Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the statements provided calculate beta with the equation given below and provide a explanation suggesting whether the current share price is high, low, or

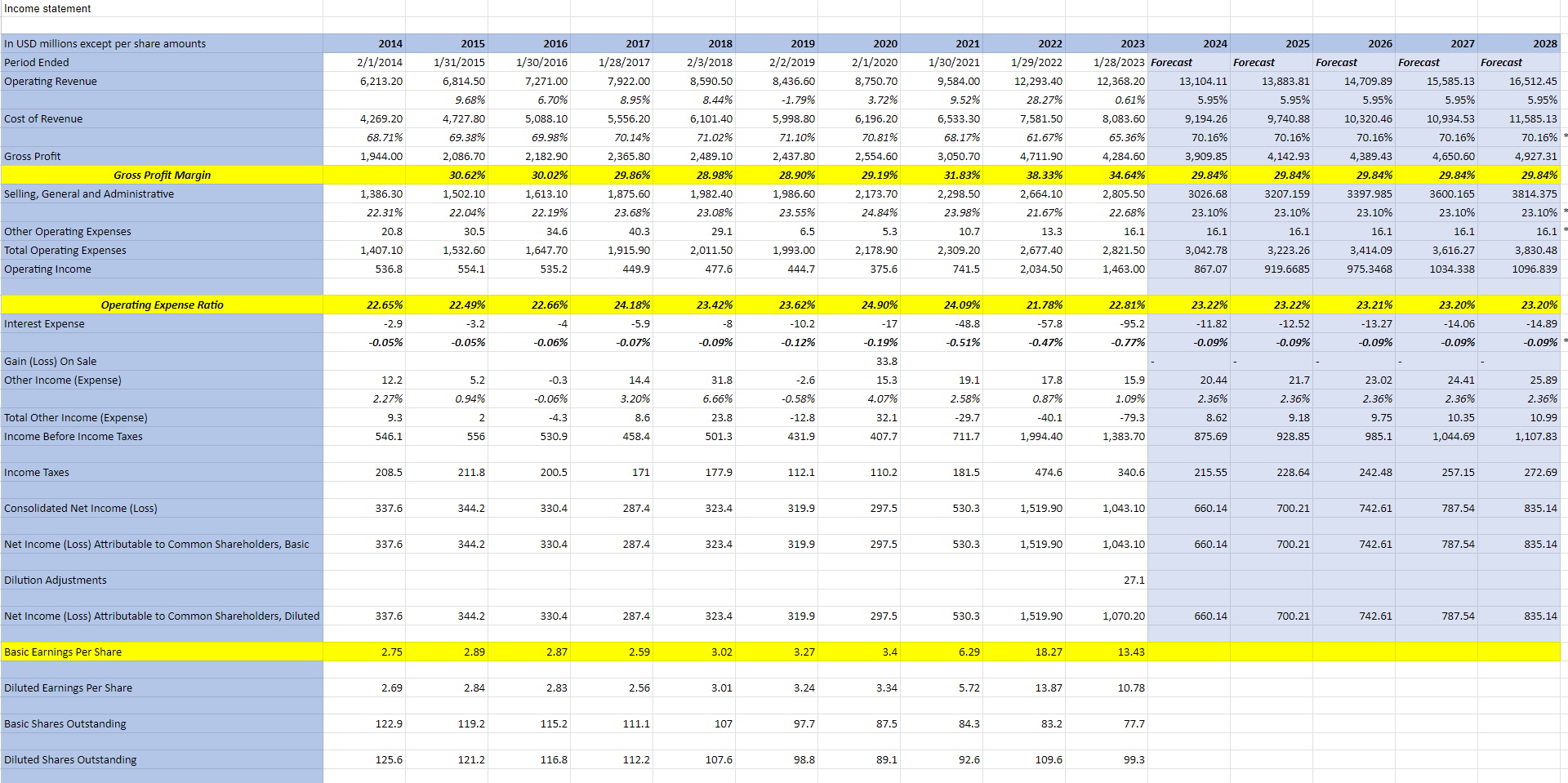

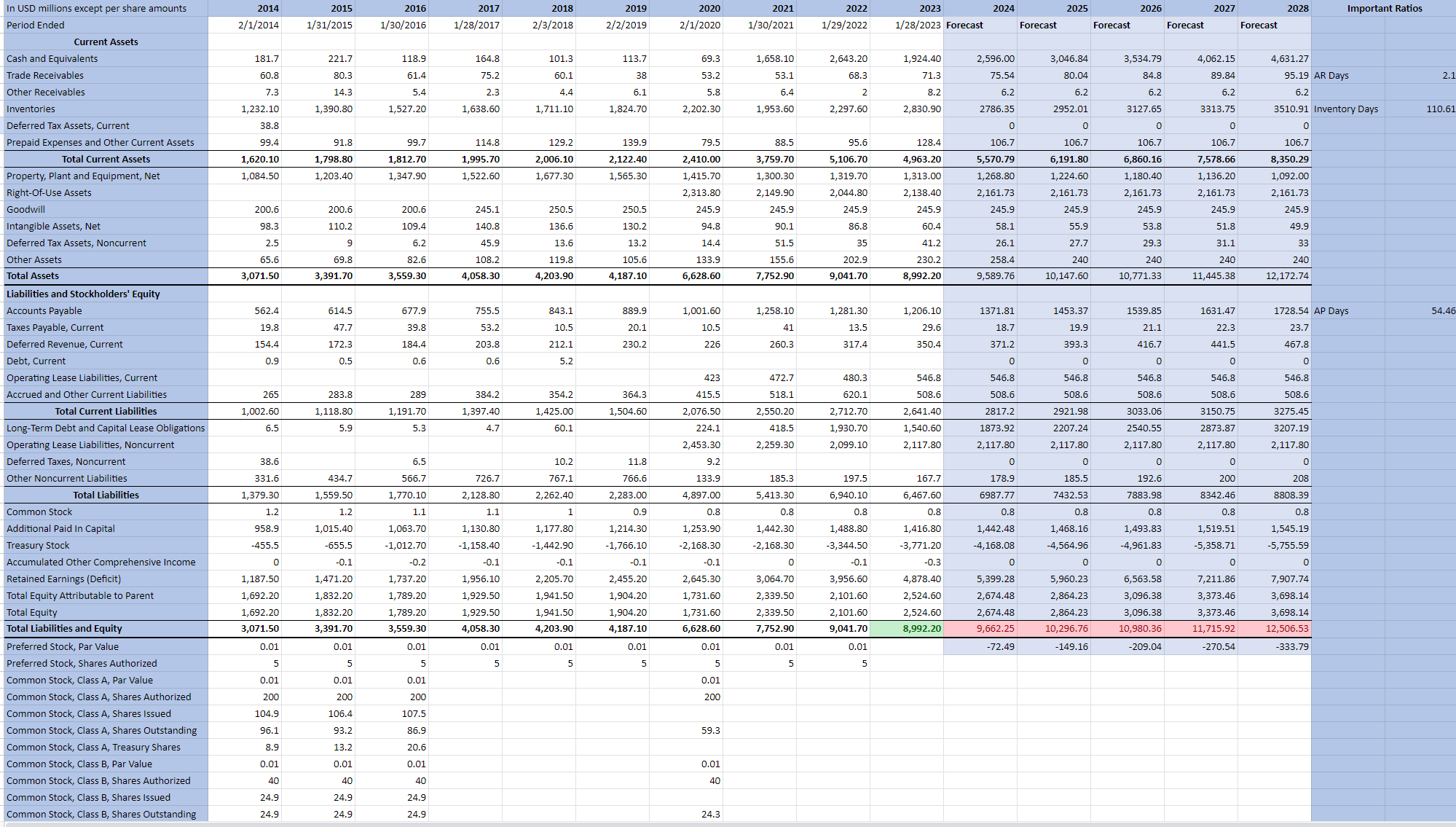

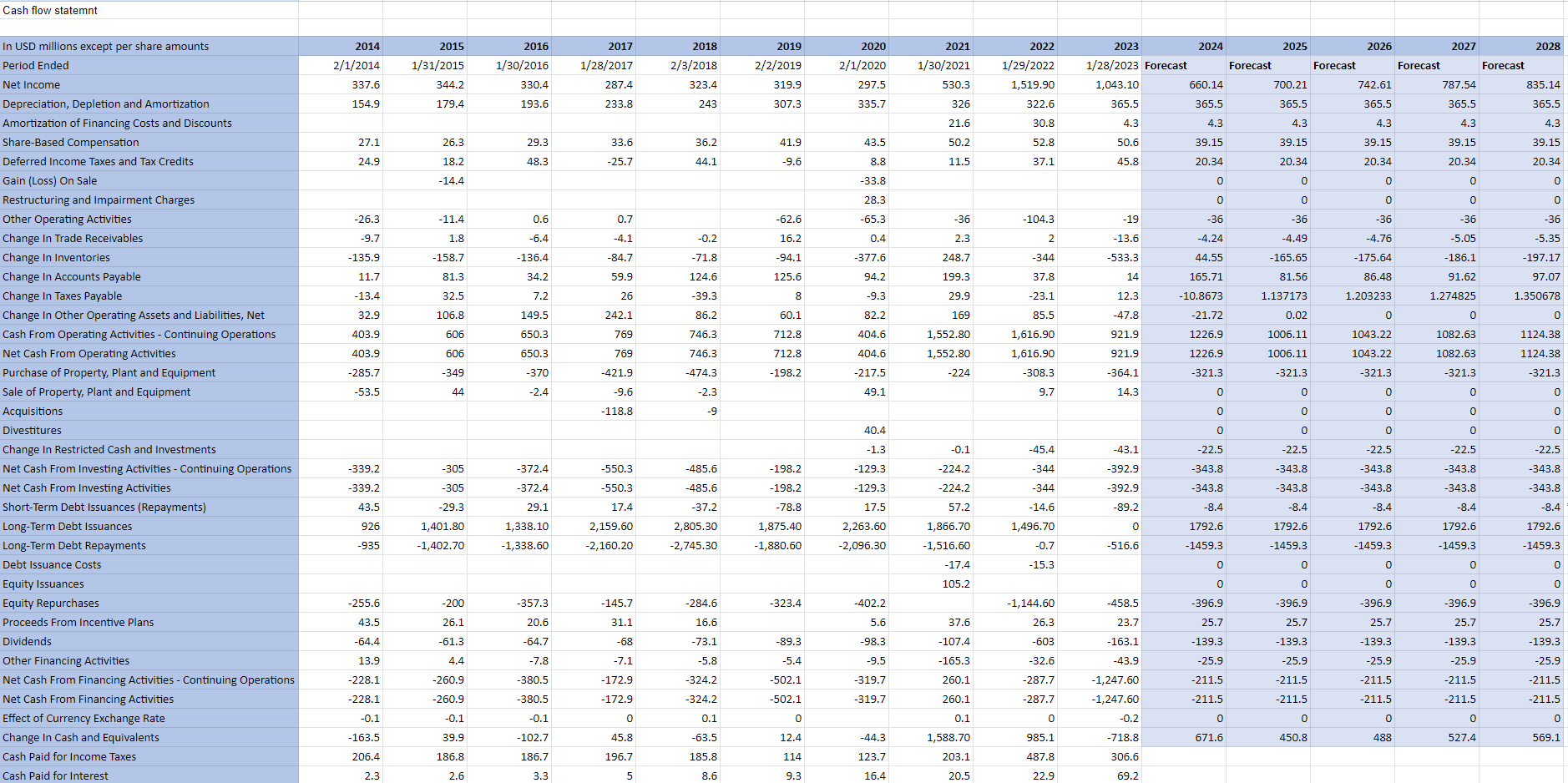

Using the statements provided calculate beta with the equation given below and provide a explanation suggesting whether the current share price is high, low, or correct. For insight the stock is Dick's Sporting Goods

- as a reference for the explanation look to this - How much will the growth rate within the economy increase in the next two to three years?

Balance sheet -

Cash Flow Statement - This has the equation for beta that is needed. Fill in the blanks to find it.

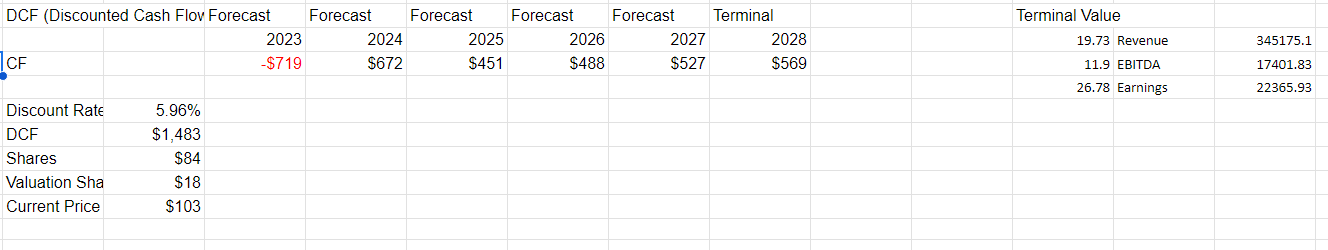

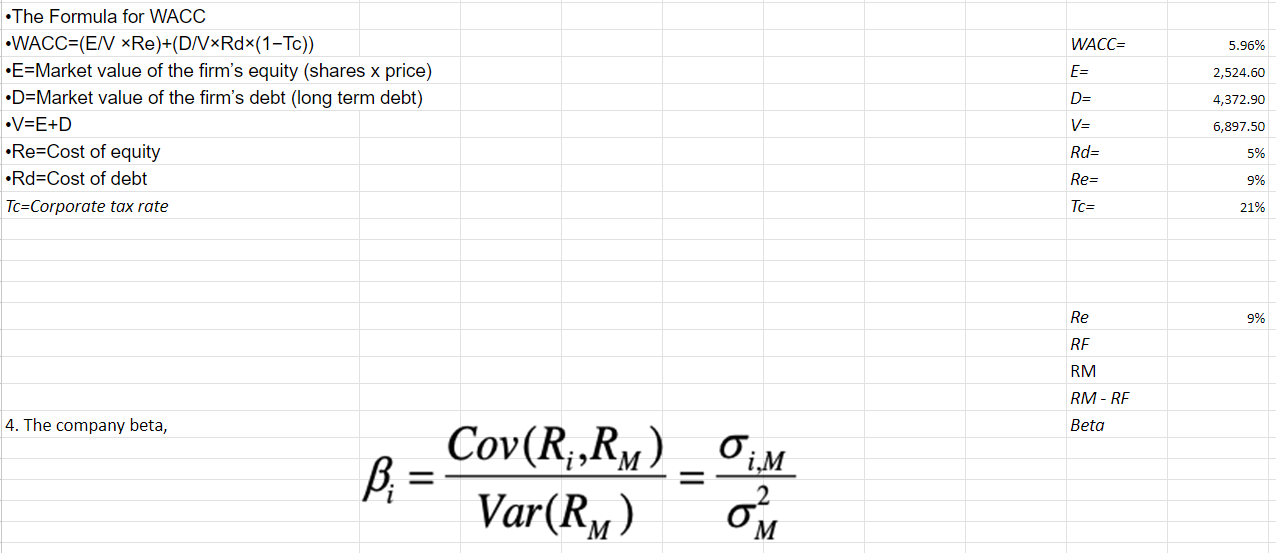

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{ DCF (Discounted Cash Flov Forecast } & Forecast & Forecast & Forecast & Forecast & Terminal & Terminal Value & & \\ \hline & & 2023 & 2024 & 2025 & 2026 & 2027 & 2028 & 19.73 & Revenue & 345175.1 \\ \hline CF & & $719 & $672 & $451 & $488 & $527 & $569 & 11.9 & EBITDA & 17401.83 \\ \hline & & & & & & & & 26.78 & Earnings & 22365.93 \\ \hline Discount Rate & 5.96% & & & & & & & & & \\ \hline DCF & $1,483 & & & & & & & & & \\ \hline Shares & $84 & & & & & & & & & \\ \hline Valuation Sha & $18 & & & & & & & & & \\ \hline Current Price & $103 & & & & & & & & & \\ \hline & & & & & & & & & & \\ \hline \end{tabular} -The Formula for WACC -WACC =(E/NRe)+(D/VRd(1Tc)) E= Market value of the firm's equity (shares x price) - D= Market value of the firm's debt (long term debt) - V=E+D - Re=Cost of equity - Rd=Cost of debt TC= Corporate tax rate 4. The company beta

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started