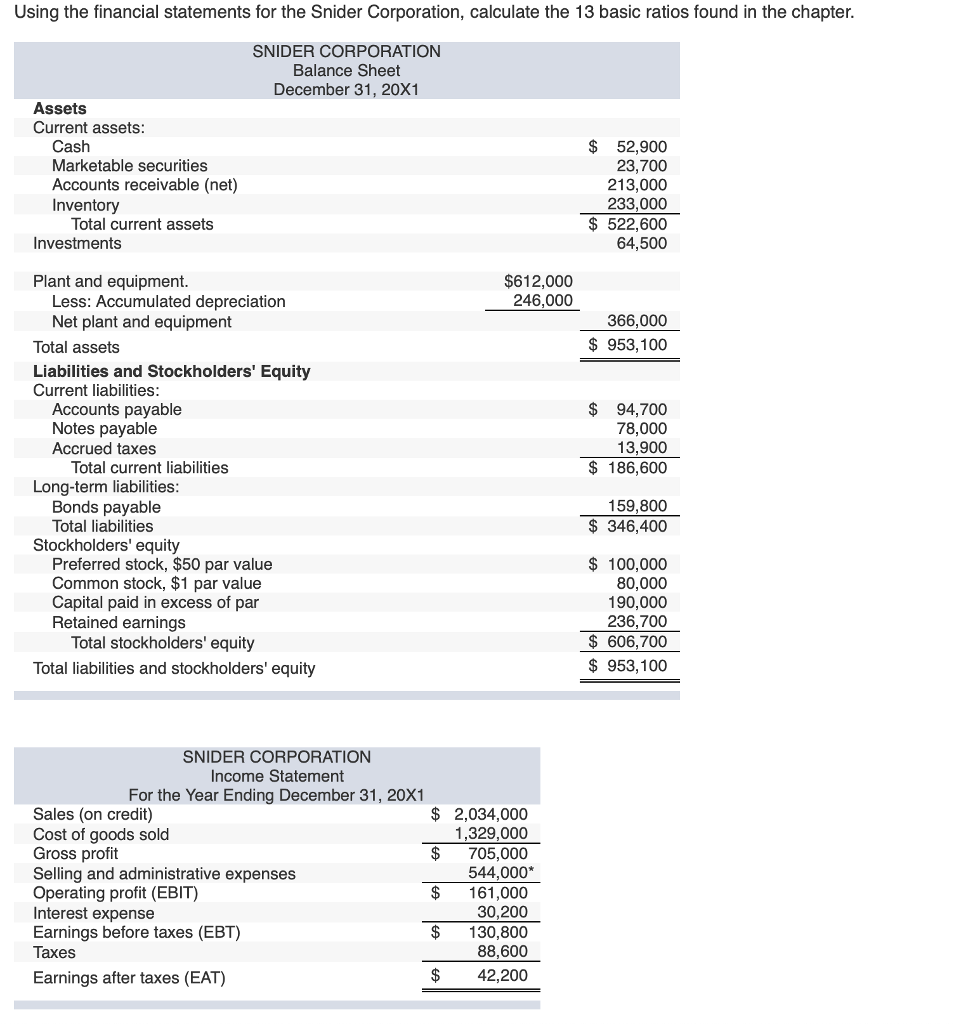

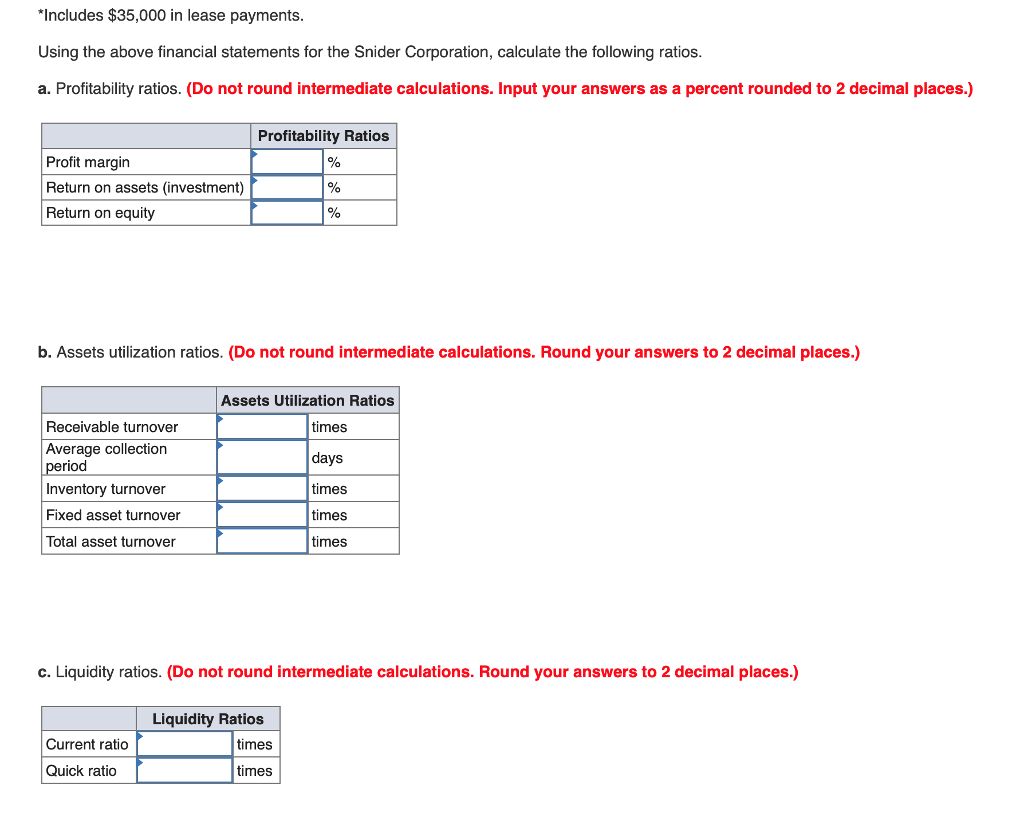

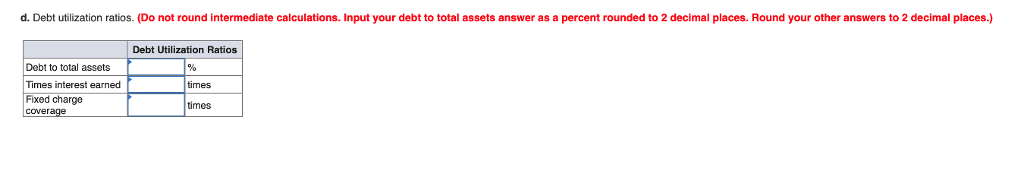

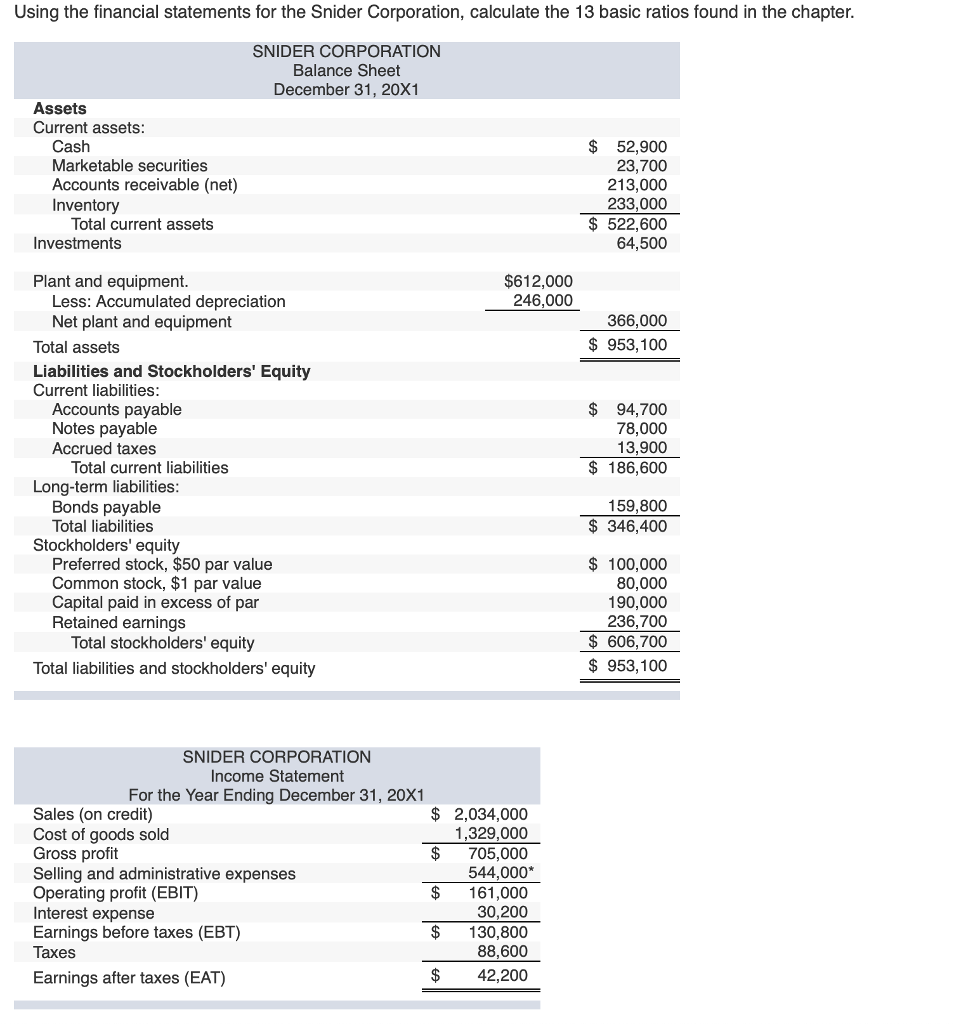

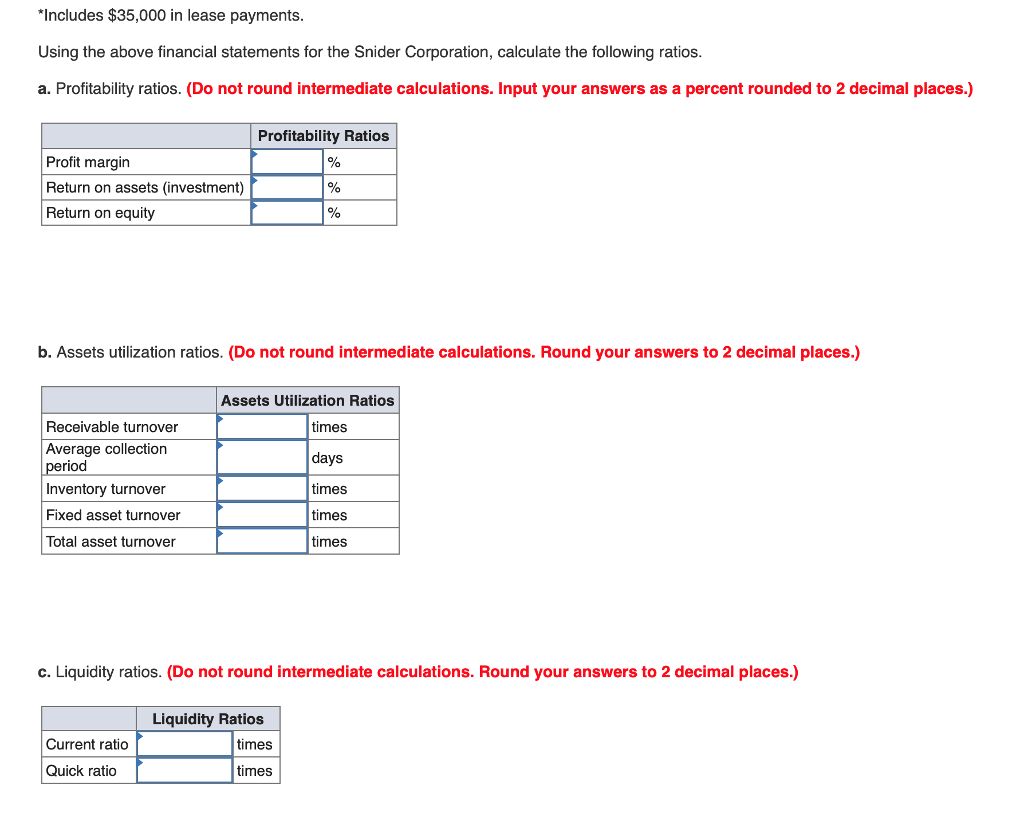

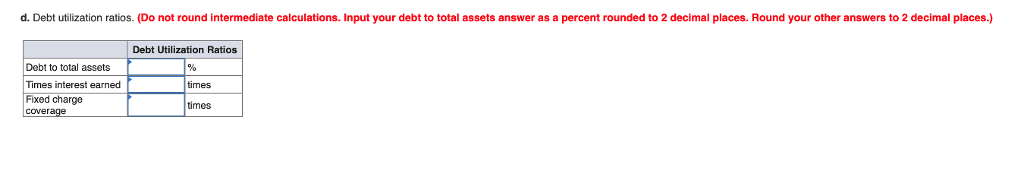

Using the financial statements for the Snider Corporation, calculate the 13 basic ratios found in the chapter SNIDER CORPORATION Balance Sheet December 31, 20X1 Assets Current assets Cash Marketable securities Accounts receivable (net) Inventory $ 52,900 23,700 213,000 233,000 $522,600 64,500 Total current assets Investments Plant and equipment $612,000 246,000 Less: Accumulated depreciation Net plant and equipment 366,000 $ 953,100 Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Notes payable Accrued taxes $ 94,700 78,000 13,900 $ 186,600 Total current liabilities Long-term liabilities Bonds payable Total liabilities 159,800 $ 346,400 Stockholders' equity Preferred stock, $50 par value Common stock, $1 par value Capital paid in excess of par Retained earnings $100,000 80,000 190,000 236,700 $ 606,700 $ 953,100 Total stockholders' equity Total liabilities and stockholders' equity SNIDER CORPORATION Income Statement For the Year Ending December 31, 20x1 Sales (on credit) Cost of goods sold Gross profit Selling and administrative expenses Operating profit (EBIT) Interest expense Earnings before taxes (EBT) Taxes $ 2,034,000 1,329,000 $705,000 544,000* $ 161,000 30,200 $130,800 88,600 $ 42,200 Earnings after taxes (EAT) Includes $35,000 in lease payments. Using the above financial statements for the Snider Corporation, calculate the following ratios. a. Profitability ratios. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Profitability Ratios Profit margin Return on assets (investment) Return on equity b. Assets utilization ratios. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Assets Utilization Ratios Receivable turnover Average collection period Inventory turnover Fixed asset turnover Total asset turnover times days times times times c. Liquidity ratios. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Liquidity Ratios Current ratio times Quick ratio times