Answered step by step

Verified Expert Solution

Question

1 Approved Answer

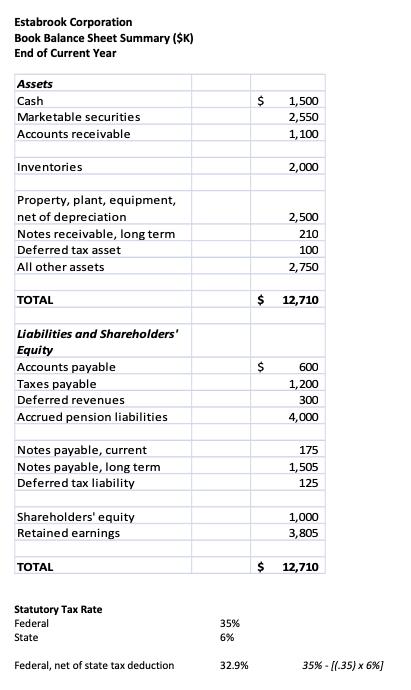

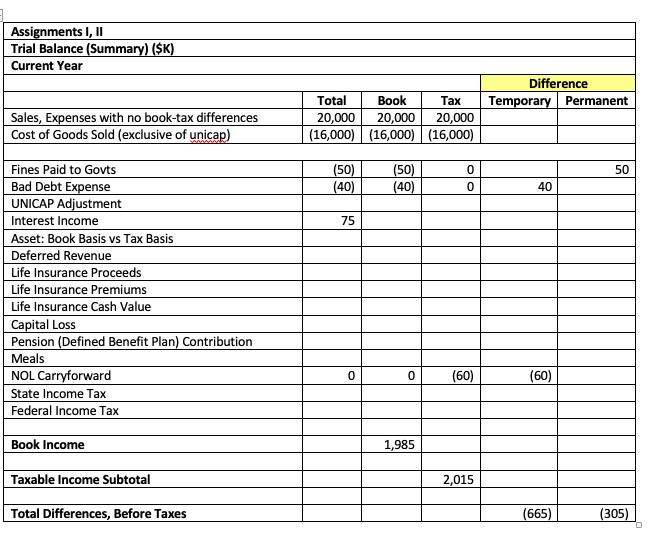

Using the information provided, compute book income before taxes for Estabrook. Identify and measure Estabrooks booktax differences. Classify each of the booktax differences as temporary

Using the information provided, compute book income before taxes for Estabrook.

Identify and measure Estabrook’s book‐tax differences. Classify each of the book‐tax differences as temporary or permanent.

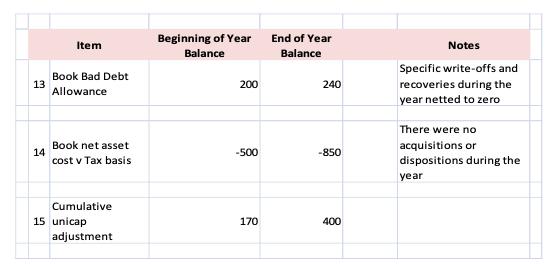

1. Estabrook's truck drivers were responsible for $50 in speeding tickets, all of which the company paid during the current year. 2. The interest income was received from bonds issued by ExxonMobil ($30) and the City of Charleston ($45). 3. The Deferred Revenue account was established because Estabrook received full payment this year on a contract for services, one-half of which Estabrook will perform next year, and one-half of which it will perform the following year. 4. Estabrook holds life insurance policies on its five officers. Activity concerning these policies this year included the following. Proceeds collected, due to death of VP-Operations Premiums paid, all policies Increase in cash surrender value, all policies 500 200 45 5. Estabrook sold some of its marketable securities, held as a capital asset per a previous IRS audit settlement, at a $75 loss. 6. Estabrook contributed $1,000 to its defined benefit retirement plans, but due to carryovers $1,750 qualified for an income tax deduction in the current year. 7. Estabrook's tax department reported a $70 total of documented expenses for meals. 8. Estabrook holds a $60 NOL carryforward, for both state and federal purposes. 9. Estabrook has elected to forego any federal NOL carryback. None of the states in which Estabrook holds an NOL allows a carryback at this time. 10. Estabrook accrued a current-year tax expense of $1,000 federal and $200 state. 11. Statutory tax rates for Estabrook are 35% federal and 6% for the states (blended). Thus, if needed, the applicable federal tax rate net of the state tax deduction is 32.9 percent. Unless otherwise noted, state income tax laws piggyback onto federal income tax provisions in all states in which Estabrook has nexus. None of the states with which Estabrook has nexus allows a deduction for book federal income tax expense. 12. There are no enacted state or federal income tax rate changes that apply to Estabrook. Other balance sheet data follow.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Using the information Compute Income before taxes bask Speeding ticket 50 Bond Incomo 30 43 7...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started