using the horizontal amd vertical analysis provided answer the following questions:

Consider the current ratios and quick ratios of the case company. What trend do you notice over the 2021 - 2022 period, and what does the trend suggest about the company's liquidity position?

Investigate the accounts receivable turnover and inventory turnover of the company over the

2021 - 2022 period. What do these patterns tell you about the firm's ability to convert account receivables and inventories into cash?

Examine the debt ratios and the time interest earned ratios over the 2021 - 2022 period.

What do these patterns suggest about the firm's level of riskiness and protection for creditors?

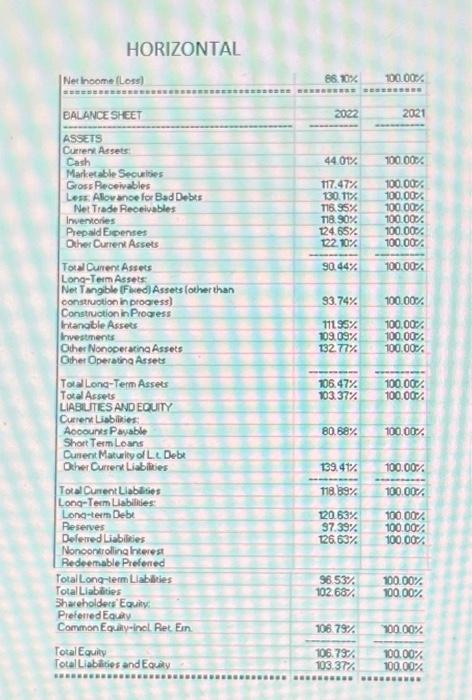

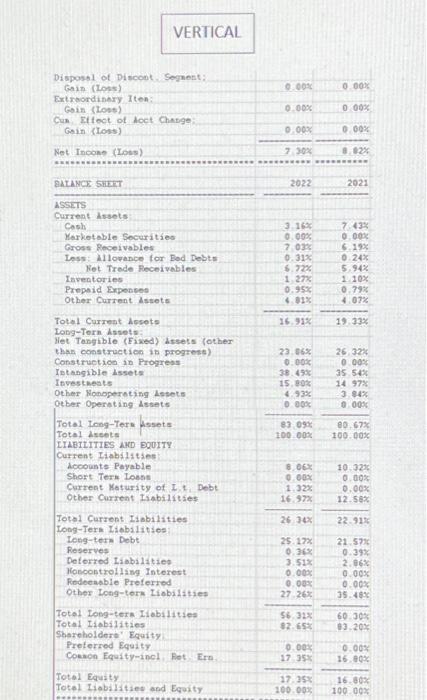

Perform the horizontal and vertical analysis over the 2021 - 2022 period to supplement your ratio analyses above. In terms of debt-paying ability, what else do you find from the horizontal and vertical analyses?

Based on your answers to all questions above, provide an overall assessment of the company's short-term and long-term debt-paying ability

HORIZONTAL \begin{tabular}{|c|c|c|} \hline & \begin{tabular}{r} 88.0% \\ =mxnn= \end{tabular} & 10000% \\ \hline & & \\ \hline CESHEET & 2022 & 2021 \\ \hline \multicolumn{3}{|l|}{ ASSETS } \\ \hline Curren A. & & \\ \hline ash & 44.01% & 100.00% \\ \hline Market & & \\ \hline Gros & 7.47% & 100.00% \\ \hline Less: Allovance for Bad Debts & 130.11% & 100% \\ \hline Net Trade Receivables & n6. 55% & 00% \\ \hline Inven: & 8.90% & 100.00% \\ \hline Prep: & 124.65% & 100.00% \\ \hline Oher Currenk Assets & E2. 10% & 100.00% \\ \hline Toralo & 14% & 100.00% \\ \hline & & \\ \hline \begin{tabular}{l} Assets (other than \\ yess) \end{tabular} & 93.74% & 00% \\ \hline & & \\ \hline & 195% & 100.00% \\ \hline & 109 & 100.00% \\ \hline inaAssets & 132. & 100.00% \\ \hline \multicolumn{3}{|l|}{ Other Operatina Assets } \\ \hline=1 & & 100.00% \\ \hline To & 10337% & 100.00% \\ \hline NDEQUITY & & \\ \hline \multicolumn{3}{|l|}{ Curtent Libbities: } \\ \hline nsp Payable & 80.68% & 100.00% \\ \hline \multirow{2}{*}{\multicolumn{3}{|c|}{\begin{tabular}{l} Aocounks Payable \\ Short TermLoans \\ Qunent Maturity of LC Debe \end{tabular}}} \\ \hline \multirow{2}{*}{\multicolumn{3}{|c|}{\begin{tabular}{l} Qunent Maturity of LC Debe \\ Oher Curterk Liablities \end{tabular}}} \\ \hline & & \\ \hline & 118. 69% & 100.00% \\ \hline \multicolumn{3}{|l|}{ Lona-Te } \\ \hline & & 100.00% \\ \hline= & & 100.00% \\ \hline Defered Liabilies & 126. & 100.00% \\ \hline Nonoonisoling hkerest & & \\ \hline - Prefened & & \\ \hline \multicolumn{3}{|l|}{ Total Lona-term Liabllies } \\ \hline & 102 & 100.00% \\ \hline & & cos \\ \hline \multicolumn{3}{|l|}{\begin{tabular}{l} Preferled Equay \\ Common Equiry-inol Ret Ein. \end{tabular}} \\ \hline Common Equiry-inol Ret Ein. & 106.79% & 10000% \\ \hline & & 0% \\ \hline & 103.37% & 00% \\ \hline & & \\ \hline \end{tabular} VERTICAL Dispossl of Discont. Segnent: Gain (Loss) 0.008 0.006 Goin (toot) n ner C tow Cun zitect of loct Chasge Goin (Loss) 0,00x 0.00% Net Incoin (Iows) 720x BATANCX SHDT 2022 2021 \begin{tabular}{|c|c|c|} \hline ASsets & & \\ \hline \multicolumn{3}{|l|}{ Current dsocts } \\ \hline Cosh & 3.16x & 7432 \\ \hline Kerketable Securities & 0.005 & 0.008 \\ \hline Gross Roceivables & 7.03x & 6.19x \\ \hline Less: Illowance for Bed Debts & 0.31x & 0.24% \\ \hline Net Trede Receivables: & 6.72% & 5,94% \\ \hline Inventories & 1.27x & 1.10x \\ \hline Prepoid Exponces & 0.95% & 0.79% \\ \hline Other Current Issets & 4.01x & 4.07% \\ \hline Total Curreat Assets & 16,912 & 19,33% \\ \hline \multirow{2}{*}{\multicolumn{3}{|c|}{\begin{tabular}{l} Long-Torn dssets: \\ liet Tongible (Eixed) dssets fother \end{tabular}}} \\ \hline & & \\ \hline & 23.86% & 26,324 \\ \hline Construetico in Progress & 0.0015 & 0.00% \\ \hline Intangible issets & 38.49a & 35.546 \\ \hline Investrests & 15,804 & 1497% \\ \hline Other Nonoperoting Lspets & 4.936 & \\ \hline Qtber Operating dssets & 0.000 & 0.0085 \\ \hline Totel Iong-Ter: hoset: & 83,098 & 80.67x \\ \hline Totel iseots & 100.008 & 100.00x \\ \hline \multicolumn{3}{|l|}{ LIABILITIES AKD BQUITY } \\ \hline \multicolumn{3}{|l|}{ Current Ilabilities: } \\ \hline docounte Peyable & 8.06x & 10.32% \\ \hline Short Tern Loest & 0.00x & 0.00% \\ \hline Current Moturity of I, 2 , Debt & 1,32x & 0.00x \\ \hline Other Current Iinbilitises & 16.977 & 12.58x \\ \hline Fotal Current Iinbilities & 2636x & 22.911 \\ \hline \multicolumn{3}{|l|}{ Long-Iers Liabilitios: } \\ \hline Long-ters Debt & 25.17x & 21.57x \\ \hline Reserves: & 0,36% & 0.39x \\ \hline Detorred Liabilities & 3.518 & 2.06x \\ \hline Koecontrolling Interest & 0.008 & 0.00x \\ \hline Redecanble Preferred. & 0,00x & 0.00x \\ \hline Other Long-tork Liobilities & 27.26% & 35.484 \\ \hline Totel Lopg-tera Iiabilities & 56,32x & 60.008 \\ \hline Total Iiabilities & 92.658 & 03.20x \\ \hline \multicolumn{3}{|l|}{ Shereholdere' Equity } \\ \hline Preteried Equity & 0.005 & 0.009 \\ \hline Coenon Equity-inol, Ret, Ern. & 17,35 & 16.00% \\ \hline Total Equity & 17.35x & \\ \hline Totel Iiabilities and Equity & 200,003 & 100.00x \\ \hline \end{tabular}