Using the info from exercise 5.12 I need the minimum variance line parameterised by the expected retuemw=ua+b

using exercise 5.12 find the minimum variance line parameterised by the expected return w=ua+b. Zoom in on pictures if needed

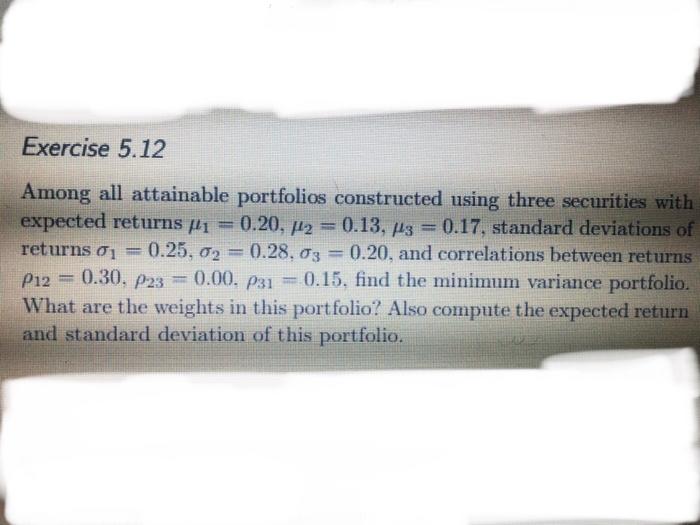

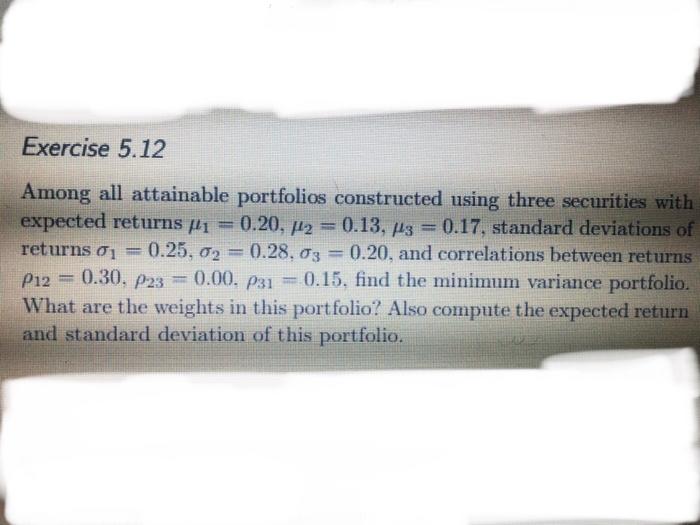

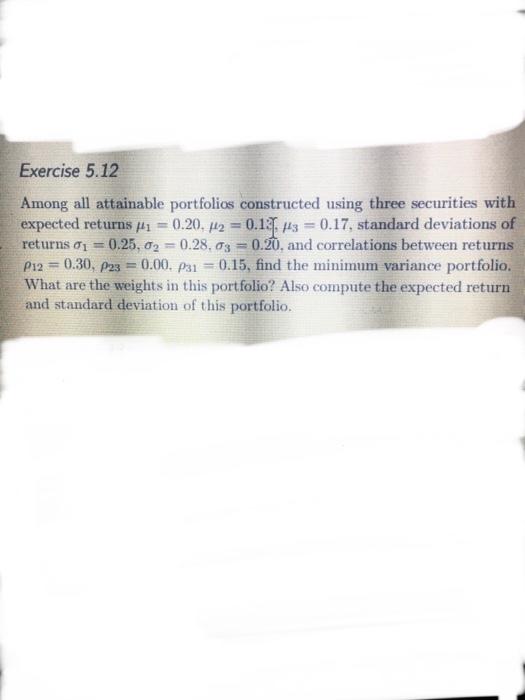

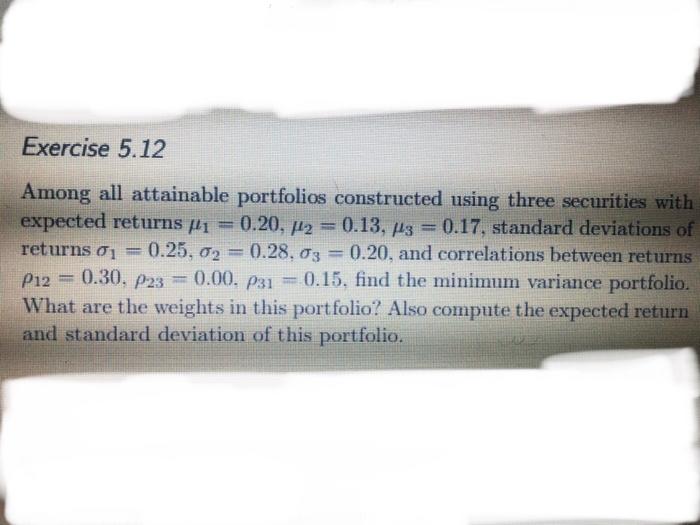

Exercise 5.12 Among all attainable portfolios constructed using three securities with expected returns #1 = 0.20, 42 = 0.125, 13 = 0.17, standard deviations of returns 01 = 0.25, 02 = 0.28, 03 = 0.20, and correlations between returns P12 = 0.30, P23 = 0.00. P31 = 0.15, find the minimum variance portfolio. What are the weights in this portfolio? Also compute the expected return and standard deviation of this portfolio (10 pts) For portfolios constructed with and without short selling from the three securities in Exercise 3.11, page 73, compute the minimum variance line parameterised by the expected return w = a +b. Exercise 5.12 Among all attainable portfolios constructed using three securities with expected returns pli = 0.20, 12 = 0.13, H3 = 0.17, standard deviations of returns 01 0.25, 02 = 0.28.03 0.20, and correlations between returns P12 = 0.30. P23 = 0.00. P31 = 0.15, find the minimum variance portfolio. What are the weights in this portfolio? Also compute the expected return and standard deviation of this portfolio. (10 pts) For portfolios constructed with and without short selling from the three securities in Exercise 3.11, page 73, compute the minimum variance line parameterised by the expected return w = pa+b. Exercise 5.12 Among all attainable portfolios constructed using three securities with expected returns #1 = 0.20, 42 = 0.125, 13 = 0.17, standard deviations of returns 01 = 0.25, 02 = 0.28, 03 = 0.20, and correlations between returns P12 = 0.30, P23 = 0.00. P31 = 0.15, find the minimum variance portfolio. What are the weights in this portfolio? Also compute the expected return and standard deviation of this portfolio (10 pts) For portfolios constructed with and without short selling from the three securities in Exercise 3.11, page 73, compute the minimum variance line parameterised by the expected return w = a +b. Exercise 5.12 Among all attainable portfolios constructed using three securities with expected returns pli = 0.20, 12 = 0.13, H3 = 0.17, standard deviations of returns 01 0.25, 02 = 0.28.03 0.20, and correlations between returns P12 = 0.30. P23 = 0.00. P31 = 0.15, find the minimum variance portfolio. What are the weights in this portfolio? Also compute the expected return and standard deviation of this portfolio. (10 pts) For portfolios constructed with and without short selling from the three securities in Exercise 3.11, page 73, compute the minimum variance line parameterised by the expected return w = pa+b