Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the Black-Scholes formula and the cumulative normal distribution (i.e. see Table 21.2, p. 717 of the prescribed textbook), compute the call and put option

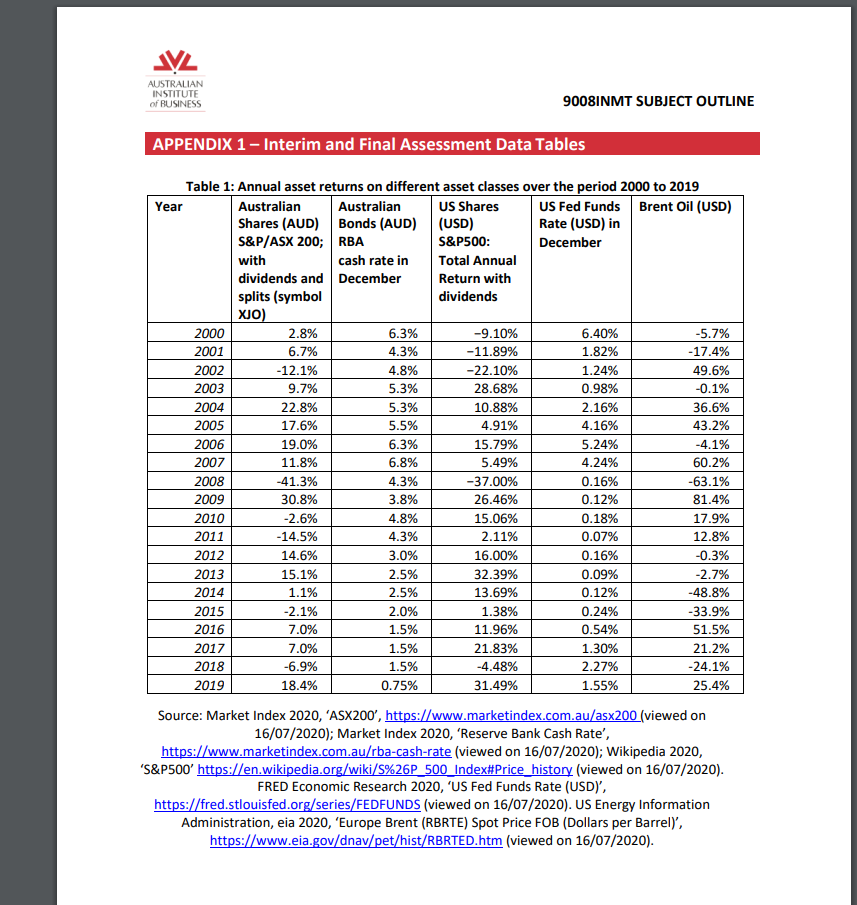

- Using the Black-Scholes formula and the cumulative normal distribution (i.e. see Table 21.2, p. 717 of the prescribed textbook), compute the call and put option prices using the data from Table 2 ofAppendix 1. First compute d1 and d2, then using Table 21.2 in the textbook, find the N(d)'s and use interpolation if needed to find the exact call and put prices.

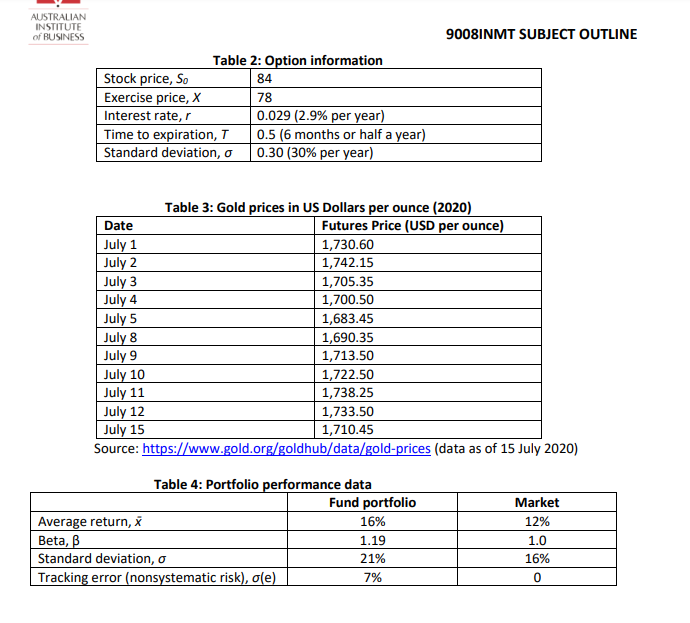

- Assume the current futures price for gold for delivery 10 days from 1 July 2020 is US$1,730.60 per ounce. Suppose that from 2 July 2020 to 15 July 2020 the gold prices were as in Table 3 ofAppendix 1. Assume one futures contract consists of 100 ounces of gold. Also, assume the maintenance margin is 5% and the initial margin is 10%. Calculate the daily mark-to-market settlements for each contract held by the short position. Briefly discuss basis risk (i.e. you can give an example if it makes it easier to discuss). [Hint: see Chapter 22 and examples 22.1 and 22.2 of the textbook.]

- Evaluate a fund's portfolio performance in terms of the market (e.g. outperformance or underperformance) using the Sharpe ratio, Treynor measure, Jensen's alpha and the Information ratio using data from Table 4 ofAppendix 1. Assume the risk-free rate is 1.75%. Briefly discuss each of the four measures, plus the Morningstar risk-adjusted return model.

?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started