Answered step by step

Verified Expert Solution

Question

1 Approved Answer

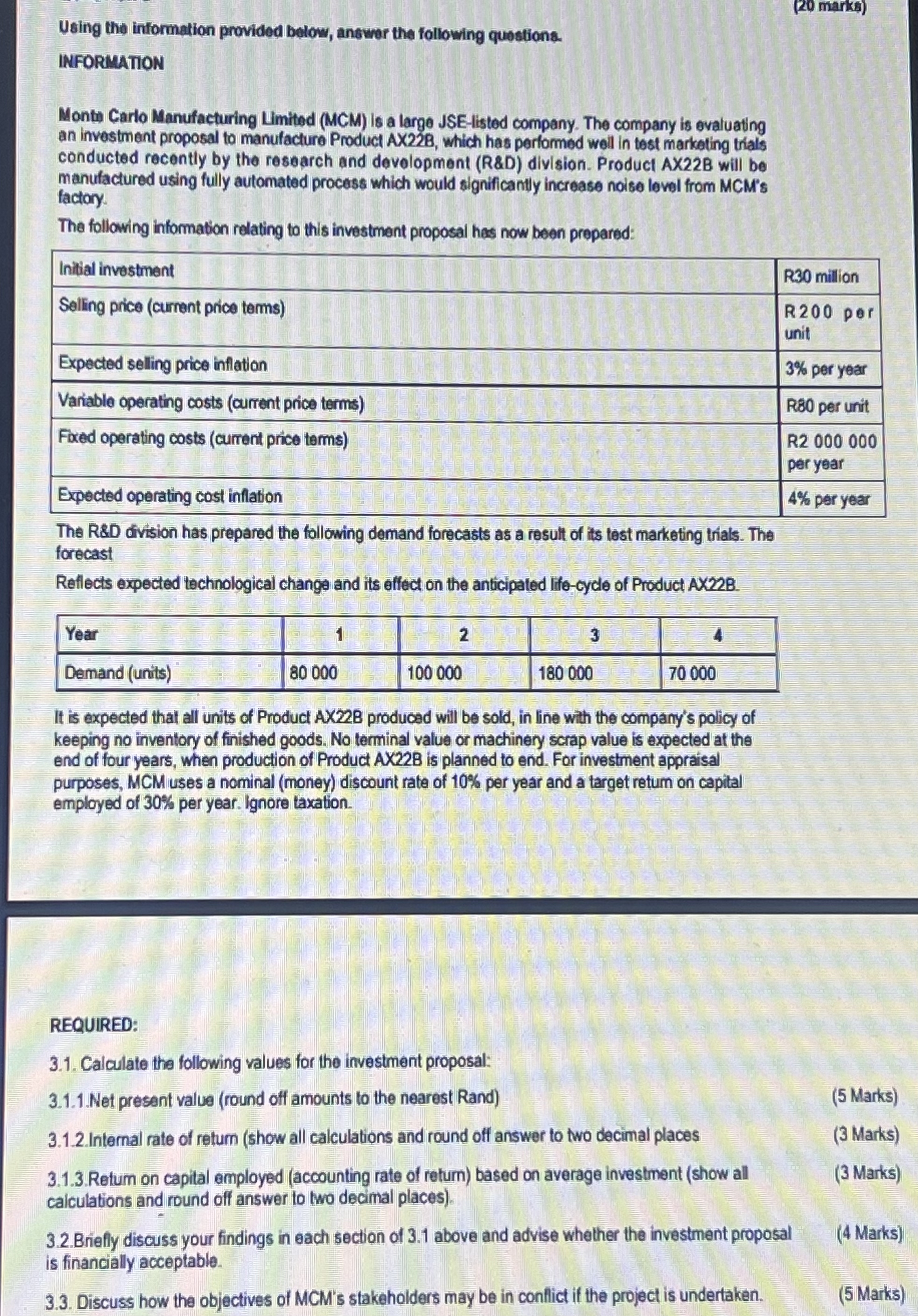

Using the information provided betow, answer the following questions. ( 2 0 marks ) INFORMATION Monts Carlo Manufacturing Limited ( MCM ) is a large

Using the information provided betow, answer the following questions.

marks

INFORMATION

Monts Carlo Manufacturing Limited MCM is a large JSElisted company. The company is evaluating an investment proposal to manufacture Product AX which has performed weil in test marketing trials conducted recently by the research and development R&D division. Product AXB will be manufactured using fully automated process which would significantly increase noise level from MCMs factory.

The following information relating to this investment proposal has now been prepared:

tableInitial investment,R millionSelling price current price termstableR perunitExpected selling price inflation, per yearVariable operating costs current price termsR per unitFixed operating costs current price termstableRper yearExpected operating cost inflation, per year

The R&D division has prepared the following demand forecasts as a result of its test marketing trials. The forecast

Reflects expected technological change and its effect on the anticipated lifecycle of Product AXB

tableYearDemand units

It is expected that all units of Product AXB producad will be sold, in line with the company's policy of keeping no inventory of finished goods. No terminal value or machinery scrap value is expected at the end of four years, when production of Product AXB is planned to end. For investment appraisal purposes, MCM uses a nominal money discount rate of per year and a target retum on capital employed of per year. Ignore taxation.

REQUIRED:

Calculate the following values for the investment proposal:

Net present value round off amounts to the nearest Rand

Marks

Internal rate of retum show all calculations and round off answer to two decimal places

Marks

Retum on capital employed accounting rate of return based on average investment show all

Marks

calculations and round off answer to two decimal places

Briefly discuss your findings in each section of above and advise whether the investment proposal

Marks

is financially acceptable.

Discuss how the objectives of MCMs stakeholders may be in conflict if the project is undertaken.

Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started