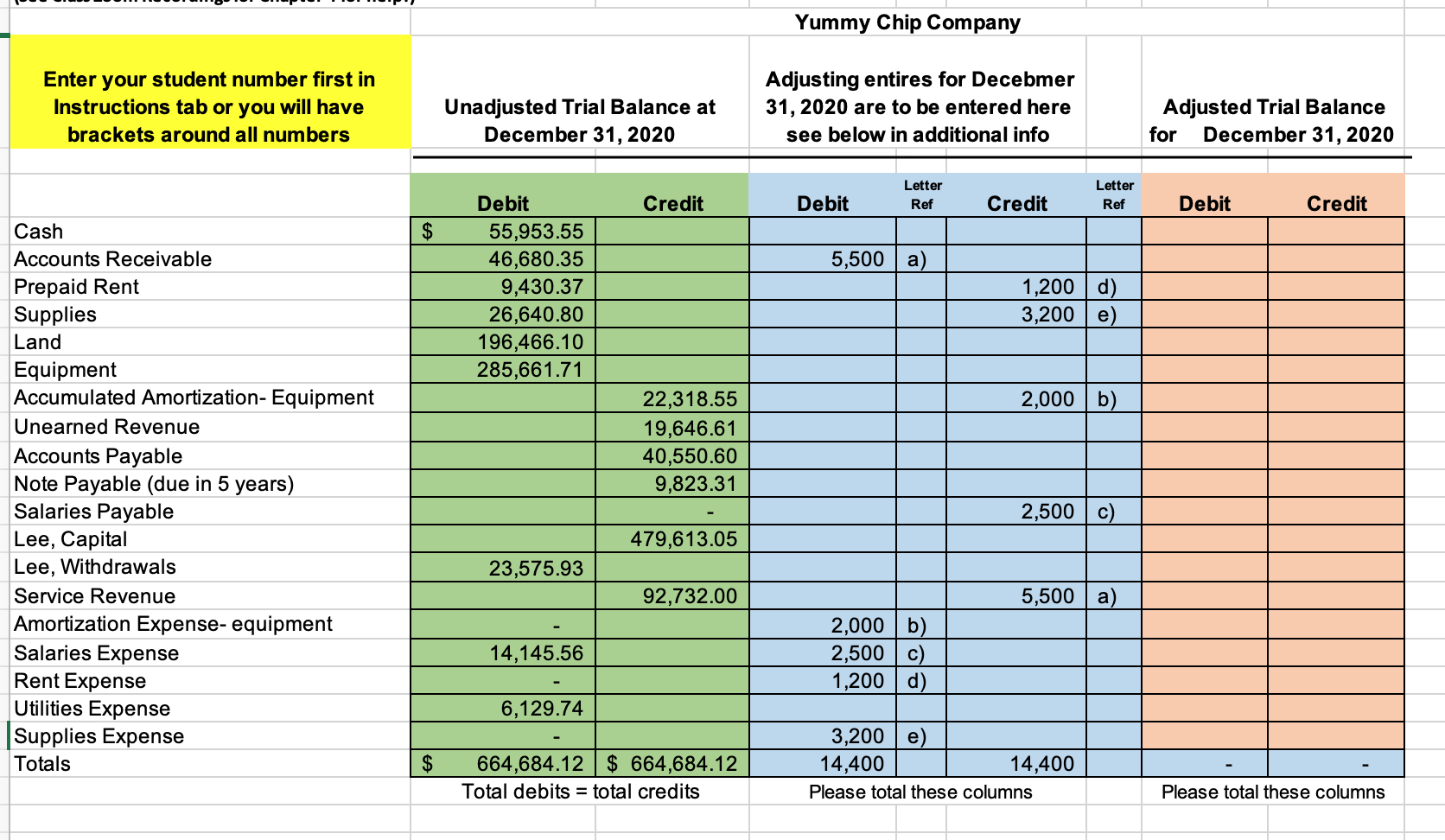

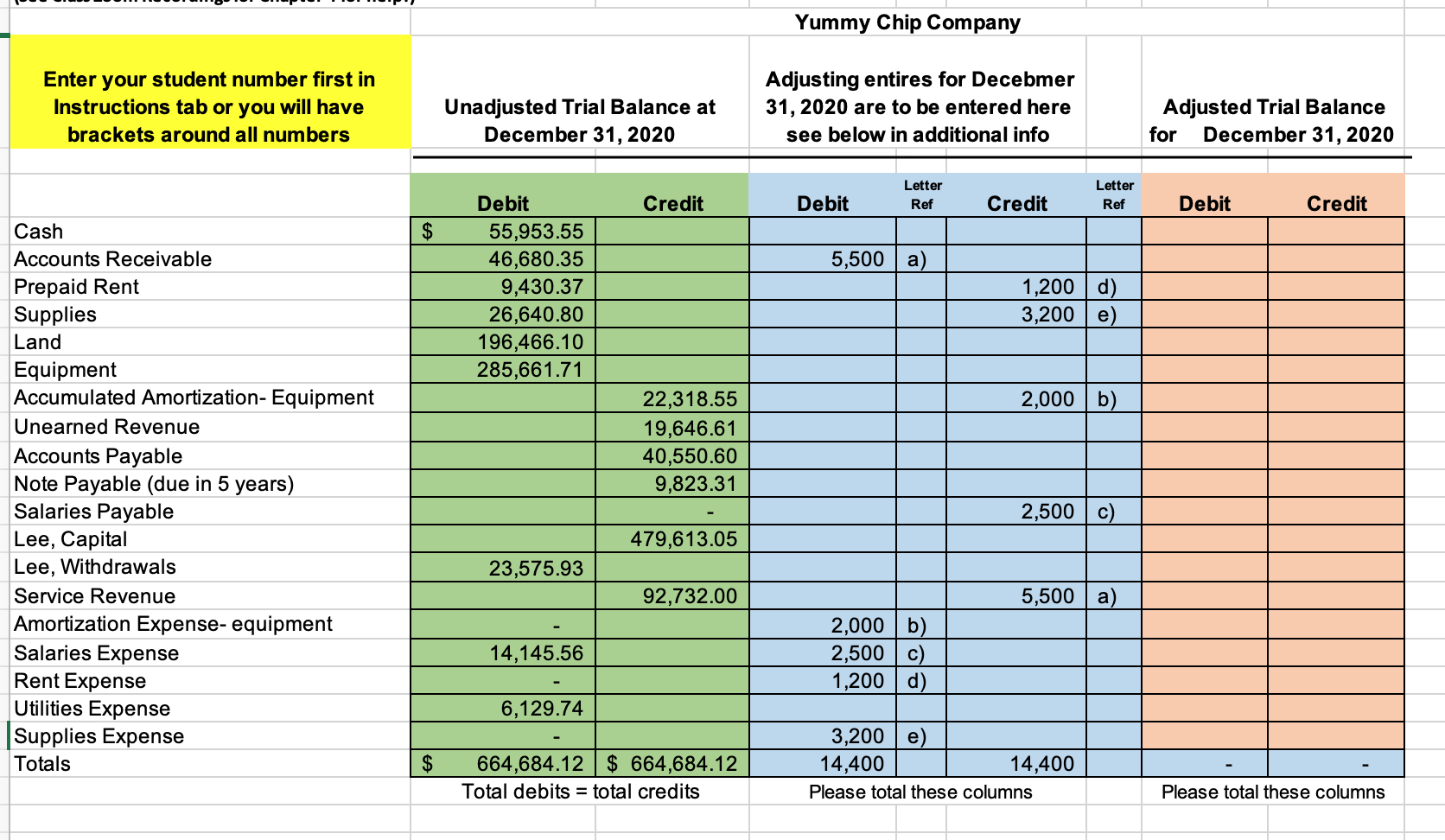

Using the following information, create an adjusted trial balance (pink column).

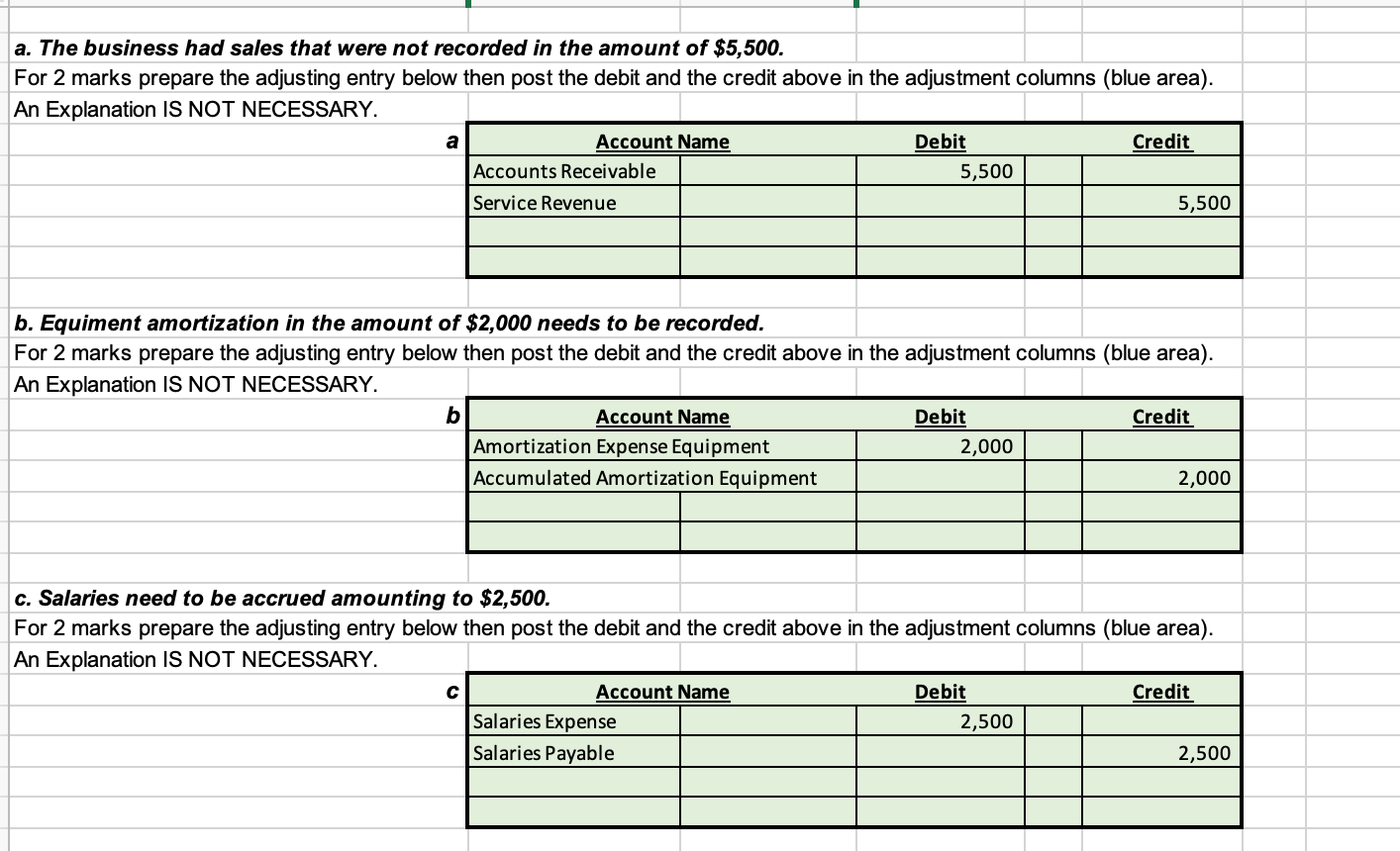

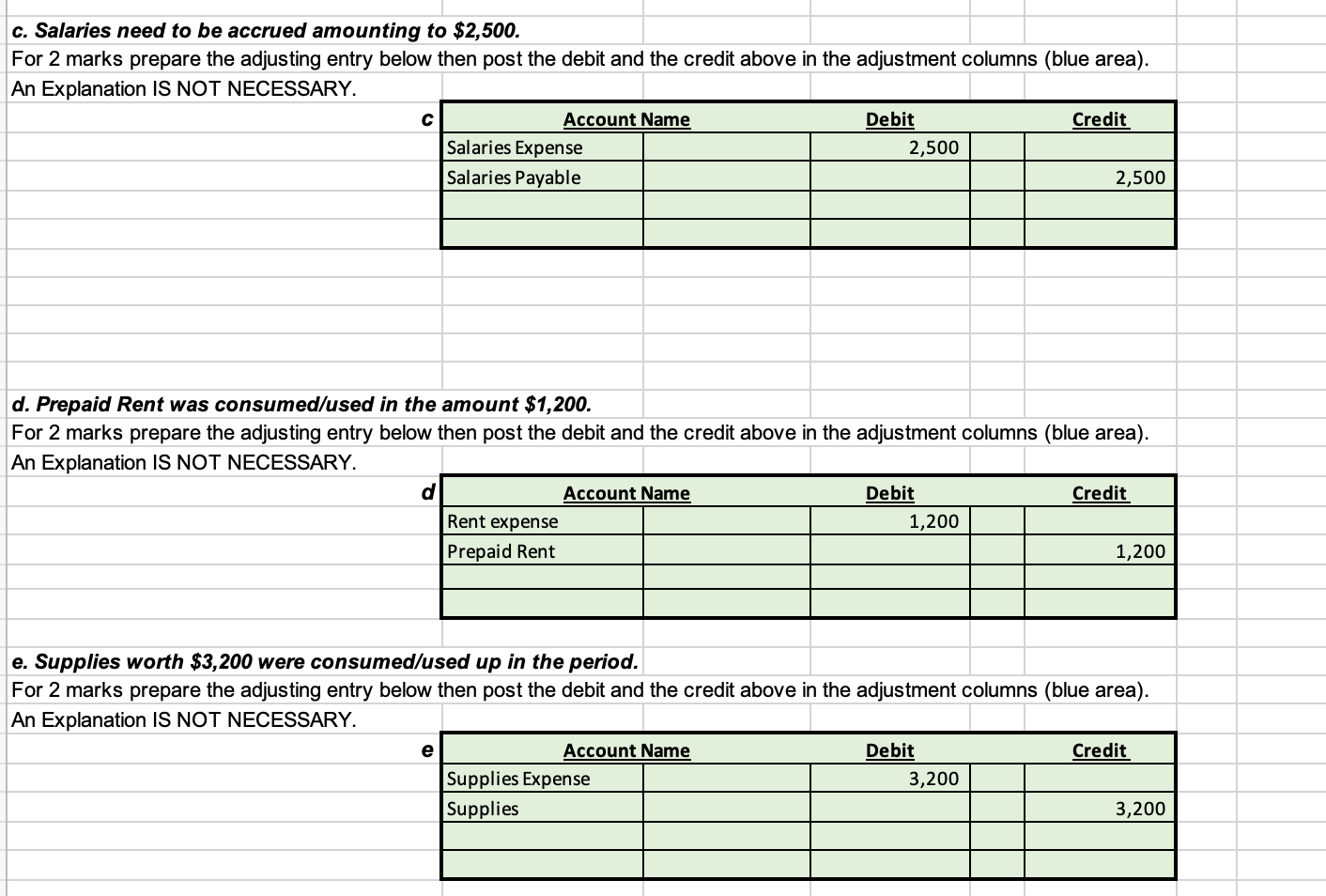

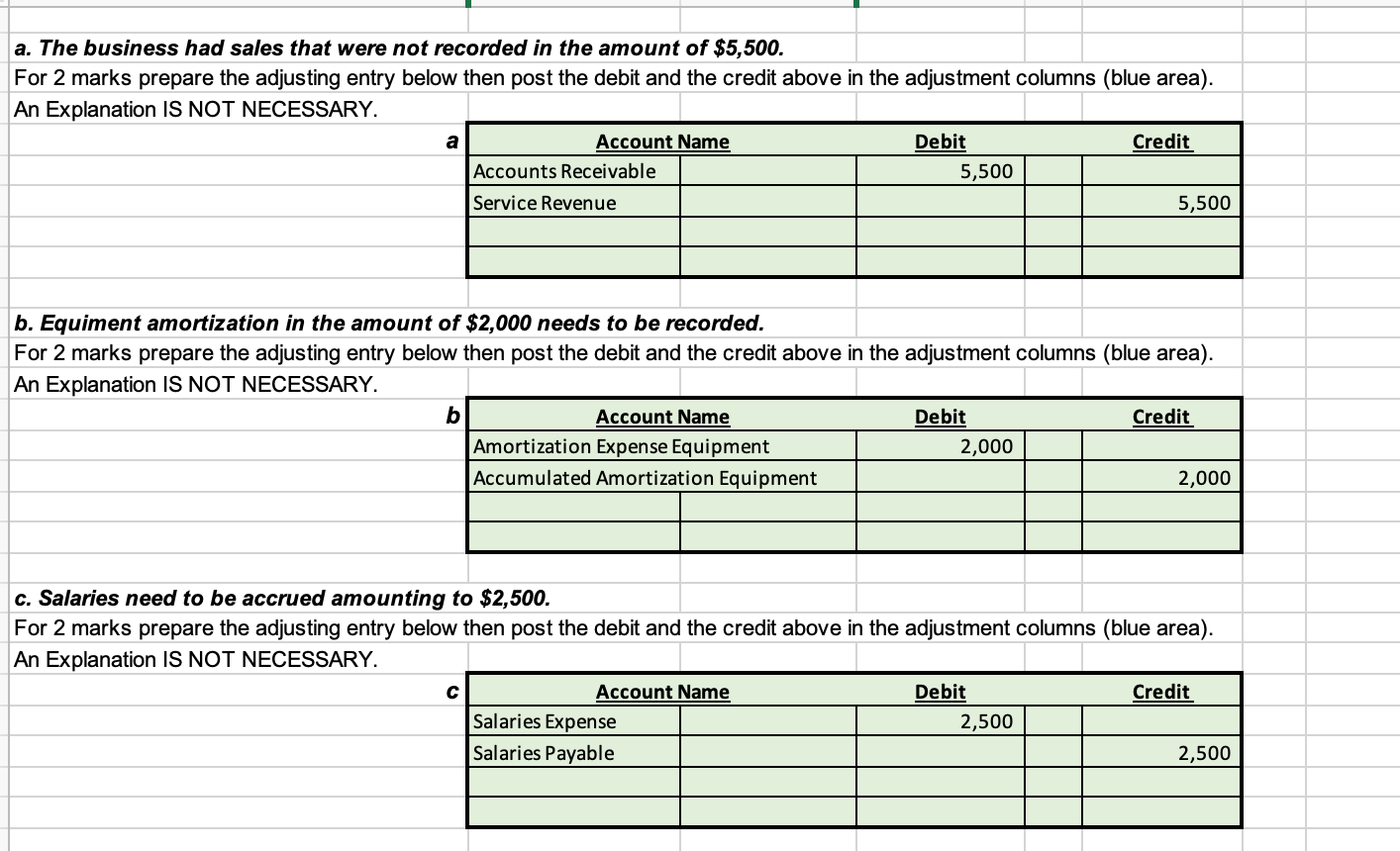

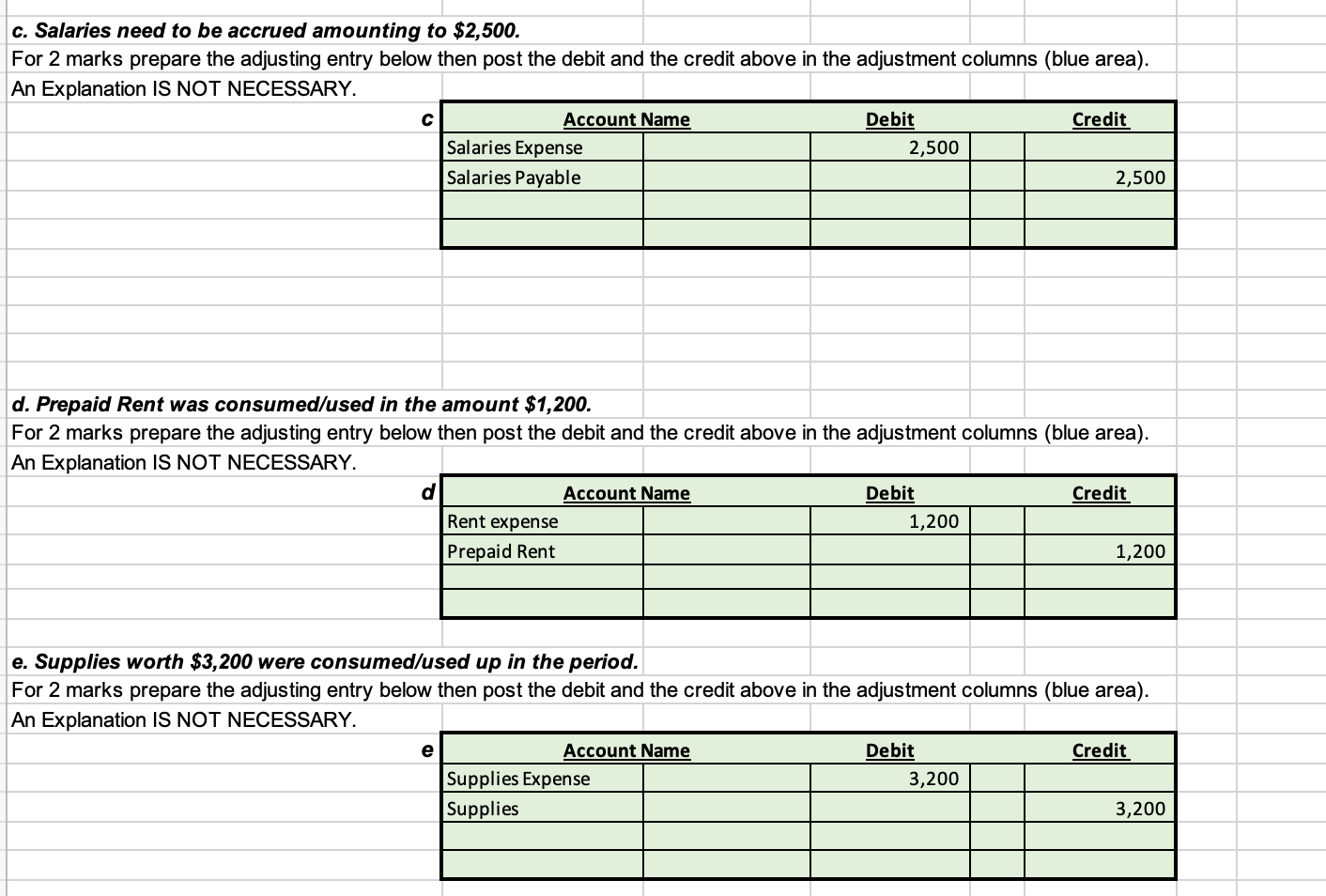

a. The business had sales that were not recorded in the amount of $5,500. For 2 marks prepare the adjusting entry below then post the debit and the credit above in the adjustment columns (blue area). An Explanation IS NOT NECESSARY. a Account Name Debit Credit Accounts Receivable 5,500 Service Revenue 5,500 b. Equiment amortization in the amount of $2,000 needs to be recorded. For 2 marks prepare the adjusting entry below then post the debit and the credit above in the adjustment columns (blue area). An Explanation IS NOT NECESSARY. b Account Name Debit Credit Amortization Expense Equipment 2,000 Accumulated Amortization Equipment 2,000 c. Salaries need to be accrued amounting to $2,500. For 2 marks prepare the adjusting entry below then post the debit and the credit above in the adjustment columns (blue area). An Explanation IS NOT NECESSARY. Account Name Debit Credit Salaries Expense 2,500 Salaries Payable 2,500 Yummy Chip Company Enter your student number first in Instructions tab or you will have brackets around all numbers Unadjusted Trial Balance at December 31, 2020 Adjusting entires for Decebmer 31, 2020 are to be entered here see below in additional info Adjusted Trial Balance for December 31, 2020 Credit Debit Letter Ref Credit Letter Ref Debit Credit $ 5,500 a) Debit 55,953.55 46,680.35 9,430.37 26,640.80 196,466.10 285,661.71 1,200 d) 3,200 e) b) 22,318.55 19,646.61 40,550.60 9,823.31 Cash Accounts Receivable Prepaid Rent Supplies Land Equipment Accumulated Amortization - Equipment Unearned Revenue Accounts Payable Note Payable (due in 5 years) Salaries Payable Lee, Capital Lee, Withdrawals Service Revenue Amortization Expense- equipment Salaries Expense Rent Expense Utilities Expense Supplies Expense Totals 2,500) 479,613.05 23,575.93 92,732.00 5,500 a) 14,145.56 2,000 b) 2,500 c) 1,200 d) 6,129.74 $ 664,684.12 $ 664,684.12 Total debits = total credits 3,200 e) 14,400 14,400 Please total these columns Please total these columns C. Salaries need to be accrued amounting to $2,500. For 2 marks prepare the adjusting entry below then post the debit and the credit above in the adjustment columns (blue area). An Explanation IS NOT NECESSARY. Account Name Debit Credit Salaries Expense 2,500 Salaries Payable 2,500 d. Prepaid Rent was consumed/used in the amount $1,200. For 2 marks prepare the adjusting entry below then ost the debit and the credit above in the adjustment columns (blue area). An Explanation IS NOT NECESSARY. d Account Name Debit Credit Rent expense 1,200 Prepaid Rent 1,200 e. Supplies worth $3,200 were consumed/used up in the period. For 2 marks prepare the adjusting entry below then post the debit and the credit above in the adjustment columns (blue area). An Explanation IS NOT NECESSARY. e Account Name Debit Credit Supplies Expense 3,200 Supplies 3,200