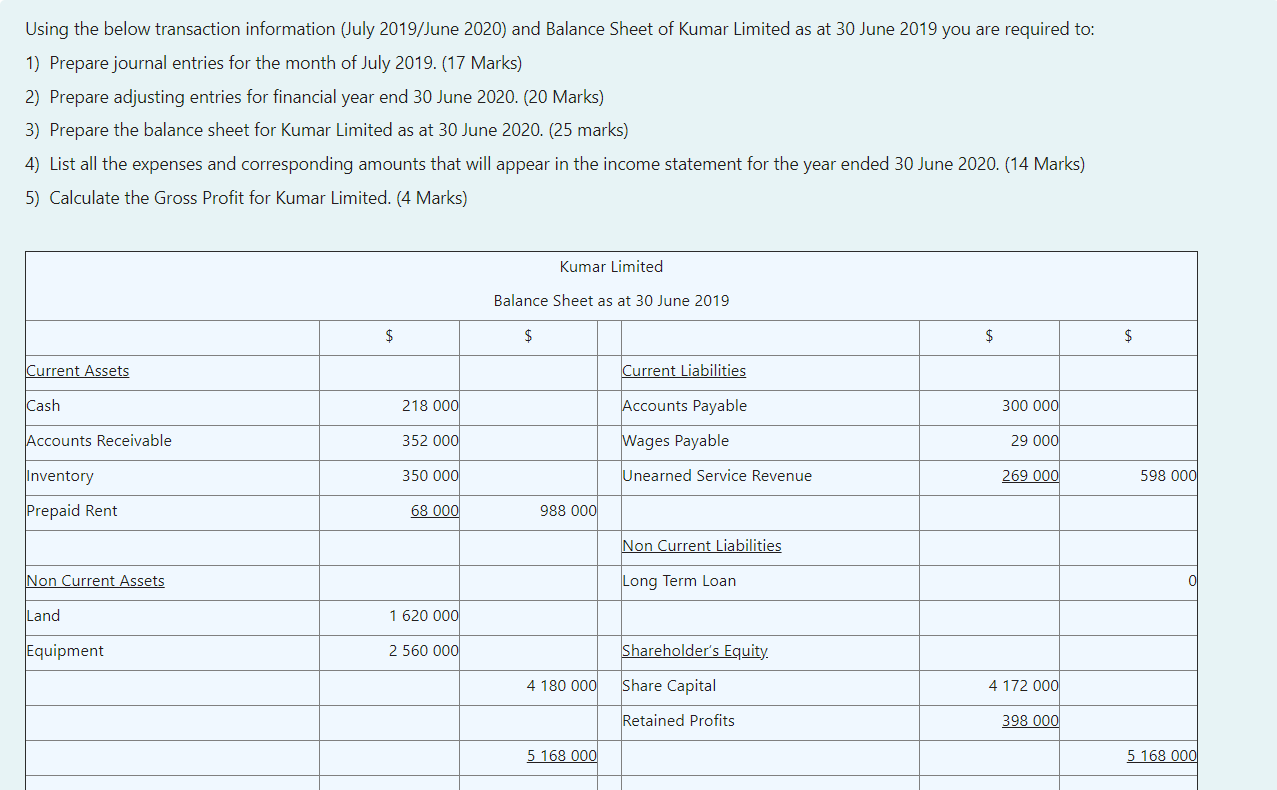

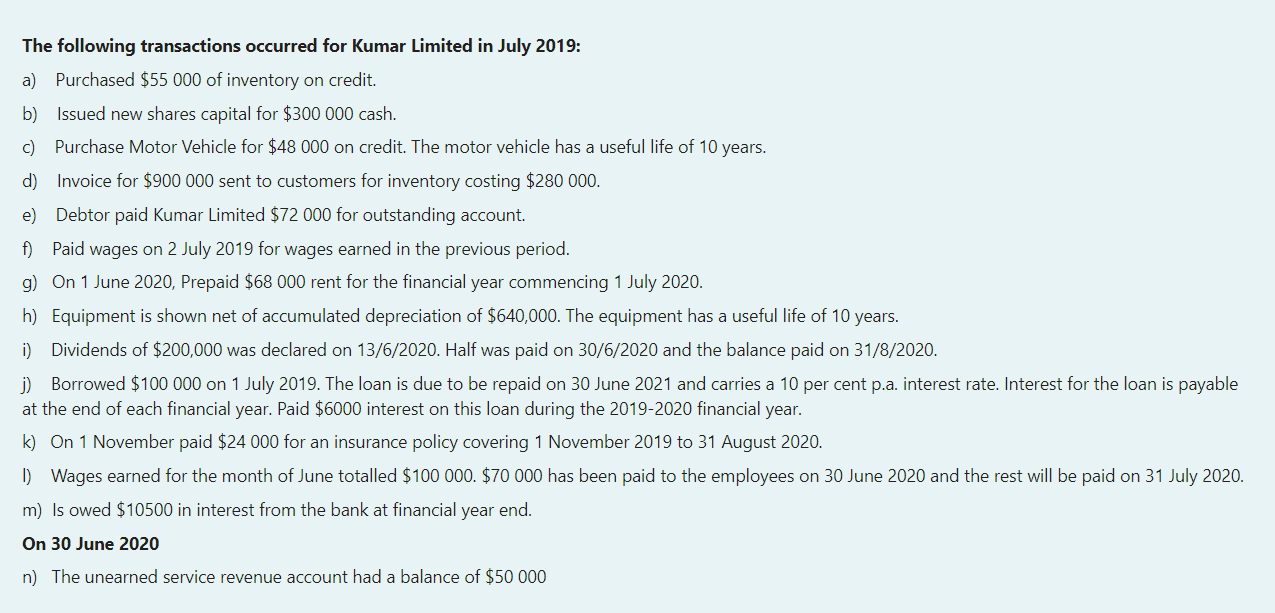

Using the below transaction information (July 2019/June 2020) and Balance Sheet of Kumar Limited as at 30 June 2019 you are required to: 1) Prepare journal entries for the month of July 2019. (17 Marks) 2) Prepare adjusting entries for financial year end 30 June 2020. (20 Marks) 3) Prepare the balance sheet for Kumar Limited as at 30 June 2020. (25 marks) 4) List all the expenses and corresponding amounts that will appear in the income statement for the year ended 30 June 2020. (14 Marks) 5) Calculate the Gross Profit for Kumar Limited. (4 Marks) Kumar Limited Balance Sheet as at 30 June 2019 $ $ $ $ Current Assets Current Liabilities Cash 218 000 Accounts Payable 300 000 Accounts Receivable 352 000 Wages Payable 29 000 Inventory 350 000 Unearned Service Revenue 269 000 598 000 Prepaid Rent 68 000 988 000 Non Current Liabilities Non Current Assets Long Term Loan Land 1 620 000 Equipment 2 560 000 Shareholder's Equity 4 180 000 Share Capital 4 172 000 Retained Profits 398 000 5 168 000 5 168 000 The following transactions occurred for Kumar Limited in July 2019: a) Purchased $55 000 of inventory on credit. b) Issued new shares capital for $300 000 cash. c) Purchase Motor Vehicle for $48 000 on credit. The motor vehicle has a useful life of 10 years. d) Invoice for $900 000 sent to customers for inventory costing $280 000. e) Debtor paid Kumar Limited $72 000 for outstanding account. f) Paid wages on 2 July 2019 for wages earned in the previous period. g) On 1 June 2020, Prepaid $68 000 rent for the financial year commencing 1 July 2020. h) Equipment is shown net of accumulated depreciation of $640,000. The equipment has a useful life of 10 years. i) Dividends of $200,000 was declared on 13/6/2020. Half was paid on 30/6/2020 and the balance paid on 31/8/2020. j) Borrowed $100 000 on 1 July 2019. The loan is due to be repaid on 30 June 2021 and carries a 10 per cent p.a. interest rate. Interest for the loan is payable at the end of each financial year. Paid $6000 interest on this loan during the 2019-2020 financial year. k) On 1 November paid $24 000 for an insurance policy covering 1 November 2019 to 31 August 2020. 1 Wages earned for the month of June totalled $100 000. $70 000 has been paid to the employees on 30 June 2020 and the rest will be paid on 31 July 2020. m) is owed $10500 in interest from the bank at financial year end. On 30 June 2020 n) The unearned service revenue account had a balance of $50 000 4. List the expenses and corresponding amounts for the year ended 30 June 2020 (14 Marks)