Answered step by step

Verified Expert Solution

Question

1 Approved Answer

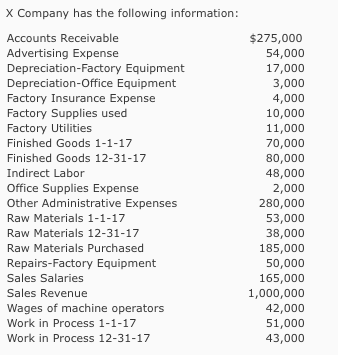

Using the chart answer: 1.) Compute cost of direct materials used. 2.) Compute cost of goods manufactured. 3.) Compute cost of goods sold. 4.) Compute

Using the chart answer:

1.) Compute cost of direct materials used.

2.) Compute cost of goods manufactured.

3.) Compute cost of goods sold.

4.) Compute gross profit.

5.) Compute total operating expenses.

6.) Compute net income.

X Company has the following information: Accounts Receivable Advertising Expense Depreciation-Factory Equipment Depreciation-Office Equipment Factory Insurance Expense Factory Supplies used Factory Utilities Finished Goods 1-1-17 Finished Goods 12-31-17 Indirect Labor Office Supplies Expense Other Administrative Expenses Raw Materials 1-1-17 Raw Materials 12-31-17 Raw Materials Purchased Repairs-Factory Equipment Sales Salaries Sales Revenue Wages of machine operators Work in Process 1-1-17 Work in Process 12-31-17 $275,000 54,000 17,000 3,000 4,000 10,000 11,000 70,000 80,000 48,000 2,000 280,000 53,000 38,000 185,000 50,000 165,000 1,000,000 42,000 51,000 43,000 X Company has the following information: Accounts Receivable Advertising Expense Depreciation-Factory Equipment Depreciation-Office Equipment Factory Insurance Expense Factory Supplies used Factory Utilities Finished Goods 1-1-17 Finished Goods 12-31-17 Indirect Labor Office Supplies Expense Other Administrative Expenses Raw Materials 1-1-17 Raw Materials 12-31-17 Raw Materials Purchased Repairs-Factory Equipment Sales Salaries Sales Revenue Wages of machine operators Work in Process 1-1-17 Work in Process 12-31-17 $275,000 54,000 17,000 3,000 4,000 10,000 11,000 70,000 80,000 48,000 2,000 280,000 53,000 38,000 185,000 50,000 165,000 1,000,000 42,000 51,000 43,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started