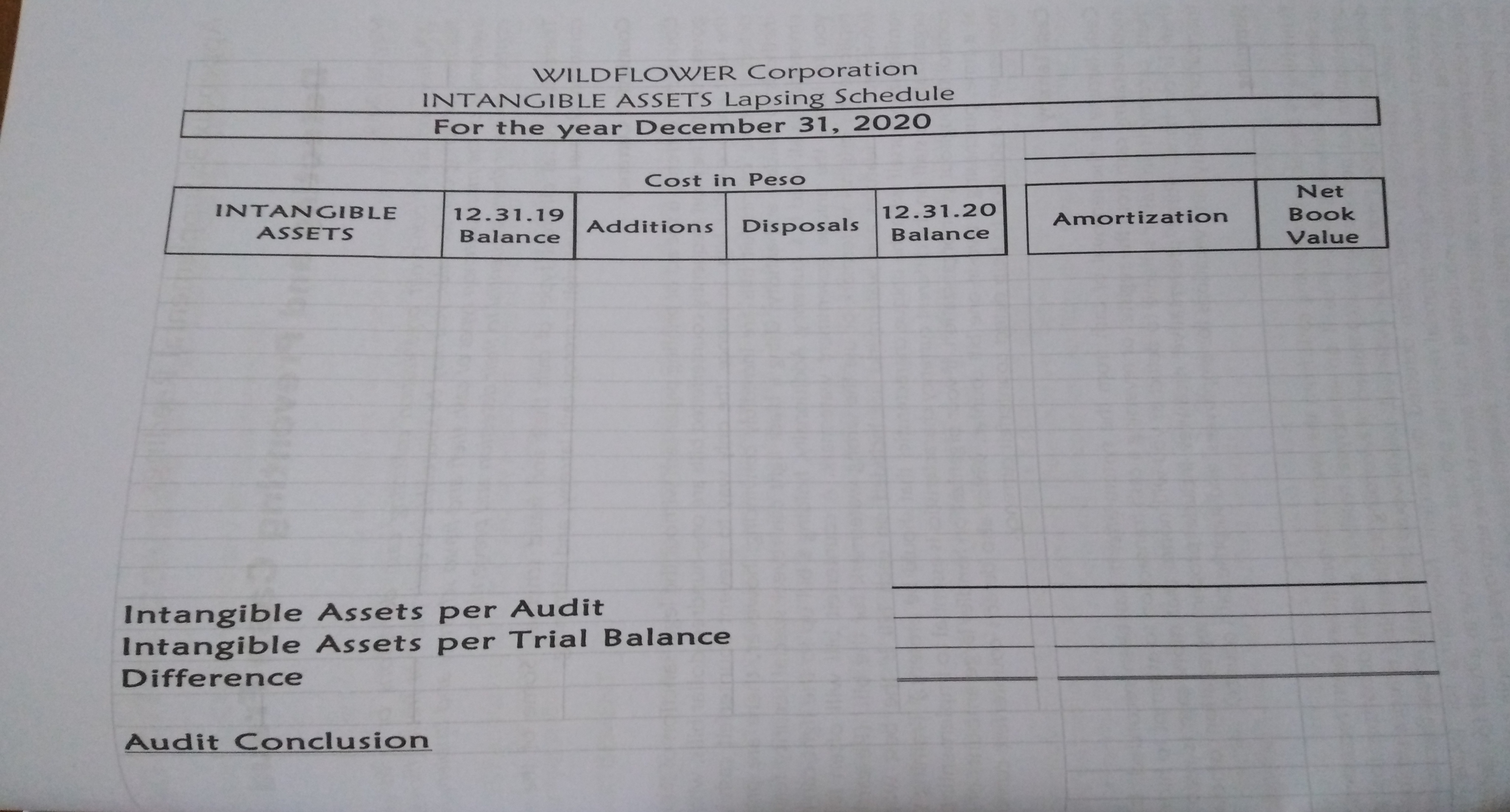

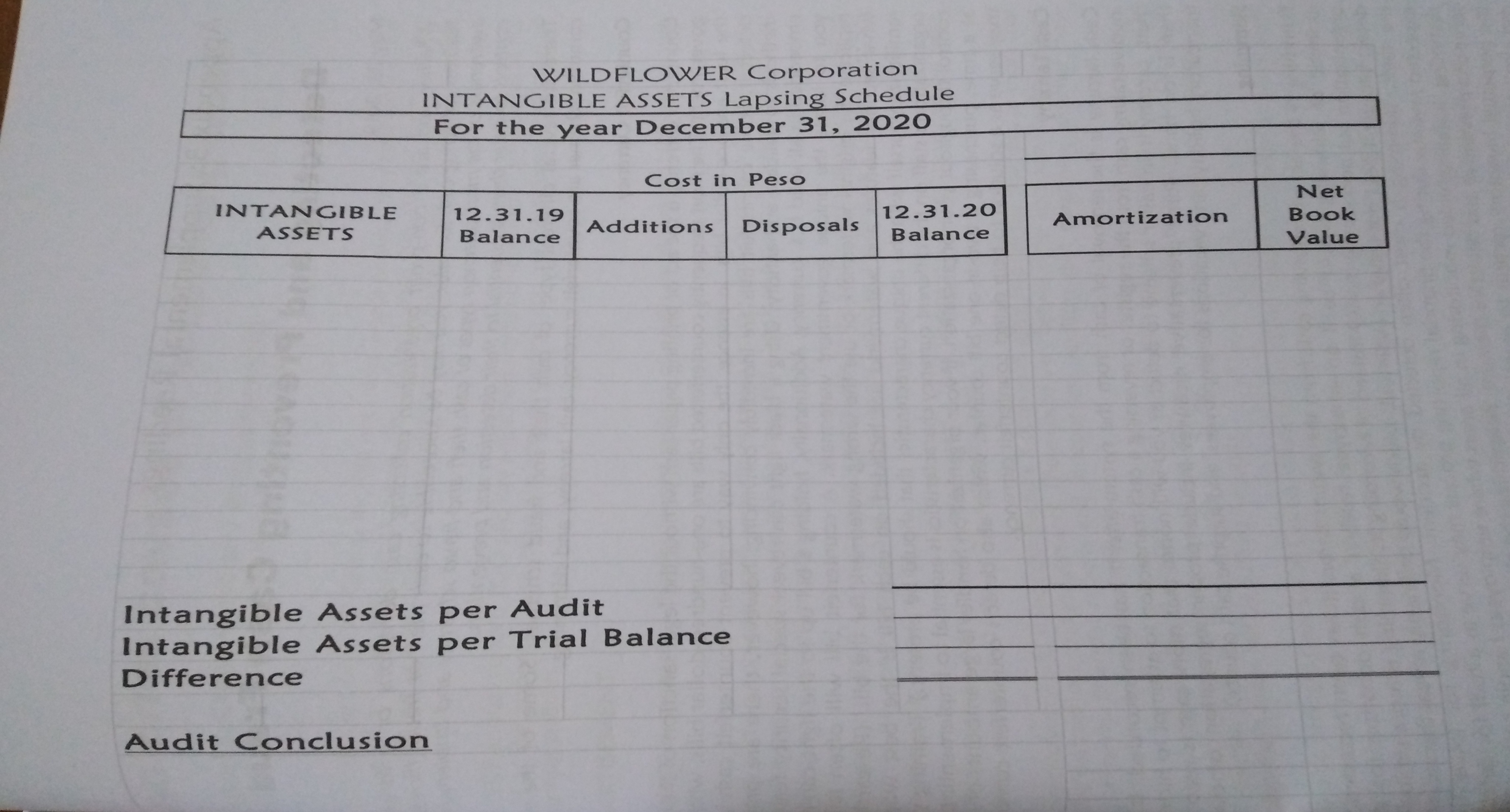

using the following information, make a Lapsing Schedule for Intangible Assets using the table on the third picture. Thank you! ???

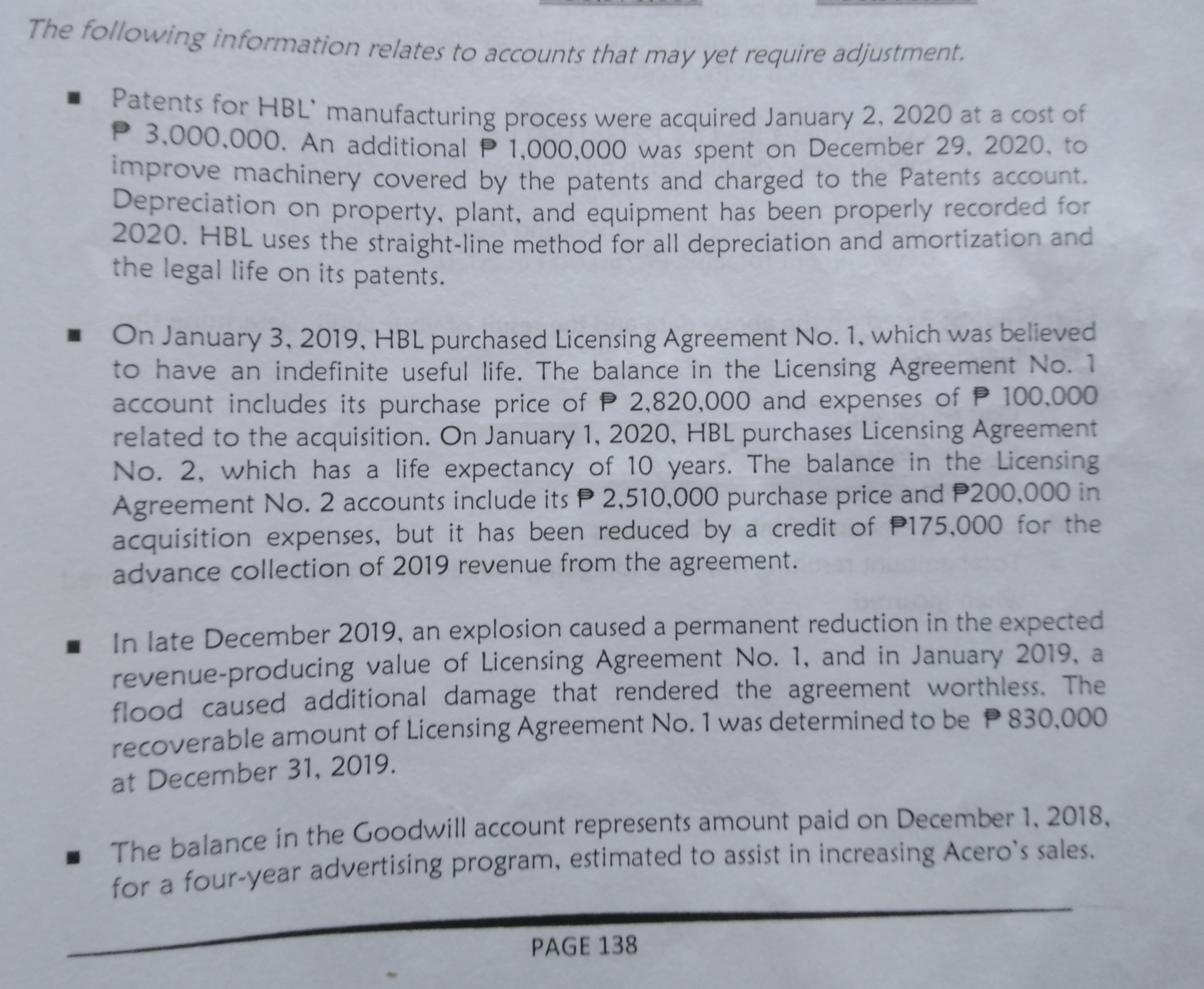

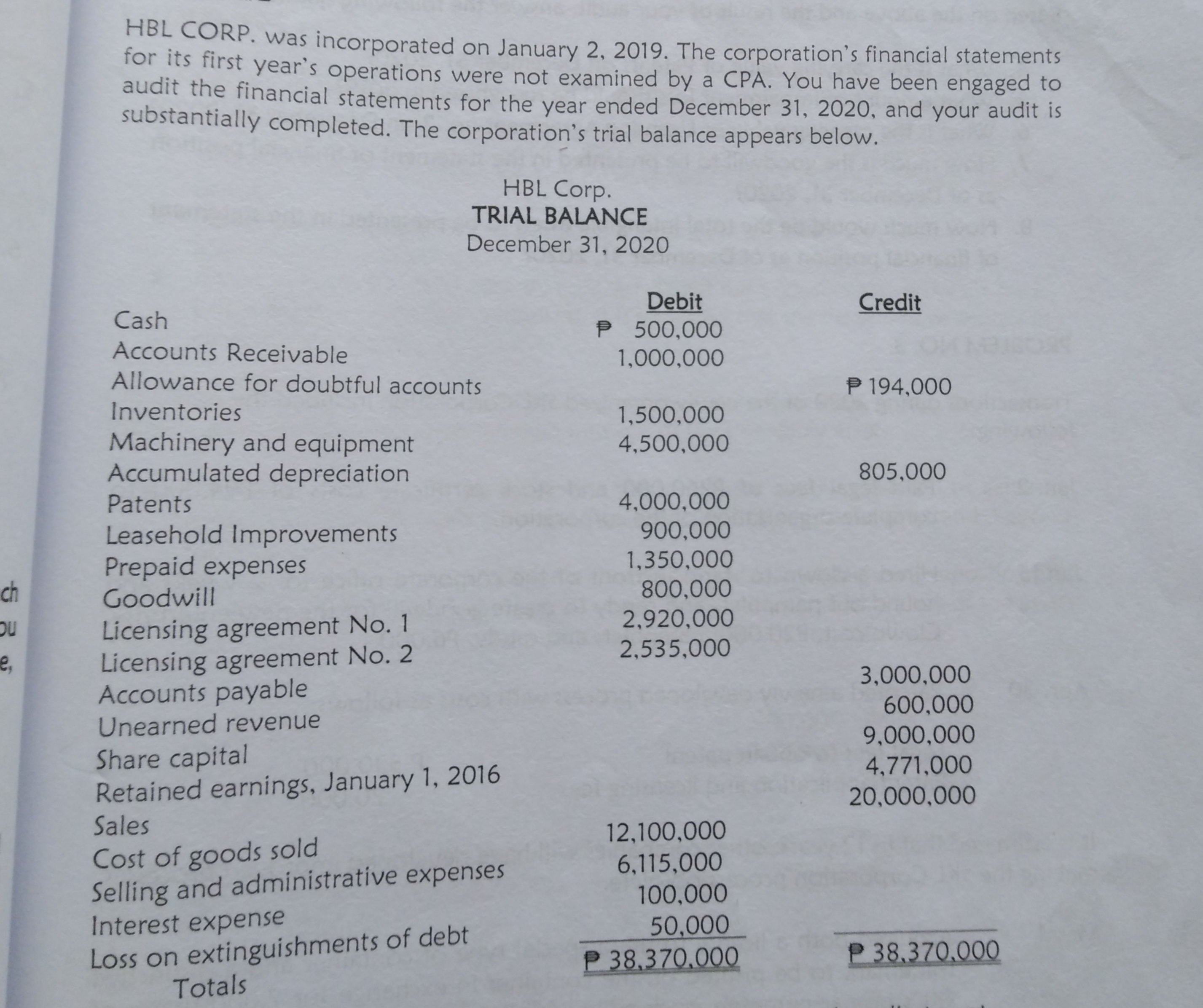

HBL CORP. was incorporated on January 2, 2019. The corporation's financial statements for its first year's operations were not examined by a CPA. You have been engaged to audit the financial statements for the year ended December 31, 2020, and your audit is substantially completed. The corporation's trial balance appears below. HBL Corp. TRIAL BALANCE December 31, 2020 Cash Debit Credit P 500,000 Accounts Receivable 1,000,000 Allowance for doubtful accounts P 194,000 Inventories 1,500,000 Machinery and equipment 4,500,000 Accumulated depreciation 805,000 Patents 4,000,000 Leasehold Improvements 900,000 Prepaid expenses 1,350,000 Goodwill 800,000 Licensing agreement No. 1 2,920,000 Licensing agreement No. 2 2,535,000 Accounts payable 3,000,000 Unearned revenue 600,000 Share capital 9,000,000 Retained earnings, January 1, 2016 4,771,000 20,000,000 Sales Cost of goods sold 12,100,000 Selling and administrative expenses 6,115,000 100,000 Interest expense Loss on extinguishments of debt 50,000 P 38,370,000 P 38.370,000 TotalsWILDFLOWER Corporation INTANGIBLE ASSETS Lapsing Schedule For the year December 31, 2020 Cost in Peso Net INTANGIBLE 12.31.19 12.31.20 ASSETS Balance Additions Disposals Amortization Book Balance Value Intangible Assets per Audit Intangible Assets per Trial Balance Difference Audit ConclusionThe following information relates to accounts that may yet require adjustment. Patents for HBL' manufacturing process were acquired January 2, 2020 at a cost of P 3,000.000. An additional P 1,000,000 was spent on December 29, 2020, to improve machinery covered by the patents and charged to the Patents account. Depreciation on property, plant, and equipment has been properly recorded for 2020. HBL uses the straight-line method for all depreciation and amortization and the legal life on its patents. On January 3, 2019, HBL purchased Licensing Agreement No. 1, which was believed to have an indefinite useful life. The balance in the Licensing Agreement No. 1 account includes its purchase price of P 2,820,000 and expenses of P 100,000 related to the acquisition. On January 1, 2020, HBL purchases Licensing Agreement No. 2, which has a life expectancy of 10 years. The balance in the Licensing Agreement No. 2 accounts include its P 2,510,000 purchase price and P200,000 in acquisition expenses, but it has been reduced by a credit of P175,000 for the advance collection of 2019 revenue from the agreement. In late December 2019, an explosion caused a permanent reduction in the expected revenue-producing value of Licensing Agreement No. 1, and in January 2019, a flood caused additional damage that rendered the agreement worthless. The recoverable amount of Licensing Agreement No. 1 was determined to be P 830,000 at December 31, 2019. The balance in the Goodwill account represents amount paid on December 1, 2018, for a four-year advertising program, estimated to assist in increasing Acero's sales. PAGE 138