Answered step by step

Verified Expert Solution

Question

1 Approved Answer

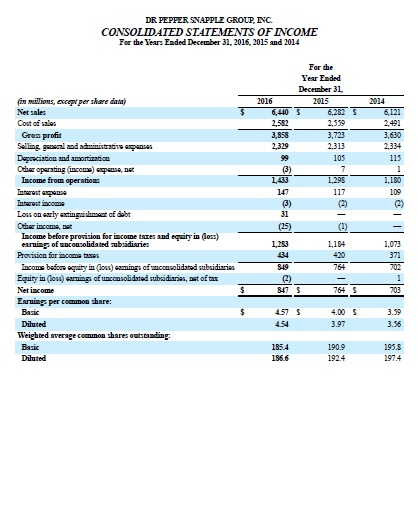

Using the information above identify the amount for the following for the year 2016: Sale revenue- Cost of Goods Sold- Operating Expenses- Profits after Taxes-

Using the information above identify the amount for the following for the year 2016:

Sale revenue-

Cost of Goods Sold-

Operating Expenses-

Profits after Taxes-

Interest-

Total Assets-

Total Stockholder's Equity-

Long Term Debt-

Number of Shares of Common Stock Outstanding-

Current Assets-

Current Liabilities-

Total Debt-

Operating Income-

Interest Expenses-

Inventory-

Accounts Receivable-

Total Sales-

Average Daily Sales-

Annual Dividends per Share-

Current Market Price Per Share-

Earnings Per Share-

After Tax Profits-

Depreciation-

Capital Expenditures-

Dividends-

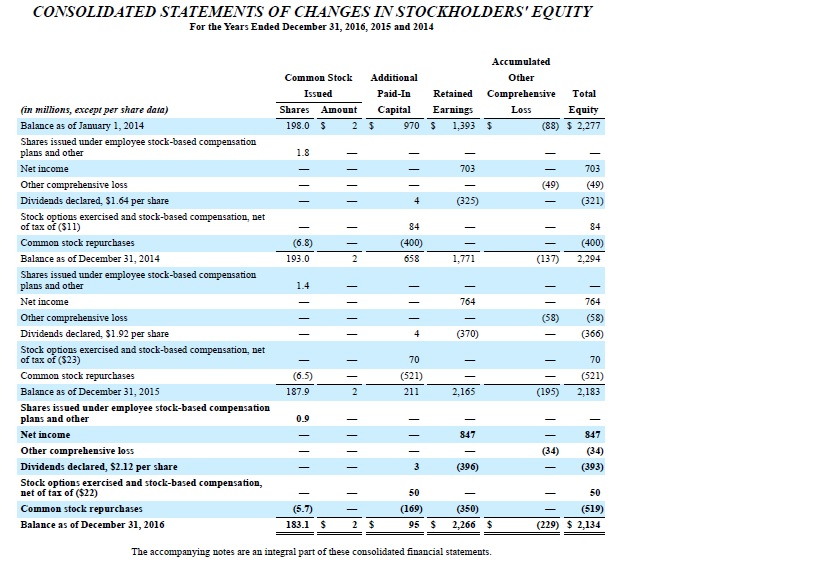

CONSOLIDATED STATEMENTS OF CHANGES INSTOCKHOLDERS' EQUITY For the Years Ended December 31, 2016, 2015 and 2014 Accumulated Common Stock Additional Issued Paid-In Shares Amount Capita Ernings 970 1,393 Retained Comprehensive Total Equity (83) 2,277 Loss in millions, except per share data) Balance as of January 1, 2014 Shares issued under employee stock-based compensation plans and other Net income Other comprehensive loss Dividends declared, $1.64 per share Stock options exercised and stock-based compensation, net of tax of (S11) Common stock repurchases Balance as of December 31, 2014 Shares issued under employee stock-based compensation plans and other Net income Other comprehensive loss Dividends declared, $1.92 per share Stock options exercised and stock-based compensation, net 198.0 S 1.8 703 703 (49) (49) (321) (325) 84 (400) 658 84 - (400) (137) 2,294 193.0 1,771 (58) (58) (366) (370) of tax of ($23) Common stock repurchases Balance as of December 31, 2015 Shares issued under employee stock-based compensation plans and other Net incone Other comprehensive loss Dividends declared, $2.12 per share Stock options exercised and stock-based compensation, net of ta of ($22) Common stock repurchases Balance as of December 31, 2016 70 (6.5) 187.9 70 - (521) (195) 2,183 (521) 2,165 0.9 847 (34) (34) (393) 847 50 50 (5.7) 183.1 $ 2 $ -- (519) (229) 2,134 (169) 95 2,266 $ The accompanying notes are an integral part of these consolidated financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started