Answered step by step

Verified Expert Solution

Question

1 Approved Answer

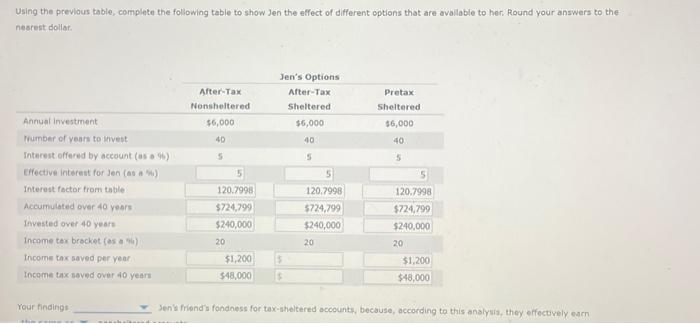

Using the previous table, complete the following table to show Jen the effect of different options that are available to her. Round your answers

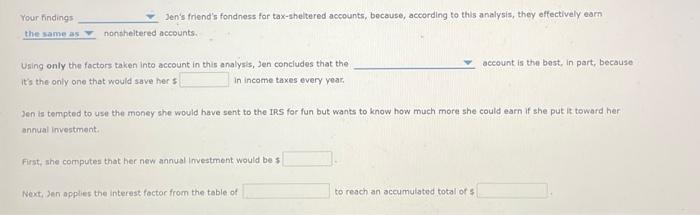

Using the previous table, complete the following table to show Jen the effect of different options that are available to her. Round your answers to the nearest dollar. Annual Investment Number of years to invest Interest offered by account (as a %6) Effective interest for Jen (as a %) Interest factor from table Accumulated over 40 years Invested over 40 years Income tax bracket (as a ) Income tax saved per year Income tax saved over 40 years Your findings the After-Tax Nonsheltered $6,000 40 5 120.7998 $724,799 $240,000 20 $1,200 $48,000 Jen's Options After-Tax Sheltered $6,000 40 5 $ $ 5 120.7998 $724,799 $240,000 20 Pretax Sheltered $6,000 40 5 5 120.7998 $724,799 $240,000 20 $1,200 $48,000 Jen's friend's fondness for tax-sheltered accounts, because, according to this analysis, they effectively earn Your findings the same as Jen's friend's fondness for tax-sheltered accounts, because, according to this analysis, they effectively earn nonsheltered accounts. Using only the factors taken into account in this analysis, Jen concludes that the it's the only one that would save her s in income taxes every year. Jen is tempted to use the money she would have sent to the IRS for fun but wants to know how much more she could earn if she put it toward her annual investment. First, she computes that her new annual Investment would be s Next, Jen applies the interest factor from the table of account is the best, in part, because i to reach an accumulated total of s

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The images contain an exercise that compares three different investment options for Jen considering their tax implications and effect on her savings T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started