Answered step by step

Verified Expert Solution

Question

1 Approved Answer

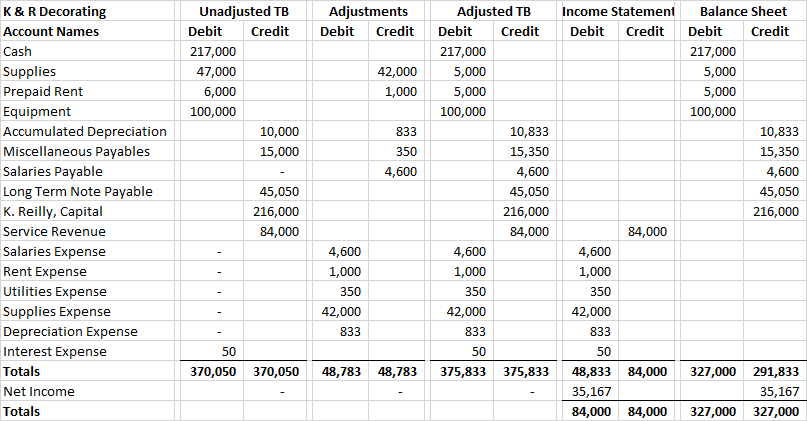

Using the following information, answer questions a - d a. Extend the adjusted trial balance to prepare the Income Statement and Balance Sheet on the

Using the following information, answer questions a - d

a. Extend the adjusted trial balance to prepare the Income Statement and Balance Sheet on the EOP worksheet.

b. Prepare the four basic financial statements for the month of January: Income Statement, Statement of Owners Equity, Balance Sheet & Statement of Cash Flows.

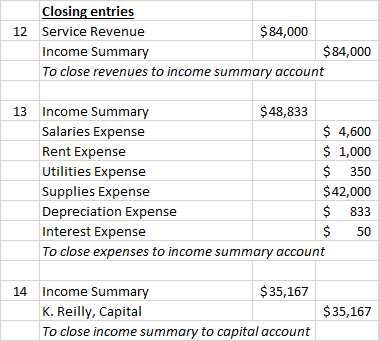

c. Prepare the closing entries and post to ledger.

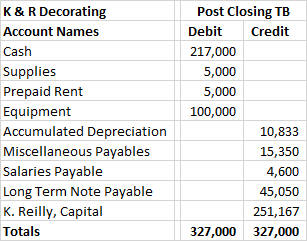

d. Prepare post closing trial balance.

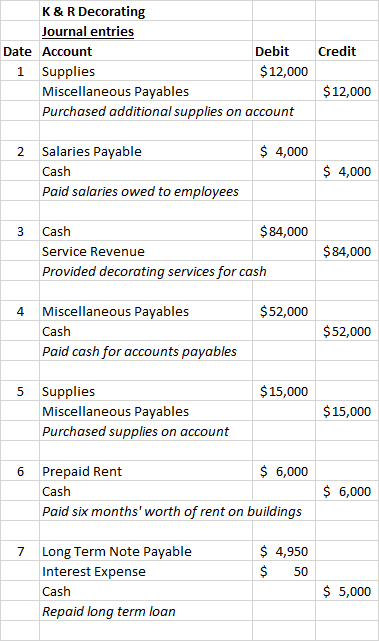

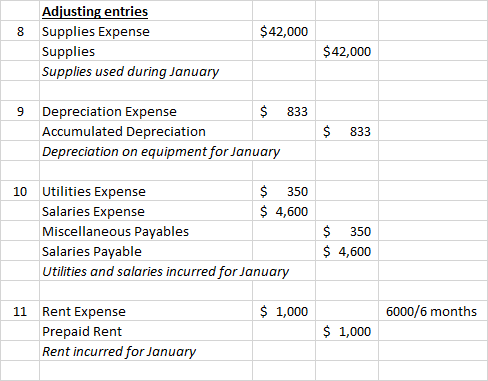

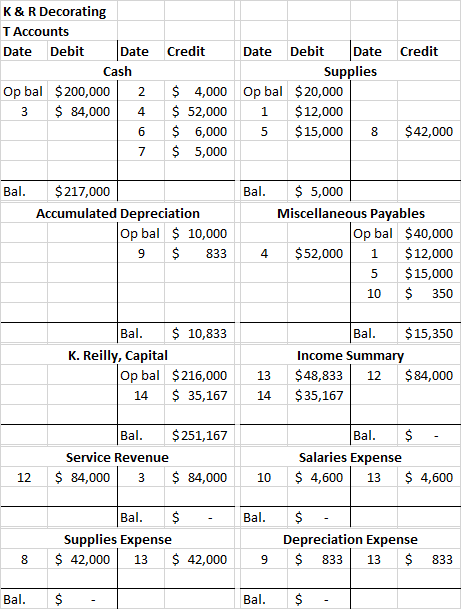

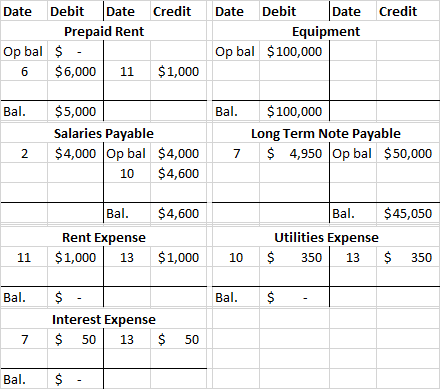

Credit K & R Decorating Journal entries Date Account Debit 1 Supplies $ 12,000 Miscellaneous Payables Purchased additional supplies on account $ 12,000 $ 4,000 2 Salaries Payable Cash Paid salaries owed to employees $ 4,000 3 Cash $ 84,000 Service Revenue Provided decorating services for cash $ 84,000 $52,000 4 Miscellaneous Payables Cash Paid cash for accounts payables $52,000 $ 15,000 5 Supplies Miscellaneous Payables Purchased supplies on account $ 15,000 6 Prepaid Rent $ 6,000 Cash Paid six months' worth of rent on buildings $ 6,000 $ 4,950 $ 50 7 Long Term Note Payable Interest Expense Cash Repaid long term loan $ 5,000 $ 42,000 Adjusting entries 8 Supplies Expense Supplies Supplies used during January $42,000 9 Depreciation Expense $ 833 Accumulated Depreciation Depreciation on equipment for January $ 833 10 Utilities Expense $ 350 Salaries Expense $ 4,600 Miscellaneous Payables Salaries Payable Utilities and salaries incurred for January $ 350 $ 4,600 $1,000 6000/6 months 11 Rent Expense Prepaid Rent Rent incurred for January $ 1,000 Date Credit K & R Decorating T Accounts Date Debit Date Cash Op bal $200,000 2 3 $ 84,000 4 6 N Credit Date Debit Supplies $ 4,000 Op bal $20,000 $ 52,000 1 $ 12,000 $ 6,000 5 $ 15,000 8 $ 5,000 $ 42,000 7 Bal. Bal. $ 217,000 Accumulated Depreciation Op bal $ 10,000 9 $ 833 $ 5,000 Miscellaneous Payables Op bal $40,000 $52,000 1 $12,000 5 $15,000 10 $ 350 4 Bal. $ 10,833 K. Reilly, Capital Op bal $216,000 14 $ 35,167 Bal. $ 15,350 Income Summary $48,833 12 $ 84,000 $ 35,167 13 14 Bal. $ 251,167 Service Revenue $ 84,000 3 $ 84,000 Bal. $ Salaries Expense $ 4,600 13 $ 4,600 12 10 Bal. Bal. $ Supplies Expense $ 42,000 13 $ 42,000 $ Depreciation Expense $ 833 13 $ 8 9 833 Bal. $ Bal. $ $ Credit Date Debit Date Credit Prepaid Rent Op bal $ . 6 $6,000 11 $1,000 Date Debit Date Equipment Op bal $100,000 Bal. Bal. $5,000 Salaries Payable $4,000 Op bal $4,000 10 $4,600 $100,000 Long Term Note Payable $ 4,950 Op bal $50,000 2 7 Bal. $4,600 Rent Expense $1,000 13 Bal. $45,050 Utilities Expense $ 350 13 $ 350 11 $1,000 10 $ Bal. Bal. $ $ $ Interest Expense $ 50 13 $ 50 7 Bal. $ Adjustments Debit Credit Income Statement Debit Credit Unadjusted TB Debit Credit 217,000 47,000 6,000 100,000 10,000 15,000 42,000 1,000 K & R Decorating Account Names Cash Supplies Prepaid Rent Equipment Accumulated Depreciation Miscellaneous Payables Salaries Payable Long Term Note Payable K. Reilly, Capital Service Revenue Salaries Expense Rent Expense Utilities Expense Supplies Expense Depreciation Expense Interest Expense Totals Net Income Totals 833 350 4,600 Adjusted TB Debit Credit 217,000 5,000 5,000 100,000 10,833 15,350 4,600 45,050 216,000 84,000 4,600 1,000 350 42,000 833 Balance Sheet Debit Credit 217,000 5,000 5,000 100,000 10,833 15,350 4,600 45,050 216,000 45,050 216,000 84,000 4,600 1,000 350 42,000 833 84,000 4,600 1,000 350 42,000 833 50 48,833 84,000 35,167 84,000 84,000 50 50 370,050 370,050 48,783 48,783 375,833 375,833 327,000 291,833 35,167 327,000 327,000 Closing entries 12 Service Revenue $ 84,000 Income Summary $ 84,000 To close revenues to income summary account 13 Income Summary $48,833 Salaries Expense $ 4,600 Rent Expense $ 1,000 Utilities Expense $ 350 Supplies Expense $ 42,000 Depreciation Expense $ 833 Interest Expense $ 50 To close expenses to income summary account 14 Income Summary $35,167 K. Reilly, Capital To close income summary to capital account $ 35,167 K & R Decorating Account Names Cash Supplies Prepaid Rent Equipment Accumulated Depreciation Miscellaneous Payables Salaries Payable Long Term Note Payable K. Reilly, Capital Totals Post Closing TB Debit Credit 217,000 5,000 5,000 100,000 10,833 15,350 4,600 45,050 251,167 327,000 327,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started