Question

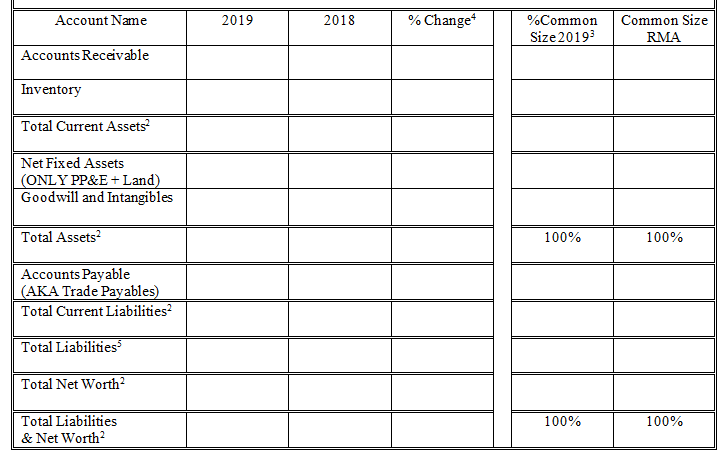

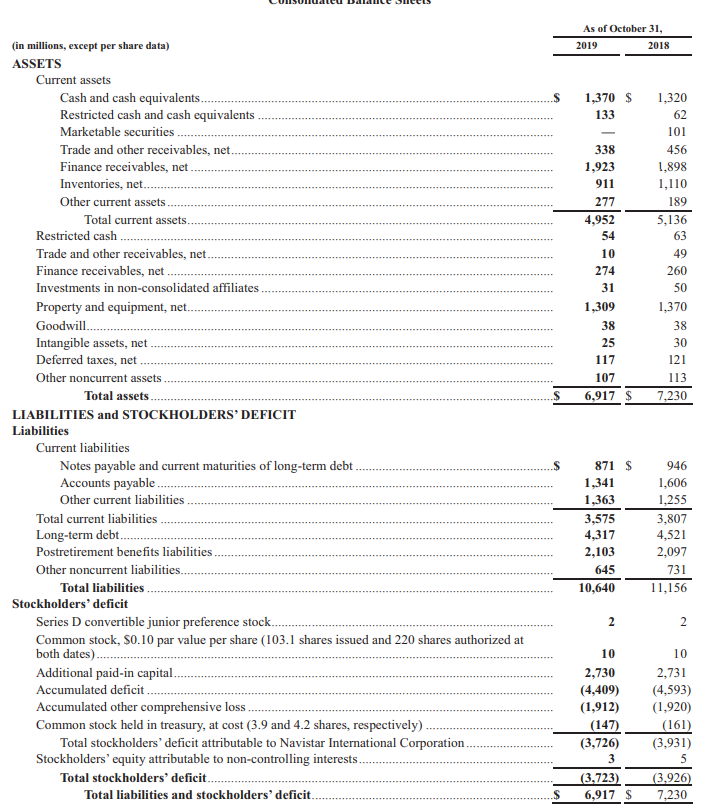

Using the following balance sheet, input the corresponding numbers into the correct section. Note Note: NOT all the accounts off of the financial statement will

Using the following balance sheet, input the corresponding numbers into the correct section.

Note

Note: NOT all the accounts off of the financial statement will go on this form. Only the accounts listed are needed for specific analysis are on this form.

2 Your Totals must equal the companys Totals! (BUT THE ACCOUNTS ON THIS FORM DONT HAVE

TO ADD UP TO THE TOTAL AMOUNT SINCE NOT ALL ACCOUNTS ARE ON THIS FORM)

3 This is (each account $ amount divided by the Total Asset $ amount) x 100

(After multiplying by 100 only include one decimal place: ex: 23.4%)

4 This is the percent change in the dollar amounts. (($ in 2019 - $ in 2018)/$ in 2018) x 100

(After multiplying by 100 only include one decimal place: ex: 23.4%)

5 For the Dollar Amounts: Total Liabilities = Total Assets minus Total Net Worth

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started