Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the data from 2009 Q2 to 2016 Q3, what is the expected quarterly percentage price change for gasoline (FOB)? Your answer should be

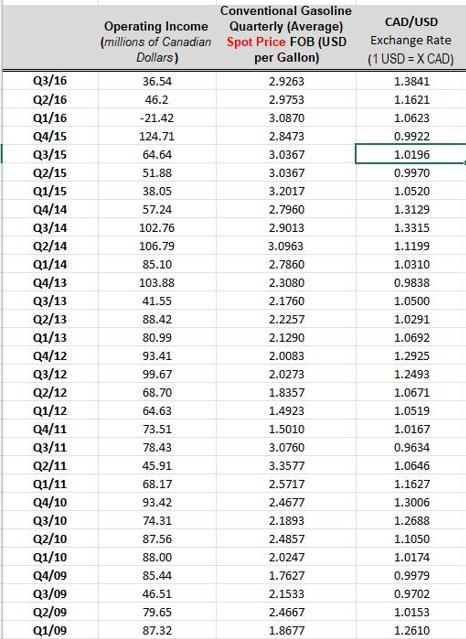

Using the data from 2009 Q2 to 2016 Q3, what is the expected quarterly percentage price change for gasoline (FOB)? Your answer should be to two decimal places with no percentage symbol. For example three and a half percent = 3.50 A Using the data from 2009 Q2 to 2016 Q3, what is the volatility of the price change for gasoline (FOB)? Again your answer should be to two decimal places with no percentage symbol. For example three and a half percent = 3.50 Q3/16 Q2/16 Q1/16 Q4/15 Q3/15 Q2/15 Q1/15 Q4/14 Q3/14 Q2/14 Q1/14 Q4/13 Q3/13 Q2/13 Q1/13 Q4/12 Q3/12 Q2/12 Q1/12 Q4/11 Q3/11 Q2/11 Q1/11 Q4/10 Q3/10 Q2/10 Q1/10 Q4/09 Q3/09 Q2/09 Q1/09 Operating Income (millions of Canadian Dollars) 36.54 46.2 -21.42 124.71 64.64 51.88 38.05 57.24 102.76 106.79 85.10 103.88 41.55 88.42 80.99 93.41 99.67 68.70 64.63 73.51 78.43 45.91 68.17 93.42 74.31 87.56 88.00 85.44 46.51 79.65 87.32 Conventional Gasoline Quarterly (Average) Spot Price FOB (USD per Gallon) 2.9263 2.9753 3.0870 2.8473 3.0367 3.0367 3.2017 2.7960 2.9013 3.0963 2.7860 2.3080 2.1760 2.2257 2.1290 2.0083 2.0273 1.8357 1.4923 1.5010 3.0760 3.3577 2.5717 2.4677 2.1893 2.4857 2.0247 1.7627 2.1533 2.4667 1.8677 CAD/USD Exchange Rate (1 USD =X CAD) 1.3841 1.1621 1.0623 0.9922 1.0196 0.9970 1.0520 1.3129 1.3315 1.1199 1.0310 0.9838 1.0500 1.0291 1.0692 1.2925 1.2493 1.0671 1.0519 1.0167 0.9634 1.0646 1.1627 1.3006 1.2688 1.1050 1.0174 0.9979 0.9702 1.0153 1.2610

Step by Step Solution

There are 3 Steps involved in it

Step: 1

mu Rimht 1 The expected quartel percentage price change ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started