Using the Consolidated Financial Statement provided for Wal-Mart, calculate return on common equity (ROCE) for fiscal X4 and X7. Identify, as far as allowed by

Using the Consolidated Financial Statement provided for Wal-Mart, calculate return on common equity (ROCE) for fiscal X4 and X7.

Identify, as far as allowed by the data, components driving any changes in ROCE from X4 to X7. (Disaggregate ROCE into net operating profit margin, net operating asset turnover and leverage.)

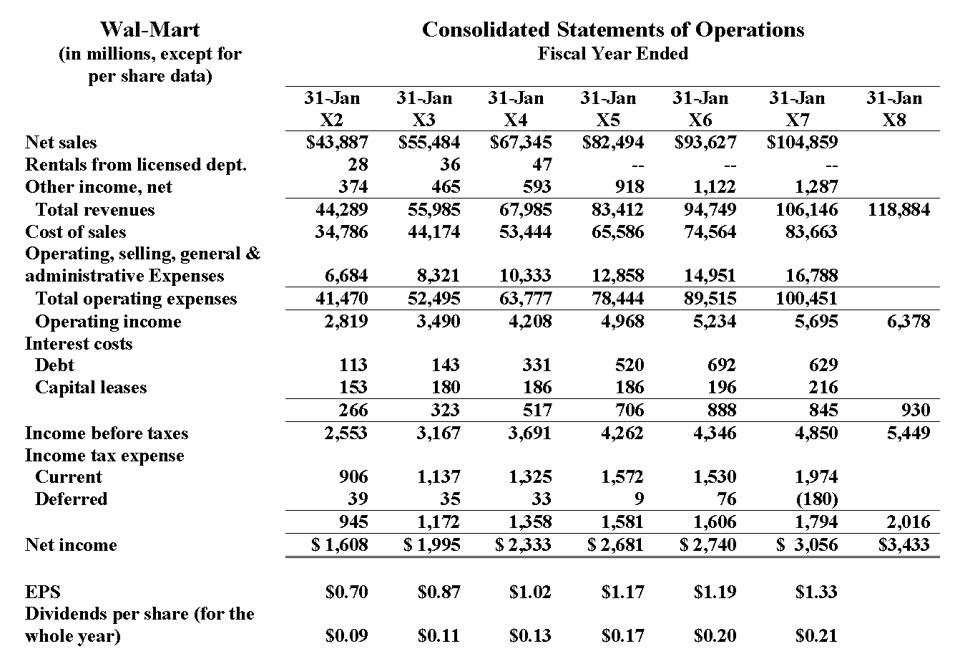

Consolidated Statements of Operations Wal-Mart (in millions, except for per share data) Fiscal Year Ended 31-Jan 31-Jan 31-Jan 31-Jan 31-Jan 31-Jan 31-Jan X2 X3 X4 X5 X6 X7 X8 Net sales $43,887 $55,484 $67,345 S82,494 $93,627 $104,859 Rentals from licensed dept. Other income, net 28 36 47 1,287 106,146 83,663 374 465 593 918 1,122 Total revenues 118,884 44,289 34,786 55,985 44,174 67,985 83,412 65,586 94,749 74,564 Cost of sales 53,444 Operating, selling, general & administrative Expenses Total operating expenses Operating income Interest costs Debt 6,684 41,470 2,819 10,333 16,788 100,451 5,695 8,321 12,858 52,495 3,490 78,444 4,968 14,951 89,515 5,234 63,777 4,208 6,378 113 143 331 520 692 629 Capital leases 153 180 186 186 196 216 266 323 517 706 888 845 930 Income before taxes 2,553 3,167 3,691 4,262 4,346 4,850 5,449 Income tax expense 1,974 (180) 1,794 $ 3,056 Current 906 1,137 1,572 1,530 1,325 33 Deferred 39 35 76 1,358 $ 2,333 945 1,172 $ 1,995 1,581 1,606 2,016 Net income $ 1,608 $ 2,681 $ 2,740 $3,433 EPS S0.70 $0.87 S1.02 $1.17 $1.19 $1.33 Dividends per share (for the whole year) $0.09 $0.11 SO. 13 $0.17 $0.20 $0.21

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Return on common equity ROCE is a measure that provides information on returns that common equity sh...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started