Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the screenshot below create the cash flow statement. show everything, and a final cleaned up version of the cash flow begin{tabular}{|l|l|l|} hline Spring 2023

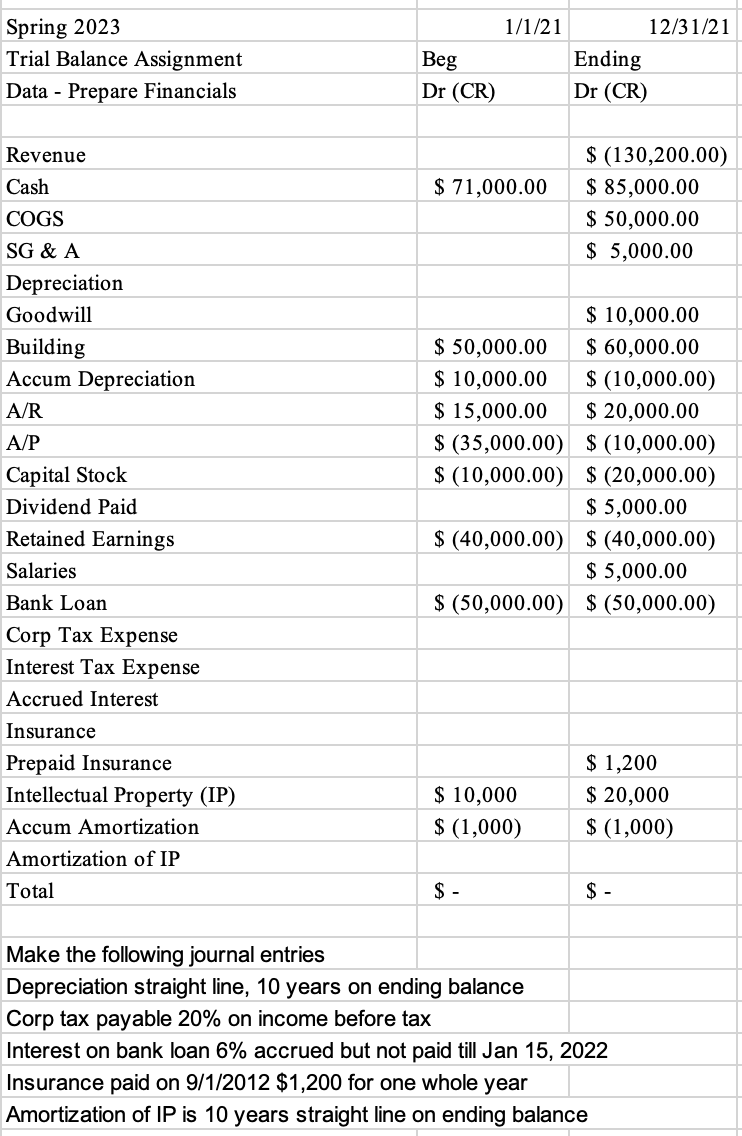

Using the screenshot below create the cash flow statement. show everything, and a final cleaned up version of the cash flow

\begin{tabular}{|l|l|l|} \hline Spring 2023 & \multicolumn{1}{|c|}{1/1/21} & \multicolumn{1}{|c|}{12/31/21} \\ \hline Trial Balance Assignment & Beg & Ending \\ \hline Data - Prepare Financials & Dr (CR) & Dr (CR) \\ \hline & & \\ \hline Revenue & & $(130,200.00) \\ \hline Cash & $1,000.00 & $85,000.00 \\ \hline COGS & & $50,000.00 \\ \hline SG \& A & & $5,000.00 \\ \hline Depreciation & & $10,000.00 \\ \hline Goodwill & $50,000.00 & $60,000.00 \\ \hline Building & $10,000.00 & $(10,000.00) \\ \hline Accum Depreciation & $15,000.00 & $20,000.00 \\ \hline A/R & $(35,000.00) & $(10,000.00) \\ \hline A/P & $(10,000.00) & $(20,000.00) \\ \hline Capital Stock & & $5,000.00 \\ \hline Dividend Paid & $(40,000.00) & $(40,000.00) \\ \hline Retained Earnings & & $5,000.00 \\ \hline Salaries & $10,000 & $20,000 \\ \hline Bank Loan & $(1,000) & $(1,000) \\ \hline Corp Tax Expense & & \\ \hline Interest Tax Expense & & $(50,000.00) \\ \hline Accrued Interest & & \\ \hline Insurance & & \\ \hline Prepaid Insurance & & \\ \hline Amtellectual Property (IP) & & \\ \hline Total & & \\ \hline \end{tabular} Make the following journal entries Depreciation straight line, 10 years on ending balance Corp tax payable 20% on income before tax Interest on bank loan 6% accrued but not paid till Jan 15, 2022 Insurance paid on 9/1/2012$1,200 for one whole year Amortization of IP is 10 years straight line on ending balance

\begin{tabular}{|l|l|l|} \hline Spring 2023 & \multicolumn{1}{|c|}{1/1/21} & \multicolumn{1}{|c|}{12/31/21} \\ \hline Trial Balance Assignment & Beg & Ending \\ \hline Data - Prepare Financials & Dr (CR) & Dr (CR) \\ \hline & & \\ \hline Revenue & & $(130,200.00) \\ \hline Cash & $1,000.00 & $85,000.00 \\ \hline COGS & & $50,000.00 \\ \hline SG \& A & & $5,000.00 \\ \hline Depreciation & & $10,000.00 \\ \hline Goodwill & $50,000.00 & $60,000.00 \\ \hline Building & $10,000.00 & $(10,000.00) \\ \hline Accum Depreciation & $15,000.00 & $20,000.00 \\ \hline A/R & $(35,000.00) & $(10,000.00) \\ \hline A/P & $(10,000.00) & $(20,000.00) \\ \hline Capital Stock & & $5,000.00 \\ \hline Dividend Paid & $(40,000.00) & $(40,000.00) \\ \hline Retained Earnings & & $5,000.00 \\ \hline Salaries & $10,000 & $20,000 \\ \hline Bank Loan & $(1,000) & $(1,000) \\ \hline Corp Tax Expense & & \\ \hline Interest Tax Expense & & $(50,000.00) \\ \hline Accrued Interest & & \\ \hline Insurance & & \\ \hline Prepaid Insurance & & \\ \hline Amtellectual Property (IP) & & \\ \hline Total & & \\ \hline \end{tabular} Make the following journal entries Depreciation straight line, 10 years on ending balance Corp tax payable 20% on income before tax Interest on bank loan 6% accrued but not paid till Jan 15, 2022 Insurance paid on 9/1/2012$1,200 for one whole year Amortization of IP is 10 years straight line on ending balance Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started