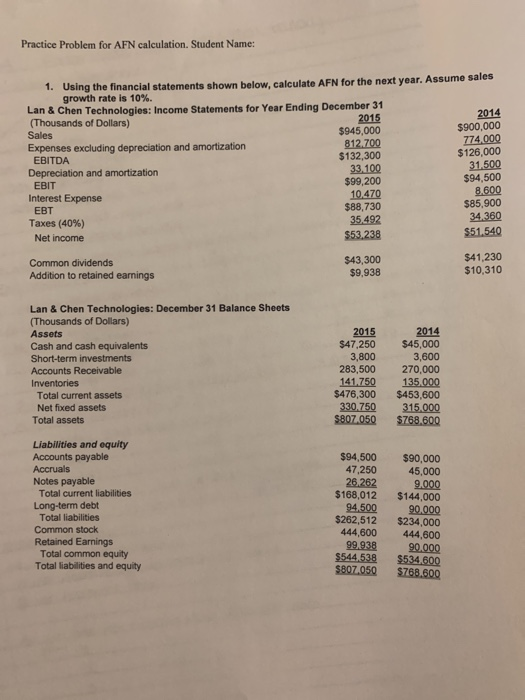

using The financial statement shown below calculate AFN for the next year. Assume sales growth rate is 10%.

Practice Problem for AFN calculation. Student Name: 1. Using the financial statements shown below.calculate AFN for the next year. Assume sales growth rate is 10%. Lan & Chen Technologies: Income Statements for Year Ending December 31 (Thousands of Dollars) 2015 2014 Sales $945,000 $900,000 Expenses excluding depreciation and amortization 812.700 774.000 EBITDA $132,300 $126,000 Depreciation and amortization 33 100 31,500 EBIT $99,200 $94,500 Interest Expense 10.470 8.600 $88,730 $85,900 Taxes (40%) 35.492 34,360 Net income $53.238 $51.540 EBT Common dividends Addition to retained earnings $43,300 $9,938 $41,230 $10,310 Lan & Chen Technologies: December 31 Balance Sheets (Thousands of Dollars) Assets Cash and cash equivalents Short-term investments Accounts Receivable Inventories Total current assets Net fixed assets Total assets 2015 $47,250 3,800 283,500 141.750 $476,300 330.750 $807,050 2014 $45,000 3,600 270,000 135.000 $453,600 315 000 $768.600 Liabilities and equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained Earnings Total common equity Total liabilities and equity $94,500 47,250 26.262 $168,012 94.500 $262,512 444,600 99.938 $544,538 $807,050 $90,000 45,000 9.000 $144,000 90.000 $234.000 444,600 90.000 $534 600 $768.600 Practice Problem for AFN calculation. Student Name: 1. Using the financial statements shown below.calculate AFN for the next year. Assume sales growth rate is 10%. Lan & Chen Technologies: Income Statements for Year Ending December 31 (Thousands of Dollars) 2015 2014 Sales $945,000 $900,000 Expenses excluding depreciation and amortization 812.700 774.000 EBITDA $132,300 $126,000 Depreciation and amortization 33 100 31,500 EBIT $99,200 $94,500 Interest Expense 10.470 8.600 $88,730 $85,900 Taxes (40%) 35.492 34,360 Net income $53.238 $51.540 EBT Common dividends Addition to retained earnings $43,300 $9,938 $41,230 $10,310 Lan & Chen Technologies: December 31 Balance Sheets (Thousands of Dollars) Assets Cash and cash equivalents Short-term investments Accounts Receivable Inventories Total current assets Net fixed assets Total assets 2015 $47,250 3,800 283,500 141.750 $476,300 330.750 $807,050 2014 $45,000 3,600 270,000 135.000 $453,600 315 000 $768.600 Liabilities and equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained Earnings Total common equity Total liabilities and equity $94,500 47,250 26.262 $168,012 94.500 $262,512 444,600 99.938 $544,538 $807,050 $90,000 45,000 9.000 $144,000 90.000 $234.000 444,600 90.000 $534 600 $768.600