Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the information in case no. 1, prepare unadjusted trial balance of Ahmeds IT consulting firm. Answer all the cases. Case 1 Ahmed was studying

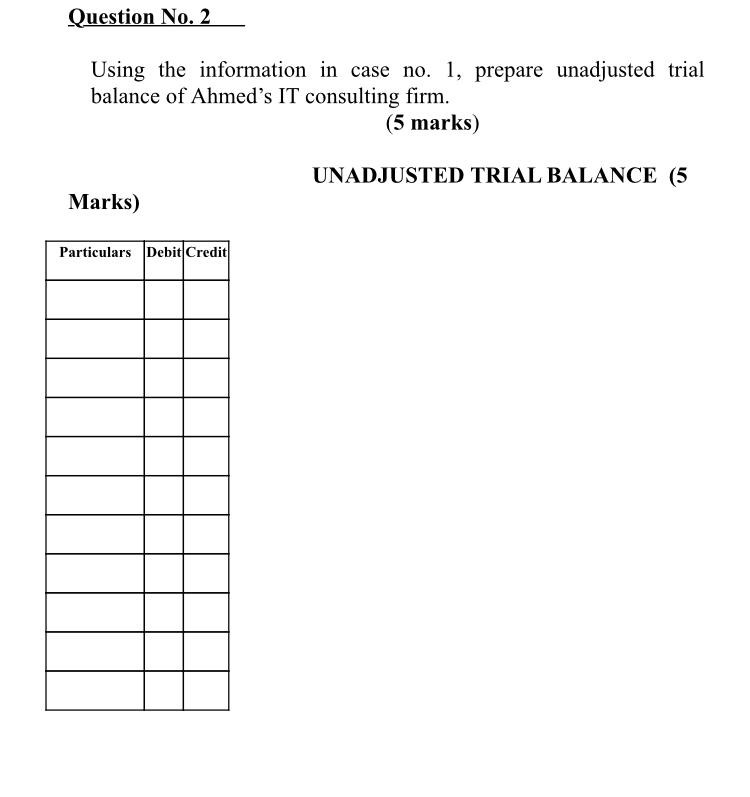

Using the information in case no. 1, prepare unadjusted trial balance of Ahmeds IT consulting firm.

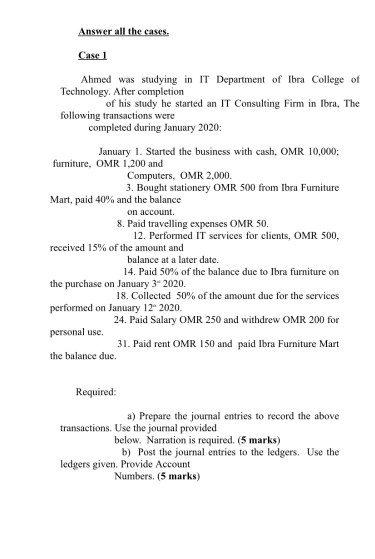

Answer all the cases. Case 1 Ahmed was studying in IT Department of Ibra College of Technology. After completion of his study he started an IT Consulting Firm in Ibra, The following transactions were completed during January 2020: January 1. Started the business with cash, OMR 10.000; furniture, OMR 1.200 and Computers, OMR 2,000. 3. Bought stationery OMR 500 from Ibra Furniture Mart, paid 40% and the balance on account. 8. Paid travelling expenses OMR 50. 12. Performed IT services for clients, OMR 500, received 15% of the amount and balance at a later date. 14. Paid 50% of the balance due to Ibra furniture on the purchase on January 3 2020. 18. Collected 50% of the amount due for the services performed on January 12 2020. 24. Paid Salary OMR 250 and withdrew OMR 200 for personal use. 31. Paid rent OMR 150 and paid Ibra Furniture Mart the balance due Required: a) Prepare the journal entries to record the above transactions. Use the journal provided below. Narration is required. (5 marks) b) Post the journal entries to the ledgers. Use the ledgers given. Provide Account Numbers, (5 marks) Question No. 2 Using the information in case no. 1, prepare unadjusted trial balance of Ahmed's IT consulting firm. (5 marks) UNADJUSTED TRIAL BALANCE (5 Marks) Particulars Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started