Question

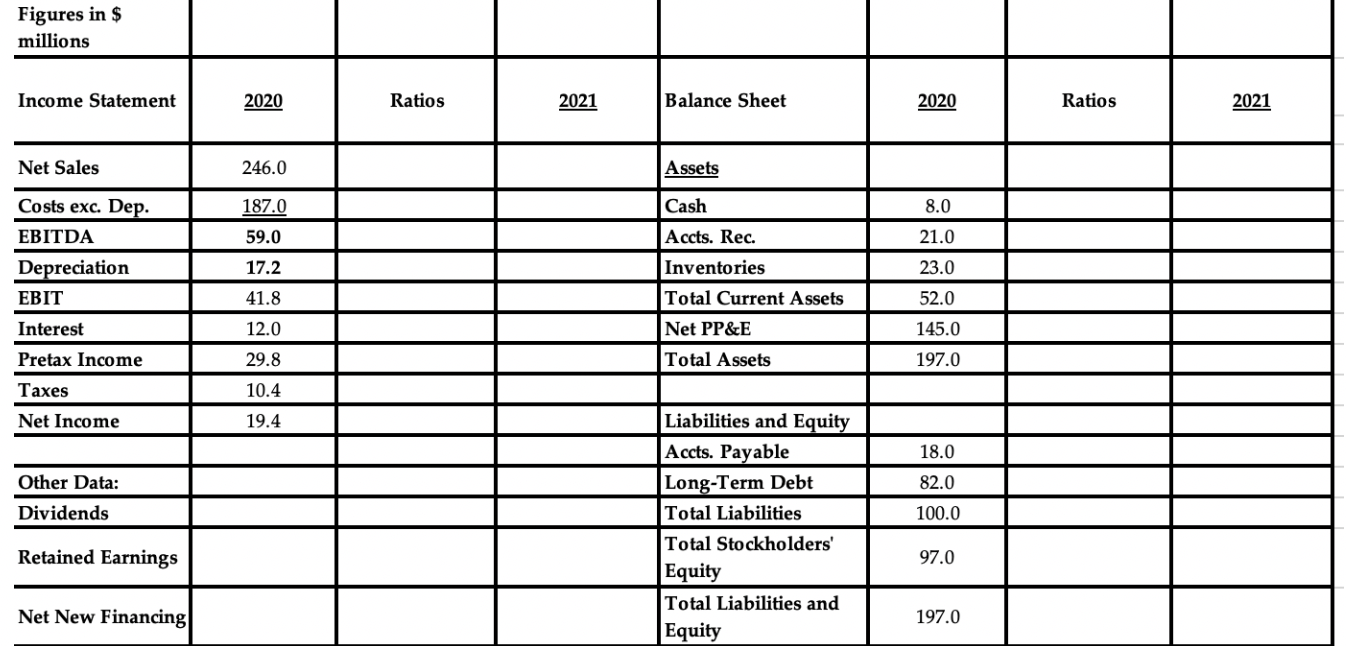

Using the percent of sales method, and assuming 18% growth in sales, no change in interest expense or debt levels, a 35% tax rate, and

Using the percent of sales method, and assuming 18% growth in sales, no change in interest expense or debt levels, a 35% tax rate, and a 60% payout ratio, calculate the following:

A) :Using the designated cells on the provided Excel sheet and the Prob 7 tab, calculate the ratios for each income statement and balance sheet item with the percent of sales method (%). Show all calculations in the provided cells on the Excel sheet and Use the provided Excel sheet to undertake pro forma analysis to determine each income statement and balance sheet item for 2021 with the percent of sales method. Show all calculations in the provided cells on the Excel sheet. Then use the provided Excel sheet to calculate in the Other Data the Dividends and Retained Earnings. Show all calculations in the provided cells on the Excel sheet and Adjust the calculation for stockholders equity as needed on the provided Excel template.

A) :Using the designated cells on the provided Excel sheet and the Prob 7 tab, calculate the ratios for each income statement and balance sheet item with the percent of sales method (%). Show all calculations in the provided cells on the Excel sheet and Use the provided Excel sheet to undertake pro forma analysis to determine each income statement and balance sheet item for 2021 with the percent of sales method. Show all calculations in the provided cells on the Excel sheet. Then use the provided Excel sheet to calculate in the Other Data the Dividends and Retained Earnings. Show all calculations in the provided cells on the Excel sheet and Adjust the calculation for stockholders equity as needed on the provided Excel template.

B) In solving for the 2021 shareholders equity, what components do you use to get your pro forma stockholders equity number and why do any adjustments need or not need to be made? Type your explanation as to why you made those calculations below and Use the provided Excel sheet to calculate the Net New Financing in Other Data. Show all calculations in the provided cells on the Excel sheet.

C) Interpret the Net New Financing number you calculate. What does this mean for the company? Will they need to get additional financing or not? Type out your answer directly below.

Figures in $ millions Income Statement 2020 Ratios 2021 Balance Sheet 2020 Ratios 2021 Net Sales 246.0 Assets 187.0 Cash 8.0 59.0 Costs exc. Dep. EBITDA Depreciation EBIT Interest 21.0 23.0 17.2 41.8 Accts. Rec. Inventories Total Current Assets Net PP&E Total Assets 52.0 12.0 145.0 Pretax Income 29.8 197.0 10.4 Taxes Net Income 19.4 18.0 82.0 Other Data: Dividends 100.0 Liabilities and Equity Accts. Payable Long-Term Debt Total Liabilities Total Stockholders' Equity Total Liabilities and Equity Retained Earnings 97.0 Net New Financing 197.0 Figures in $ millions Income Statement 2020 Ratios 2021 Balance Sheet 2020 Ratios 2021 Net Sales 246.0 Assets 187.0 Cash 8.0 59.0 Costs exc. Dep. EBITDA Depreciation EBIT Interest 21.0 23.0 17.2 41.8 Accts. Rec. Inventories Total Current Assets Net PP&E Total Assets 52.0 12.0 145.0 Pretax Income 29.8 197.0 10.4 Taxes Net Income 19.4 18.0 82.0 Other Data: Dividends 100.0 Liabilities and Equity Accts. Payable Long-Term Debt Total Liabilities Total Stockholders' Equity Total Liabilities and Equity Retained Earnings 97.0 Net New Financing 197.0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started