Answered step by step

Verified Expert Solution

Question

1 Approved Answer

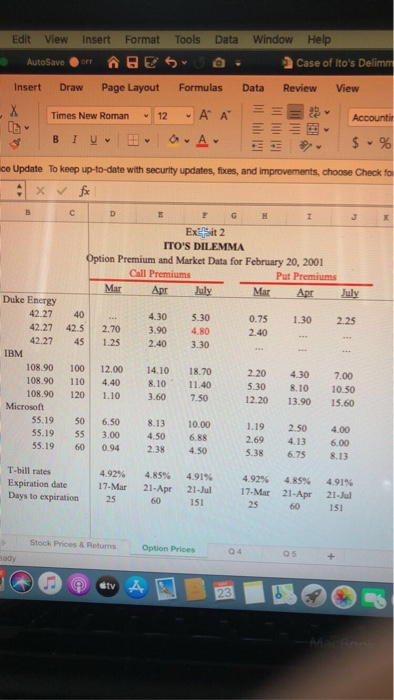

Using the Black-Scholes pricing function in Excel, compute an option value for each strike peice and maturity date in case Exhibit 2. For simplicity, assume

Using the Black-Scholes pricing function in Excel, compute an option value for each strike peice and maturity date in case Exhibit 2. For simplicity, assume zero dividend yield. Also, use Louise Ito's volatility estimates, provided in case Exhibit 1

Edit View Insert Format Tools Data Window Help AutoSave BES Case of Ito's Delimm Insert Draw Page Layout Formulas Data Review View Times New Roman ' ' 12 = Accounti BI UV IMI IM $ % ce Update To keep up-to-date with security updates, fixes, and improvements, choose Check for x x B C D E F G H I Exit 2 ITO'S DILEMMA Option Premium and Market Data for February 20, 2001 Call Premiums Put Premiums Mar Apr Mar Apr July July 1.30 2.25 40 42.5 45 2.70 1.25 4.30 3.90 2.40 5.30 4.80 3.30 0.75 2.40 Duke Energy 42.27 42.27 42.27 IBM 108.90 108.90 108.90 Microsoft 55.19 55.19 55.19 100 110 120 12.00 4.40 1.10 14.10 8.10 3.60 18.70 11.40 7.50 2.20 5.30 12.20 4.30 8.10 13.90 7.00 10.50 15.60 SO 55 60 6.50 3.00 0.94 8.13 4.50 2.38 10.00 6.88 4.50 1.19 2.69 5.38 2.50 4.13 6.75 4.00 6.00 8.13 T-bill rates Expiration date Days to expiration 4.92% 17-Mar 25 4.85% 21-Apr 60 4.91% 21-Jul 151 4.9294 4.85% 17-Mar 21-Apr 25 60 4.9196 21-Jul 151 Stock Prices & Returns Option Prices 04 05 ady + dtv 23 Edit View Insert Format Tools Data Window Help AutoSave BES Case of Ito's Delimm Insert Draw Page Layout Formulas Data Review View Times New Roman ' ' 12 = Accounti BI UV IMI IM $ % ce Update To keep up-to-date with security updates, fixes, and improvements, choose Check for x x B C D E F G H I Exit 2 ITO'S DILEMMA Option Premium and Market Data for February 20, 2001 Call Premiums Put Premiums Mar Apr Mar Apr July July 1.30 2.25 40 42.5 45 2.70 1.25 4.30 3.90 2.40 5.30 4.80 3.30 0.75 2.40 Duke Energy 42.27 42.27 42.27 IBM 108.90 108.90 108.90 Microsoft 55.19 55.19 55.19 100 110 120 12.00 4.40 1.10 14.10 8.10 3.60 18.70 11.40 7.50 2.20 5.30 12.20 4.30 8.10 13.90 7.00 10.50 15.60 SO 55 60 6.50 3.00 0.94 8.13 4.50 2.38 10.00 6.88 4.50 1.19 2.69 5.38 2.50 4.13 6.75 4.00 6.00 8.13 T-bill rates Expiration date Days to expiration 4.92% 17-Mar 25 4.85% 21-Apr 60 4.91% 21-Jul 151 4.9294 4.85% 17-Mar 21-Apr 25 60 4.9196 21-Jul 151 Stock Prices & Returns Option Prices 04 05 ady + dtv 23Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started