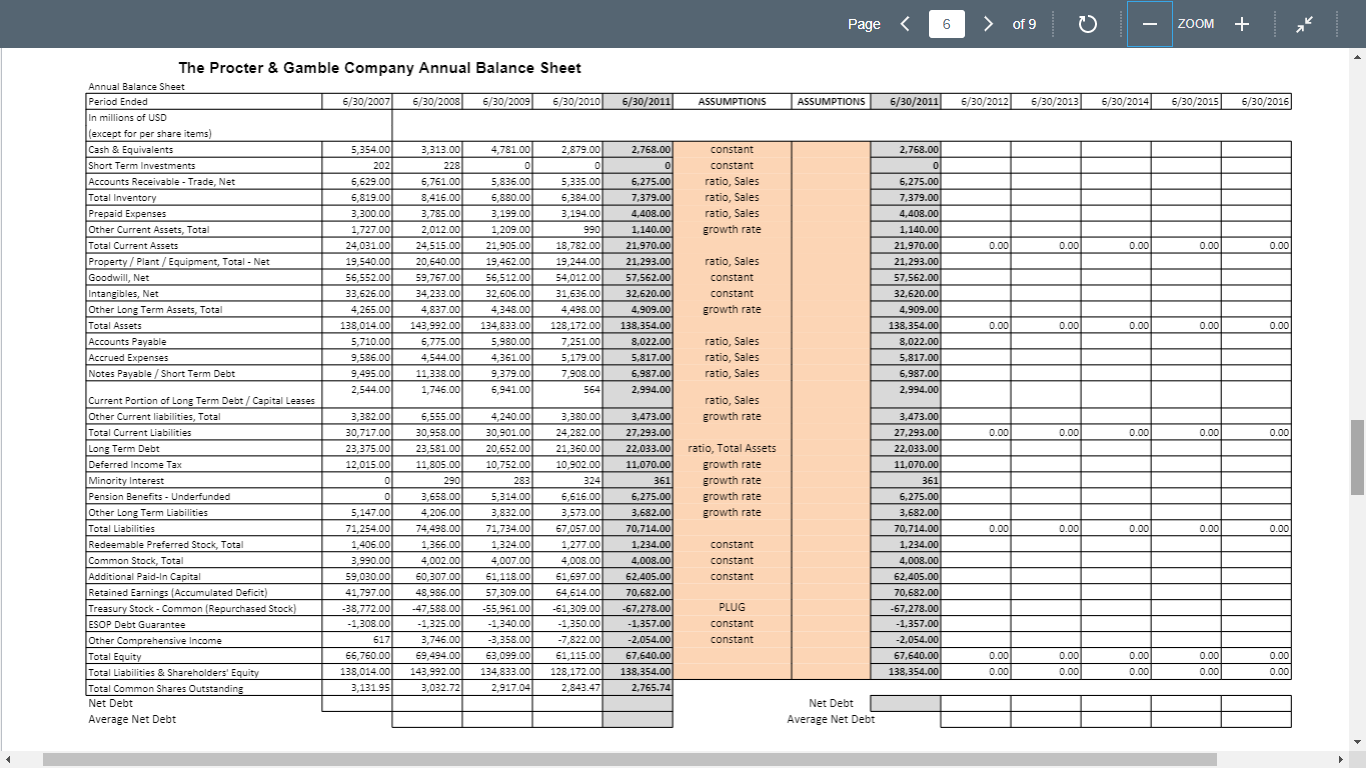

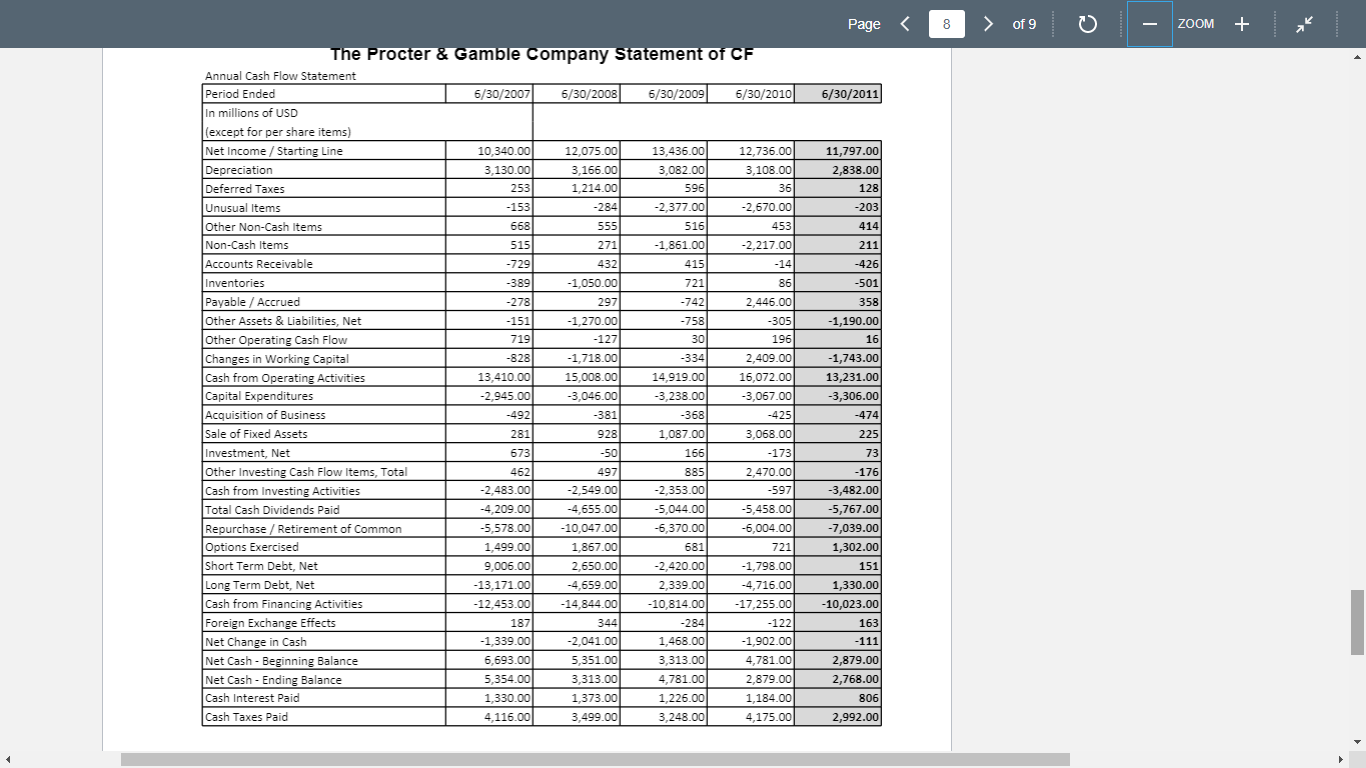

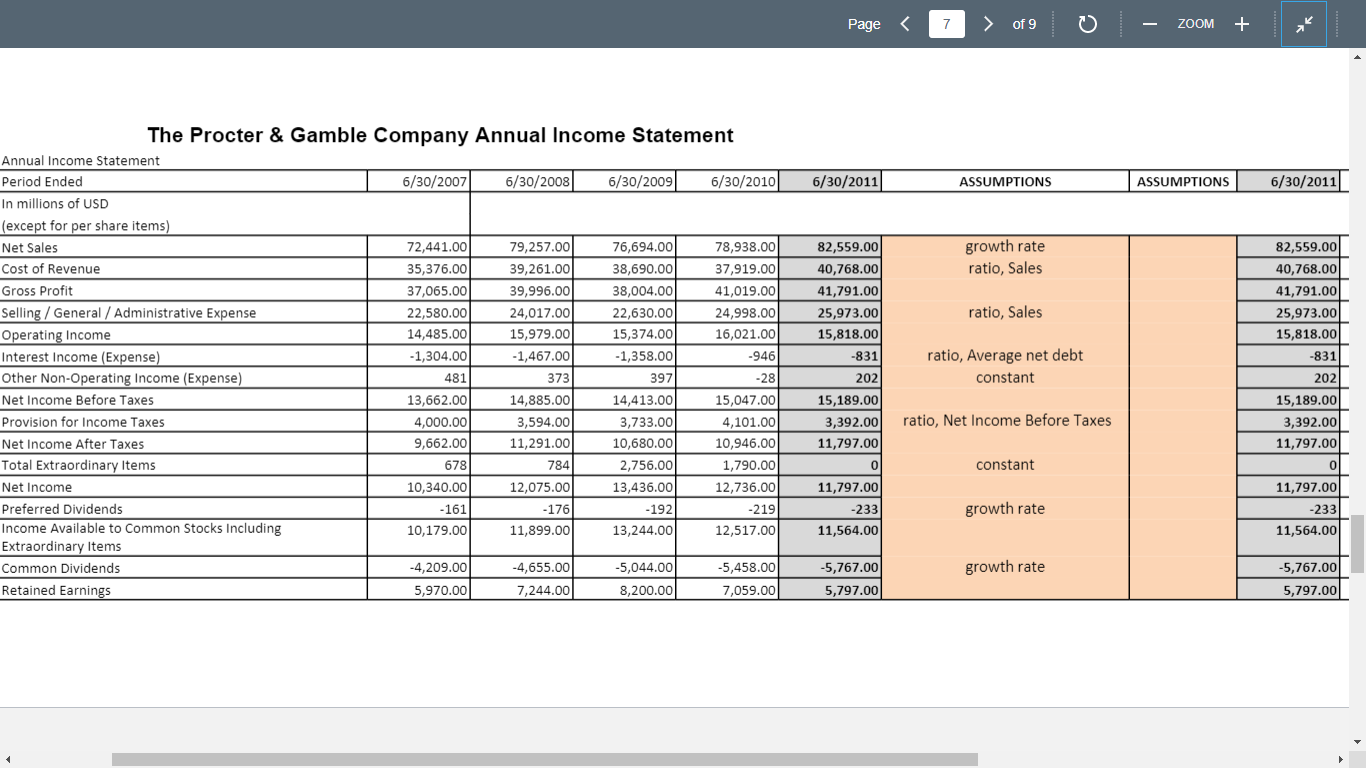

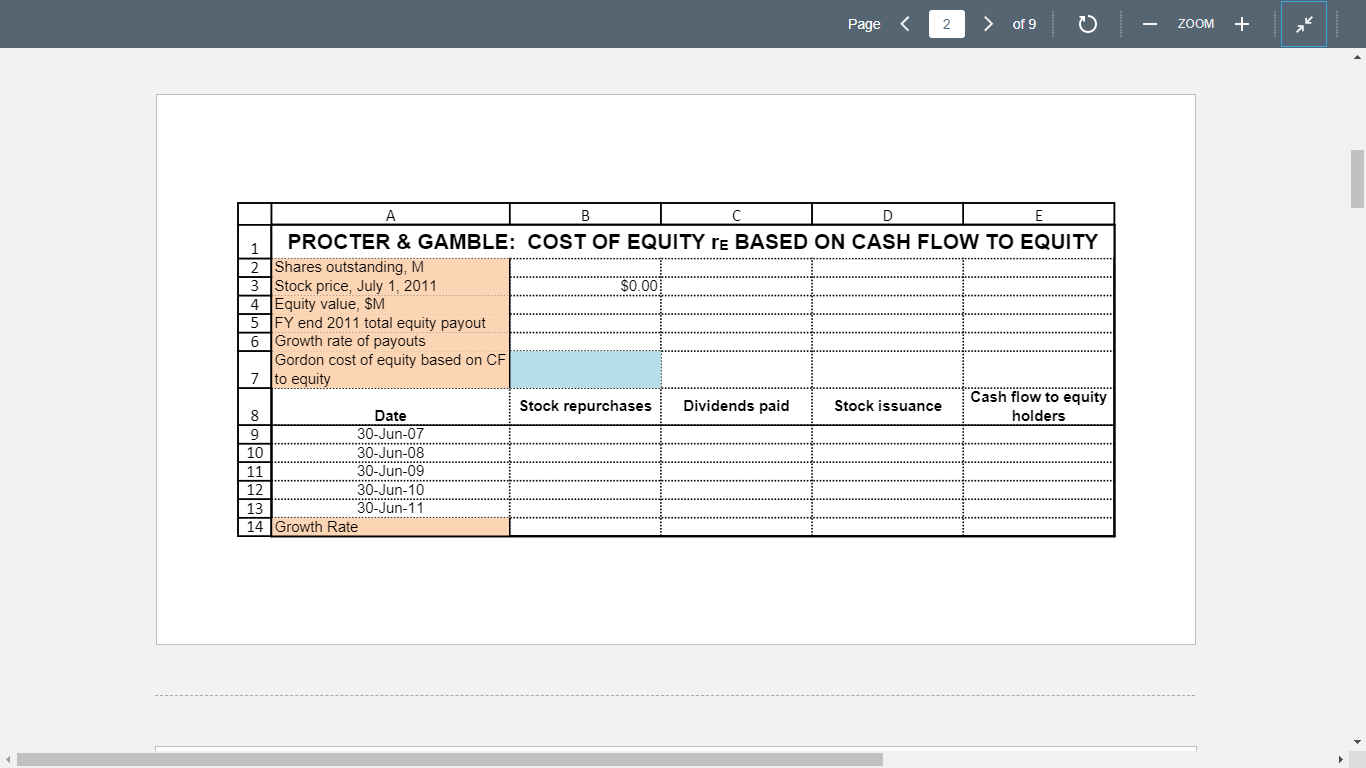

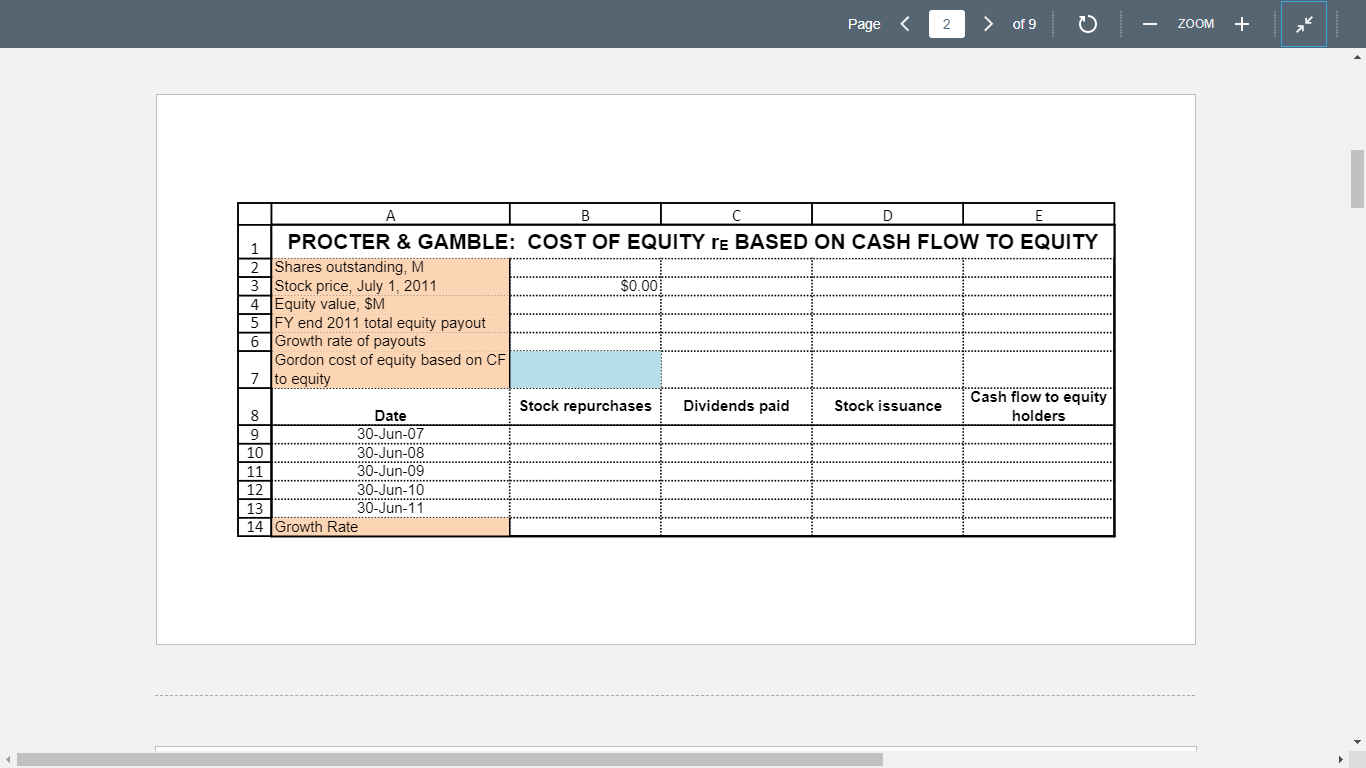

Using the financial statements provided in the Excel workbook for P&G, find total cash flow to equity for the last five years. Based on total cash flow to equity, what is the cost of common equity on July 1, 2011? Ignore any exercised options for the purpose of this assignment.

Using the financial statements provided in the Excel workbook for P&G, find total cash flow to equity for the last five years. Based on total cash flow to equity, what is the cost of common equity on July 1, 2011? Ignore any exercised options for the purpose of this assignment.

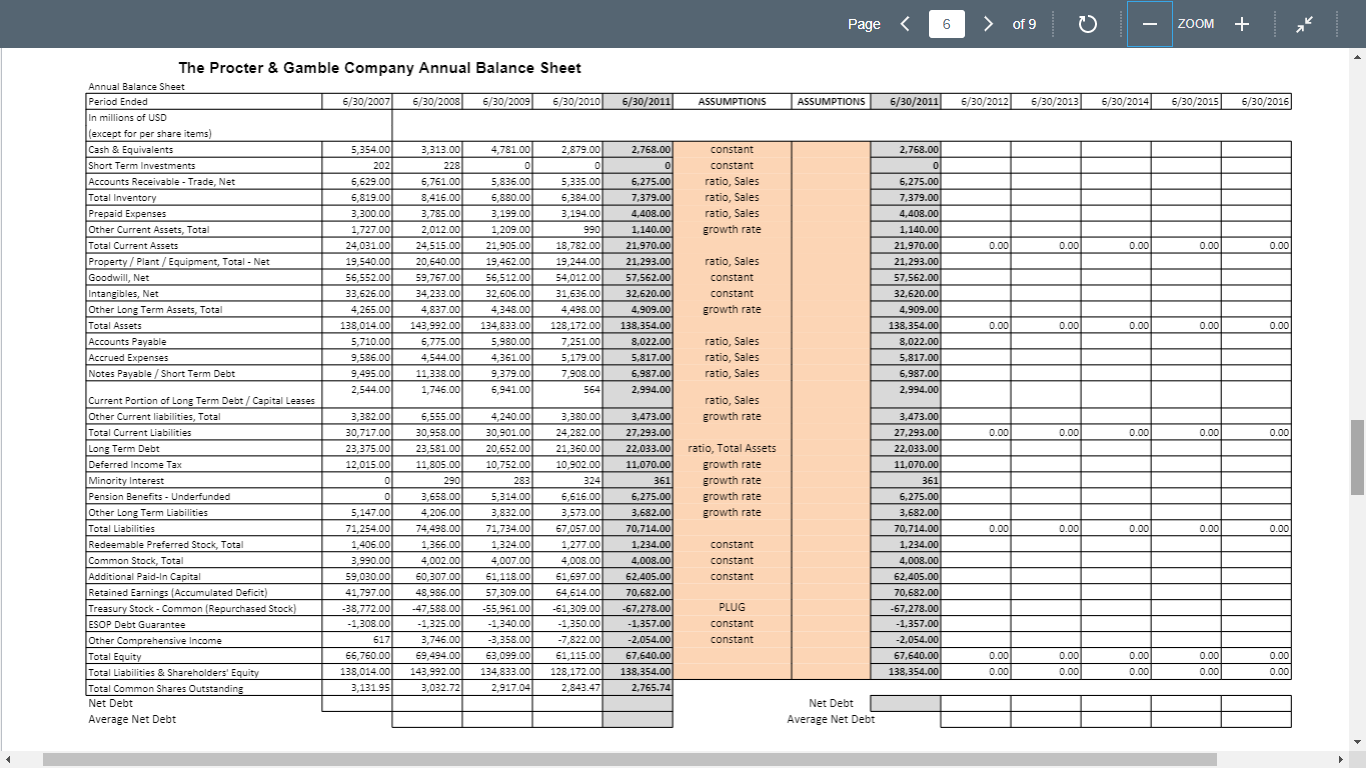

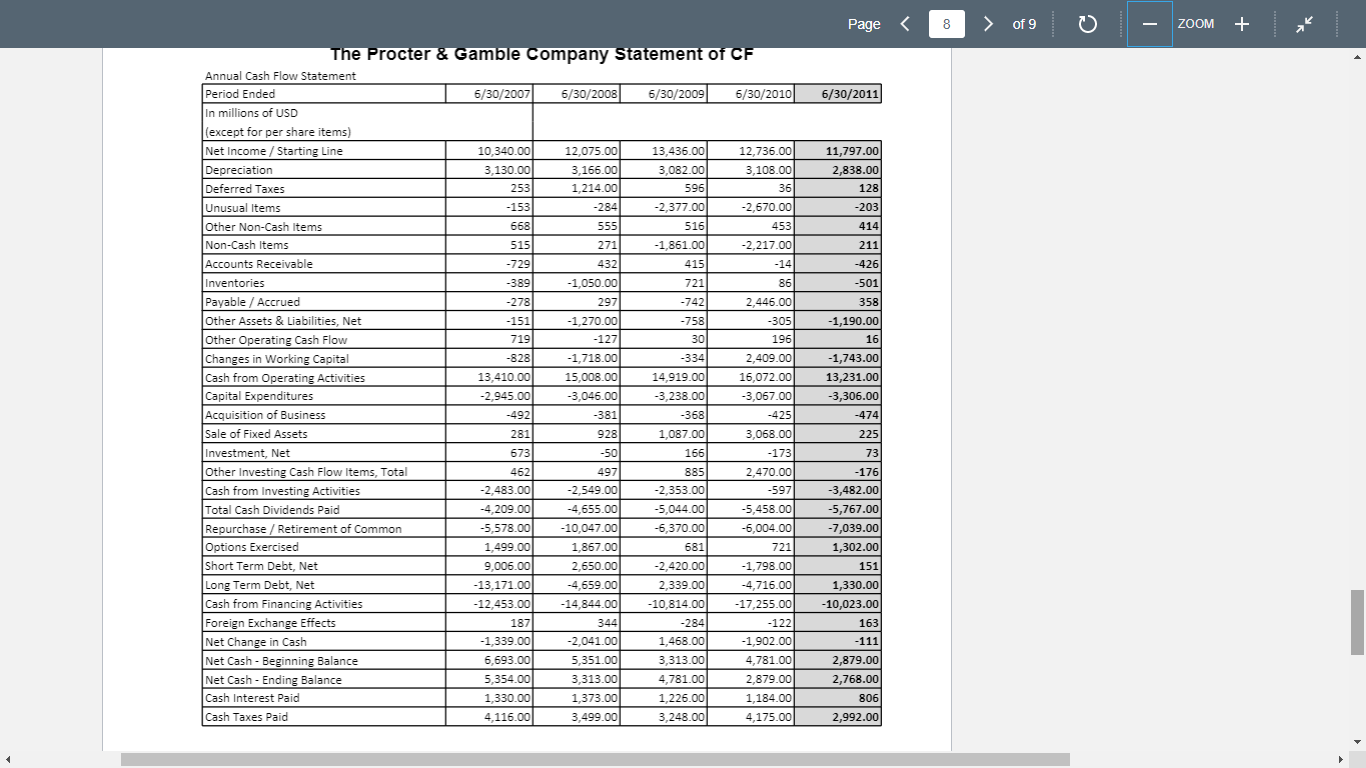

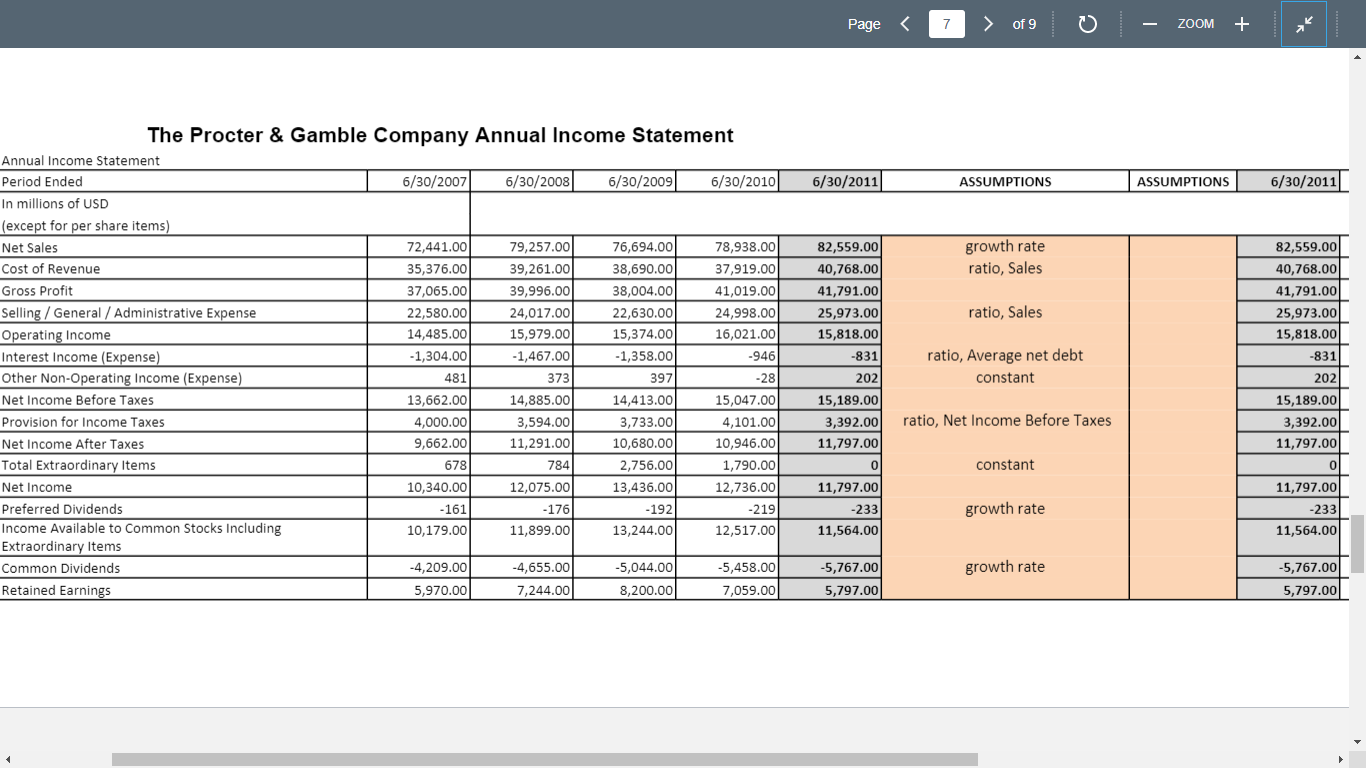

Page of 9 ZOOM + 6/30/2011 ASSUMPTIONS ASSUMPTIONS 6/30/2011 6/30/2012 6/30/2013 6/30/2014 6/30/2015 6/30/2016 2,768.00 2.768.00 0 0 constant constant ratio, Sales ratio, Sales ratio, Sales growth rate 0.00 0.00 0.00 0.00 0.00 6,275.00 7,379.00 4,408.00 1.140.00 21,970.00 2011 21.293.00 57,562.00 32,620.00 4,909.00 138,354.00 8,022.00 5.817.00 6,987.00 2.994.00 ratio, Sales constant constant growth rate 6,275.00 7,379.00 4,408.00 1,140.00 21,970.00 co 21,293.00 57,562.00 32,620.00 4,909.00 138,354.00 8,022.00 5,817.00 6,987.00 2,994.00 0.00 0.00 0.00 0.00 0.00 ratio, Sales ratio, Sales ratio, Sales The Procter & Gamble Company Annual Balance Sheet Annual Balance Sheet Period Ended 6/30/2007 6/30/2008 6/30/2009 6/30/2010 In millions of USD (except for per share items) Cash & Equivalents 5,354.00 3,313.00 4.781.00 2.879.00 Short Term Investments 202 228 0 0 Accounts Receivable - Trade, Net 6,629.00 6,761.00 5,836.00 5,335.00 Total Inventory 17 6,819.00 8,416.00 6.880.00 6,384.00 Prepaid Expenses 3,300.00 3,785.00 21 3.199.00 3,194.00 Other Current Assets, Total 1,727.00 2,012.00 1,209.00 990 Total Current Assets 24,031.00 24,515.00 100 21,905.00 18,782.00 Property/ Plant / Equipment, Total - Net 19,540.00 20,640.00 19,462.00 2 19,244.00 Goodwill, Net 56,552.00 59,767.00 56,512.00 54,012.00 Intangibles, Net 33,626.00 34,233.00 32,606.00 31,636.00 Other Long Term Assets, Total 4,265.00 4,837.00 4,348.00 4.498.00 Total Assets 138,014.00 143.992.00 134,833.00 128, 172.00 Accounts Payable 5,710.00 6,775.00 5.980.00 7.251.00 Accrued Expenses 9,586.00 4,544.00 4 361.00 5 179.00 Notes Payable / Short Term Debt 9,495.00 11 338.00 9,379.00 7.908.00 2 544.00 1,746.00 6.941.00 564 Current Portion of Long Term Debt / Capital Leases Other Current liabilities, Total 3,382.00 6,555.00 4,240.00 3,380.00 Total Current Liabilities 30,717.00 30,958.00 30.901.00 24,282.00 Long Term Debt 23,375.00 23,581.00 20,652.00 21 360.00 Deferred Income Tax 12,015.00 11,805.00 www. 10,752.00 10,902.00 Minority Interest 0 283 324 Pension Benefits - Underfunded 0 3,658.00 5,314.00 6.616.00 Other Long Term Liabilities 5.147.00 4.206.00 3,832.00 3,573.00 Total Liabilities 71 254.00 74,498.00 71,734,00 my 67,057.00 Redeemable Preferred Stock, Total 2013 1,406.00 1.366.00 1,324.00 1,277.00 Common Stock, Total 3.990,00 24 4.002.00 4,007.00 22 12 4,008.00 Additional Paid-In Capital 59,030.00 60 307.00 61 118.00 61,697.00 Retained Earnings (Accumulated Deficit) 41,797.00 B 48.986.00 14 57,309.00 2. 64,614.00 Treasury Stock - Common (Repurchased Stock) -38,772.00 -47,588.00 -55,961.00 -61,309.00 ESOP Debt Guarantee -1, 308.00 -1325.00 -1.340.00 -1.350.00 Other Comprehensive Income 617 3.746.00 3,358.00 -7,822.00 Total Equity 66,760.00 69,494.00 63,099.00 61 115.00 Total Liabilities & Shareholders' Equity 138,014.00 143,992.00 134,833.00 128,172.00 Total Common Shares Outstanding 3.131.95 3,032.72 2.917.04 2,843.47 Net Debt Average Net Debt ratio, Sales growth rate 0.00 0.00 0.001 0.001 0.00 290 ratio, Total Assets growth rate growth rate growth rate growth rate 0.00 0.00 0.00 0.00 0.00 3,473.00 27,293.00 22.033.00 11,070.00 361 6,275.00 3.682.00 70,714.00 1.234.00 4.000.00 62.405.00 70.682.00 -67,278.00 -1,357.00 -2,054.00 67,640.00 138,354.00 2,765.74 constant constant constant 3,473.00 27,293.00 22.033.00 11,070.00 361 6,275.00 3,682.00 70,714.00 1,234.00 4,008.00 62,405.00 70,682.00 can -67.278.00 -1,357.00 -2,054.00 67,640.00 138.354.00 PLUG constant constant 0.00 0.00 0.00 0.001 0.00 0.00 0.00 0.00 0.00 0.00 Net Debt Average Net Debt Page of 9 ZOOM + 6/30/2011 11,797.00 2,838.00 128 -203 414 211 -426 -501 358 The Procter & Gamble Company Statement of CF Annual Cash Flow Statement Period Ended 6/30/2007 6/30/2008 6/30/2009 6/30/2010 In millions of USD (except for per share items) Net Income / Starting Line 10,340.00 12.075.00 13,436.00 12.736.00 Depreciation 3,130.00 3.166.00 3,082.00 3.108.00 Deferred Taxes 253 1,214.00 596 36 Unusual Items -153 -284 -2,377.00 -2,670.00 Other Non-Cash Items 668 555 516 453 Non-Cash Items 515 271 -1,861.00 -2,217.00 Accounts Receivable -729 432 415 -14 Inventories -389 -1,050.00 721 86 Payable / Accrued -278 297 -742 2,446.00 Other Assets & Liabilities, Net -151 -1,270.00 -758 -305 Other Operating Cash Flow 719 -127 30 196 Changes in Working Capital -828 -1,718.00 -334 2,409.00 Cash from Operating Activities 13,410.00 15,008.00 14,919.00 16,072.00 Capital Expenditures -2,945.00 3,046.00 -3,238.00 -3,067.00 Acquisition of Business -492 -381 -368 -425 Sale of Fixed Assets 281 928 1,087.00 3,068.00 Investment, Net 673 -50 166 -173 Other Investing Cash Flow Items, Total 462 497 885 2,470.00 Cash from Investing Activities -2.483.00 -2.549.00 -2,353.00 -597 Total Cash Dividends Paid -4,209.00 -4,655.00 -5,044.00 -5,458.00 Repurchase / Retirement of Common -5,578.00 -10,047.00 -6,370.00 -6,004.00 Options Exercised 1,499.00 1,867.00 681 721 Short Term Debt, Net 9.006.00 2,650.00 -2,420.00 -1,798.00 Long Term Debt, Net -13.171.00 -4,659.00 2,339.00 -4,716.00 Cash from Financing Activities -12,453.00 -14,844.00 -10,814.00 -17,255.00 Foreign Exchange Effects 187 344 -284 -122 Net Change in Cash -1,339.00 -2,041.00 1,468.00 -1.902.00 Net Cash - Beginning Balance 6,693.00 5,351.00 3,313.00 4,781.00 Net Cash - Ending Balance 5,354.00 3,313.00 4,781.00 2,879.00 Cash Interest Paid 1,330.00 1,373.00 1,226.00 1,184.00 Cash Taxes Paid 4,116.00 3,499.00 3,248.00 4.175.00 -1,190.00 16 -1,743.00 13,231.00 -3,306.00 -474 225 73 -176 -3,482.00 -5,767.00 -7,039.00 1,302.00 151 1,330.00 -10,023.00 163 -111 2,879.00 2,768.00 806) 2,992.00 Page of 9 ZOOM + 6/30/2011 ASSUMPTIONS ASSUMPTIONS 6/30/2011 growth rate ratio, Sales 82,559.00 40,768.00 41,791.00 25,973.00 15,818.00 ratio, Sales The Procter & Gamble Company Annual Income Statement Annual Income Statement Period Ended 6/30/2007 6/30/2008 6/30/2009 6/30/2010 In millions of USD (except for per share items) Net Sales 72,441.00 79,257.00 76,694.00 78,938.00 Cost of Revenue 35,376.00 39,261.00 38,690.00 37,919.00 Gross Profit 37,065.00 39,996.00 38,004.00 41,019.00 Selling / General / Administrative Expense 22,580.00 24,017.00 22,630.00 24,998.00 Operating Income 14,485.00 15,979.00 15,374.00 16,021.00 Interest Income (Expense) -1,304.00 -1,467.00 -1,358.00 -946 Other Non-Operating Income (Expense) 481 373 397 -28 Net Income Before Taxes 13,662.00 14,885.00 14,413.00 15,047.00 Provision for Income Taxes 4,000.00 3,594.00 3,733.00 4,101.00 Net Income After Taxes 9,662.00 11,291.00 10,680.00 10,946.00 Total Extraordinary Items 6781 784 2,756.00 1,790.00 Net Income 10,340.00 12,075.00 13,436.00 12,736.00 Preferred Dividends - 161 -176 -192 -219 Income Available to Common Stocks including 10,179.00 11,899.00 13,244.00 12.517.00 Extraordinary Items Common Dividends -4,209.00 -4,655.00 -5,044.00 -5,458.00 Retained Earnings 5,970.00 7,244.00 8,200.00 7,059.00 82,559.00 40,768.00 41,791.00 25,973.00 15,818.00 -831 202 15,189.00 3,392.00 11,797.00 -831 ratio, Average net debt constant 202 15,189.00 3,392.00 11,797.00 ratio, Net Income Before Taxes 0 constant 0 11,797.00 -233 11,564.00) growth rate 11,797.00 -233 11,564.00 -5,767.00 growth rate -5,767.00 5,797.00 5,797.00 Page of 9 ZOOM + 6/30/2011 ASSUMPTIONS ASSUMPTIONS 6/30/2011 6/30/2012 6/30/2013 6/30/2014 6/30/2015 6/30/2016 2,768.00 2.768.00 0 0 constant constant ratio, Sales ratio, Sales ratio, Sales growth rate 0.00 0.00 0.00 0.00 0.00 6,275.00 7,379.00 4,408.00 1.140.00 21,970.00 2011 21.293.00 57,562.00 32,620.00 4,909.00 138,354.00 8,022.00 5.817.00 6,987.00 2.994.00 ratio, Sales constant constant growth rate 6,275.00 7,379.00 4,408.00 1,140.00 21,970.00 co 21,293.00 57,562.00 32,620.00 4,909.00 138,354.00 8,022.00 5,817.00 6,987.00 2,994.00 0.00 0.00 0.00 0.00 0.00 ratio, Sales ratio, Sales ratio, Sales The Procter & Gamble Company Annual Balance Sheet Annual Balance Sheet Period Ended 6/30/2007 6/30/2008 6/30/2009 6/30/2010 In millions of USD (except for per share items) Cash & Equivalents 5,354.00 3,313.00 4.781.00 2.879.00 Short Term Investments 202 228 0 0 Accounts Receivable - Trade, Net 6,629.00 6,761.00 5,836.00 5,335.00 Total Inventory 17 6,819.00 8,416.00 6.880.00 6,384.00 Prepaid Expenses 3,300.00 3,785.00 21 3.199.00 3,194.00 Other Current Assets, Total 1,727.00 2,012.00 1,209.00 990 Total Current Assets 24,031.00 24,515.00 100 21,905.00 18,782.00 Property/ Plant / Equipment, Total - Net 19,540.00 20,640.00 19,462.00 2 19,244.00 Goodwill, Net 56,552.00 59,767.00 56,512.00 54,012.00 Intangibles, Net 33,626.00 34,233.00 32,606.00 31,636.00 Other Long Term Assets, Total 4,265.00 4,837.00 4,348.00 4.498.00 Total Assets 138,014.00 143.992.00 134,833.00 128, 172.00 Accounts Payable 5,710.00 6,775.00 5.980.00 7.251.00 Accrued Expenses 9,586.00 4,544.00 4 361.00 5 179.00 Notes Payable / Short Term Debt 9,495.00 11 338.00 9,379.00 7.908.00 2 544.00 1,746.00 6.941.00 564 Current Portion of Long Term Debt / Capital Leases Other Current liabilities, Total 3,382.00 6,555.00 4,240.00 3,380.00 Total Current Liabilities 30,717.00 30,958.00 30.901.00 24,282.00 Long Term Debt 23,375.00 23,581.00 20,652.00 21 360.00 Deferred Income Tax 12,015.00 11,805.00 www. 10,752.00 10,902.00 Minority Interest 0 283 324 Pension Benefits - Underfunded 0 3,658.00 5,314.00 6.616.00 Other Long Term Liabilities 5.147.00 4.206.00 3,832.00 3,573.00 Total Liabilities 71 254.00 74,498.00 71,734,00 my 67,057.00 Redeemable Preferred Stock, Total 2013 1,406.00 1.366.00 1,324.00 1,277.00 Common Stock, Total 3.990,00 24 4.002.00 4,007.00 22 12 4,008.00 Additional Paid-In Capital 59,030.00 60 307.00 61 118.00 61,697.00 Retained Earnings (Accumulated Deficit) 41,797.00 B 48.986.00 14 57,309.00 2. 64,614.00 Treasury Stock - Common (Repurchased Stock) -38,772.00 -47,588.00 -55,961.00 -61,309.00 ESOP Debt Guarantee -1, 308.00 -1325.00 -1.340.00 -1.350.00 Other Comprehensive Income 617 3.746.00 3,358.00 -7,822.00 Total Equity 66,760.00 69,494.00 63,099.00 61 115.00 Total Liabilities & Shareholders' Equity 138,014.00 143,992.00 134,833.00 128,172.00 Total Common Shares Outstanding 3.131.95 3,032.72 2.917.04 2,843.47 Net Debt Average Net Debt ratio, Sales growth rate 0.00 0.00 0.001 0.001 0.00 290 ratio, Total Assets growth rate growth rate growth rate growth rate 0.00 0.00 0.00 0.00 0.00 3,473.00 27,293.00 22.033.00 11,070.00 361 6,275.00 3.682.00 70,714.00 1.234.00 4.000.00 62.405.00 70.682.00 -67,278.00 -1,357.00 -2,054.00 67,640.00 138,354.00 2,765.74 constant constant constant 3,473.00 27,293.00 22.033.00 11,070.00 361 6,275.00 3,682.00 70,714.00 1,234.00 4,008.00 62,405.00 70,682.00 can -67.278.00 -1,357.00 -2,054.00 67,640.00 138.354.00 PLUG constant constant 0.00 0.00 0.00 0.001 0.00 0.00 0.00 0.00 0.00 0.00 Net Debt Average Net Debt Page of 9 ZOOM + 6/30/2011 11,797.00 2,838.00 128 -203 414 211 -426 -501 358 The Procter & Gamble Company Statement of CF Annual Cash Flow Statement Period Ended 6/30/2007 6/30/2008 6/30/2009 6/30/2010 In millions of USD (except for per share items) Net Income / Starting Line 10,340.00 12.075.00 13,436.00 12.736.00 Depreciation 3,130.00 3.166.00 3,082.00 3.108.00 Deferred Taxes 253 1,214.00 596 36 Unusual Items -153 -284 -2,377.00 -2,670.00 Other Non-Cash Items 668 555 516 453 Non-Cash Items 515 271 -1,861.00 -2,217.00 Accounts Receivable -729 432 415 -14 Inventories -389 -1,050.00 721 86 Payable / Accrued -278 297 -742 2,446.00 Other Assets & Liabilities, Net -151 -1,270.00 -758 -305 Other Operating Cash Flow 719 -127 30 196 Changes in Working Capital -828 -1,718.00 -334 2,409.00 Cash from Operating Activities 13,410.00 15,008.00 14,919.00 16,072.00 Capital Expenditures -2,945.00 3,046.00 -3,238.00 -3,067.00 Acquisition of Business -492 -381 -368 -425 Sale of Fixed Assets 281 928 1,087.00 3,068.00 Investment, Net 673 -50 166 -173 Other Investing Cash Flow Items, Total 462 497 885 2,470.00 Cash from Investing Activities -2.483.00 -2.549.00 -2,353.00 -597 Total Cash Dividends Paid -4,209.00 -4,655.00 -5,044.00 -5,458.00 Repurchase / Retirement of Common -5,578.00 -10,047.00 -6,370.00 -6,004.00 Options Exercised 1,499.00 1,867.00 681 721 Short Term Debt, Net 9.006.00 2,650.00 -2,420.00 -1,798.00 Long Term Debt, Net -13.171.00 -4,659.00 2,339.00 -4,716.00 Cash from Financing Activities -12,453.00 -14,844.00 -10,814.00 -17,255.00 Foreign Exchange Effects 187 344 -284 -122 Net Change in Cash -1,339.00 -2,041.00 1,468.00 -1.902.00 Net Cash - Beginning Balance 6,693.00 5,351.00 3,313.00 4,781.00 Net Cash - Ending Balance 5,354.00 3,313.00 4,781.00 2,879.00 Cash Interest Paid 1,330.00 1,373.00 1,226.00 1,184.00 Cash Taxes Paid 4,116.00 3,499.00 3,248.00 4.175.00 -1,190.00 16 -1,743.00 13,231.00 -3,306.00 -474 225 73 -176 -3,482.00 -5,767.00 -7,039.00 1,302.00 151 1,330.00 -10,023.00 163 -111 2,879.00 2,768.00 806) 2,992.00 Page of 9 ZOOM + 6/30/2011 ASSUMPTIONS ASSUMPTIONS 6/30/2011 growth rate ratio, Sales 82,559.00 40,768.00 41,791.00 25,973.00 15,818.00 ratio, Sales The Procter & Gamble Company Annual Income Statement Annual Income Statement Period Ended 6/30/2007 6/30/2008 6/30/2009 6/30/2010 In millions of USD (except for per share items) Net Sales 72,441.00 79,257.00 76,694.00 78,938.00 Cost of Revenue 35,376.00 39,261.00 38,690.00 37,919.00 Gross Profit 37,065.00 39,996.00 38,004.00 41,019.00 Selling / General / Administrative Expense 22,580.00 24,017.00 22,630.00 24,998.00 Operating Income 14,485.00 15,979.00 15,374.00 16,021.00 Interest Income (Expense) -1,304.00 -1,467.00 -1,358.00 -946 Other Non-Operating Income (Expense) 481 373 397 -28 Net Income Before Taxes 13,662.00 14,885.00 14,413.00 15,047.00 Provision for Income Taxes 4,000.00 3,594.00 3,733.00 4,101.00 Net Income After Taxes 9,662.00 11,291.00 10,680.00 10,946.00 Total Extraordinary Items 6781 784 2,756.00 1,790.00 Net Income 10,340.00 12,075.00 13,436.00 12,736.00 Preferred Dividends - 161 -176 -192 -219 Income Available to Common Stocks including 10,179.00 11,899.00 13,244.00 12.517.00 Extraordinary Items Common Dividends -4,209.00 -4,655.00 -5,044.00 -5,458.00 Retained Earnings 5,970.00 7,244.00 8,200.00 7,059.00 82,559.00 40,768.00 41,791.00 25,973.00 15,818.00 -831 202 15,189.00 3,392.00 11,797.00 -831 ratio, Average net debt constant 202 15,189.00 3,392.00 11,797.00 ratio, Net Income Before Taxes 0 constant 0 11,797.00 -233 11,564.00) growth rate 11,797.00 -233 11,564.00 -5,767.00 growth rate -5,767.00 5,797.00 5,797.00

Using the financial statements provided in the Excel workbook for P&G, find total cash flow to equity for the last five years. Based on total cash flow to equity, what is the cost of common equity on July 1, 2011? Ignore any exercised options for the purpose of this assignment.

Using the financial statements provided in the Excel workbook for P&G, find total cash flow to equity for the last five years. Based on total cash flow to equity, what is the cost of common equity on July 1, 2011? Ignore any exercised options for the purpose of this assignment.