Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the information provided for Mundl Services, journalize the transactions completed during August of the current year. Aug 1 3 4 5 11 12 15

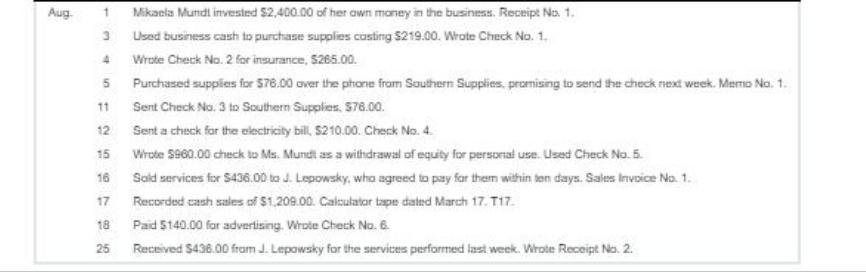

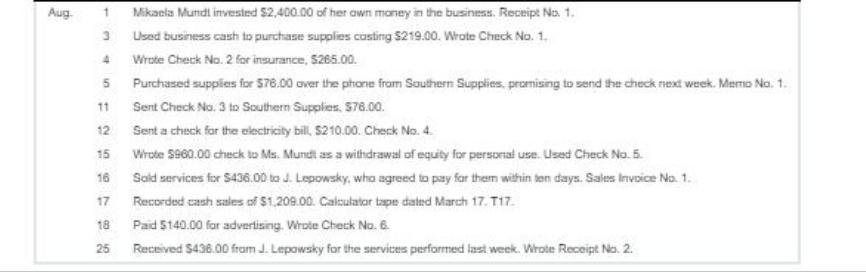

Using the information provided for Mundl Services, journalize the transactions completed during August of the current year.

Aug 1 3 4 5 11 12 15 16 17 18 25 Mikaela Mundt invested $2,400.00 of her own money in the business. Receipt No. 1. Used business cash to purchase supplies casting $219.00. Wrote Check No. 1. Wrote Check No. 2 for insurance, $265.00. Purchased supplies for $76.00 over the phone from Southern Supplies, promising to send the check next week. Memo No. 1. Sent Check No. 3 to Southern Supplies. $76.00. Sent a check for the electricity bill, $210.00. Check No. 4. Wrote $960.00 check to Ms. Mundt as a withdrawal of equity for personal use. Used Check No. 5. Sold services for $436.00 to J. Lepowsky, who agreed to pay for them within ten days. Sales Invoice No. 1. Recorded cash sales of $1,209.00. Calculator tape dated March 17. T17. Paid $140.00 for advertising. Wrote Check No. 6. Received $438.00 from J. Lepowsky for the services performed last week. Wrote Receipt No. 2.

Step by Step Solution

★★★★★

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To journalize the transactions completed during August of the current year for Mundl Services we wil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started