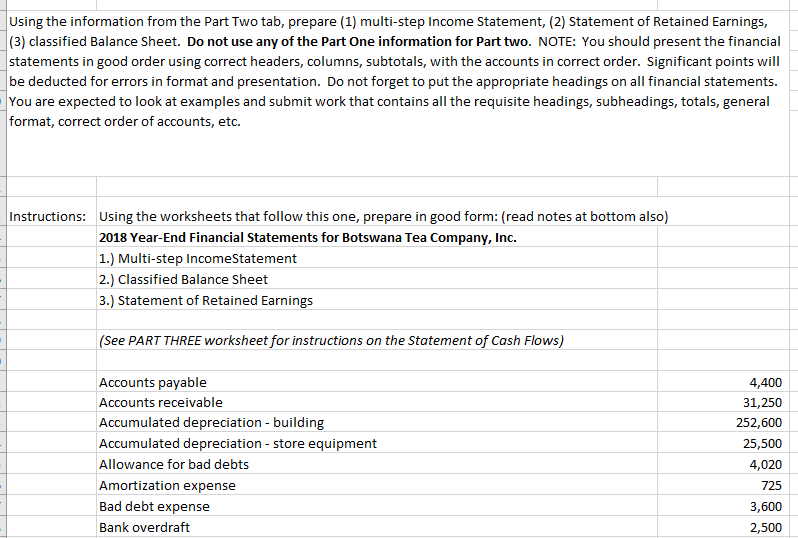

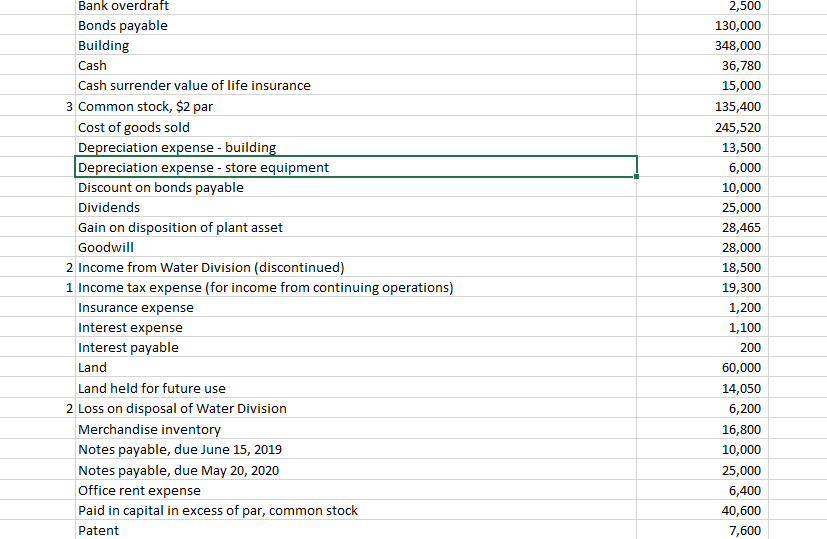

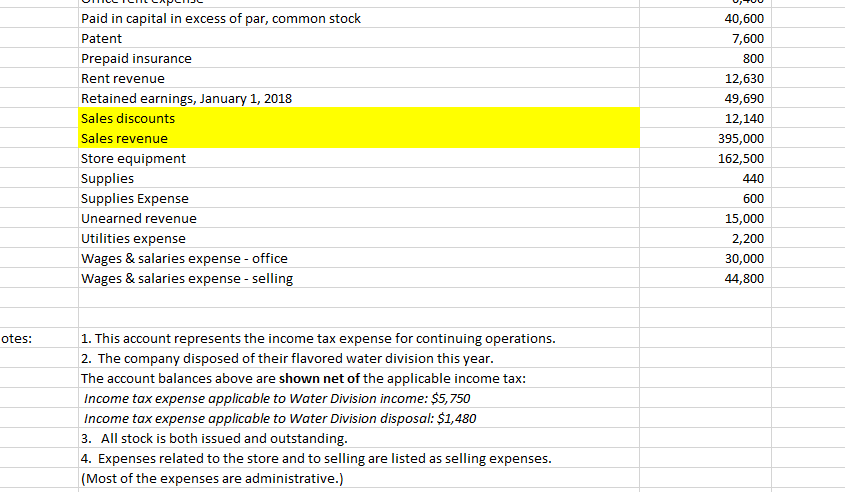

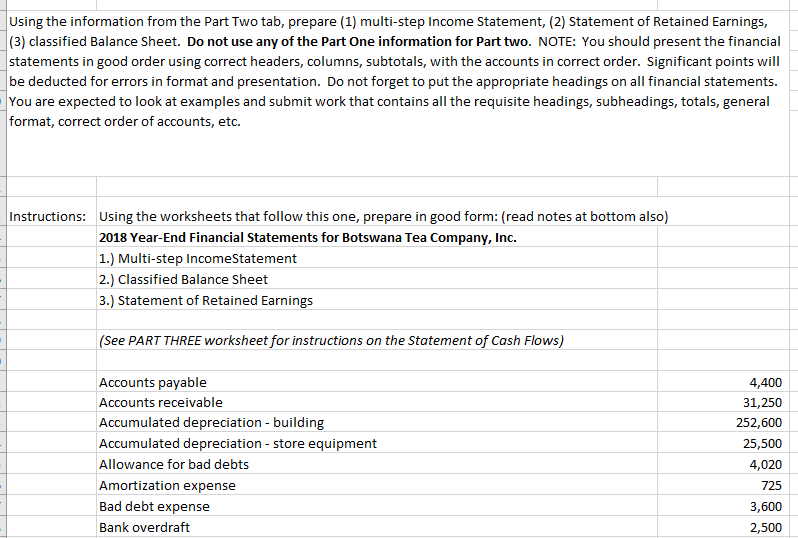

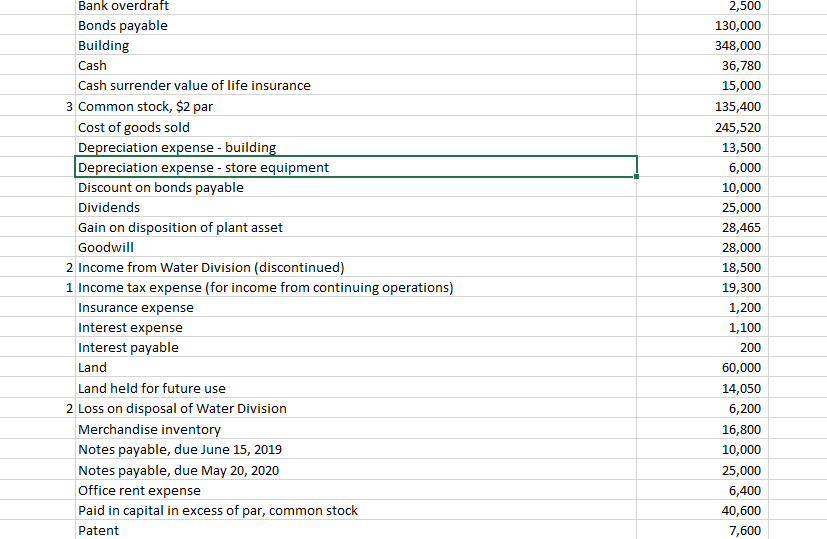

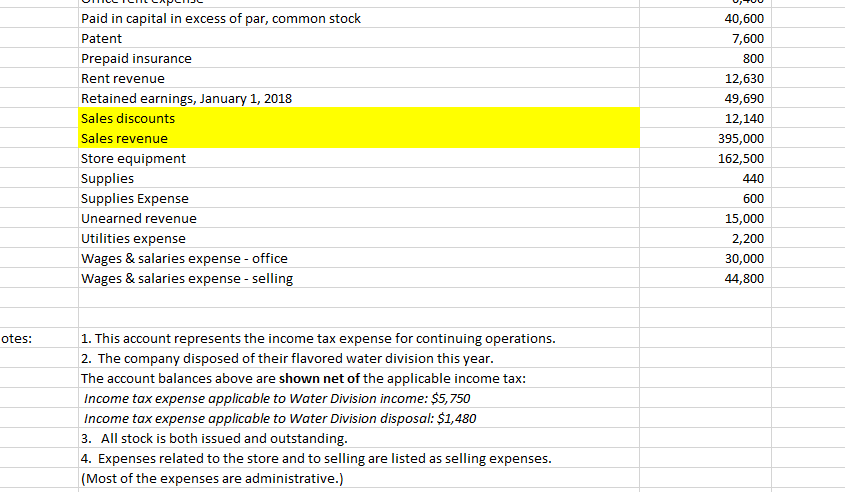

Using the information from the Part Two tab, prepare (1) multi-step Income Statement, (2) Statement of Retained Earnings (3) classified Balance Sheet. Do not use any of the Part One information for Part two. NOTE: You should present the financial statements in good order using correct headers, columns, subtotals, with the accounts in correct order. Significant points will be deducted for errors in format and presentation. Do not forget to put the appropriate headings on al financial statements. You are expected to look at examples and submit work that contains all the requisite headings, subheadings, totals, general format, correct order of accounts, etc. Using the worksheets that follow this one, prepare in good form: (read notes at bottom also) 2018 Year-End Financial Statements for Botswana Tea Company, Inc. 1.) Multi-step IncomeStatement 2.) Classified Balance Sheet 3.) Statement of Retained Earnings Instructions: (See PART THREE worksheet for instructions on the Statement of Cash Flows) Accounts payable Accounts receivable Accumulated depreciation - building Accumulated depreciation - store equipment Allowance for bad debts Amortization expense Bad debt expense Bank overdraft 4,400 31,250 252,600 25,500 4,020 725 3,600 2,500 Paid in capital in excess of par, common stock Patent Prepaid insurance Rent revenue Retained earnings, January 1, 2018 Sales discounts Sales revenue Store equipment Supplies Supplies Expense Unearned revenue Utilities expense Wages & salaries expense office Wages & salaries expense selling 40,600 7,600 800 12,630 49,690 12,140 395,000 162,500 440 600 15,000 2,200 30,000 44,800 otes 1. This account represents the income tax expense for continuing operations he company disposed of their flavored water division this year The account balances above are shown net of the applicable income tax: Income tax expense applicable to Water Division income: $5,750 Income tax expense applicable to Water Division disposal: 1,480 3. All stock is both issued and outstanding 4. Expenses related to the store and to selling are listed as selling expenses (Most of the expenses are administrative.)